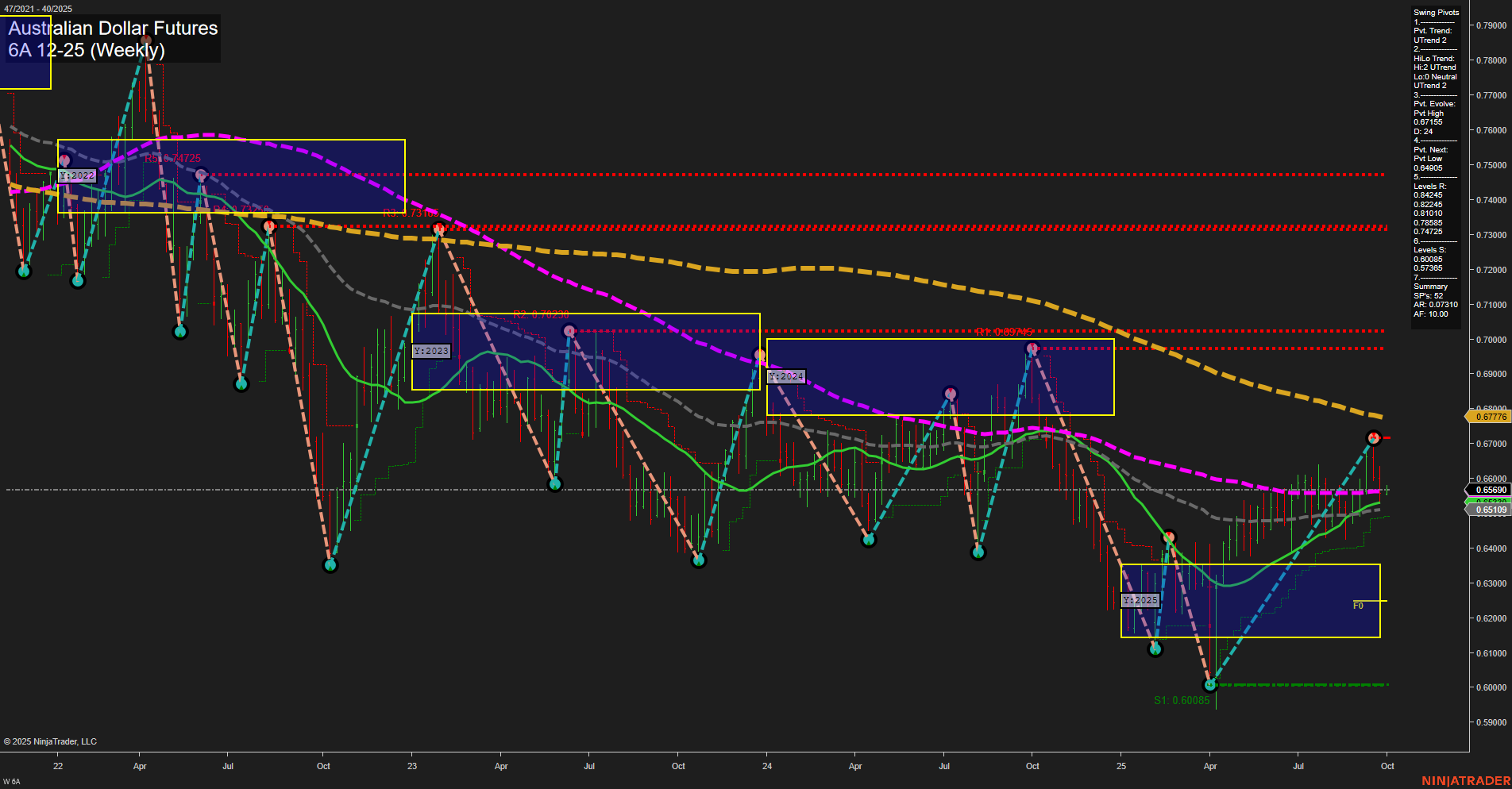

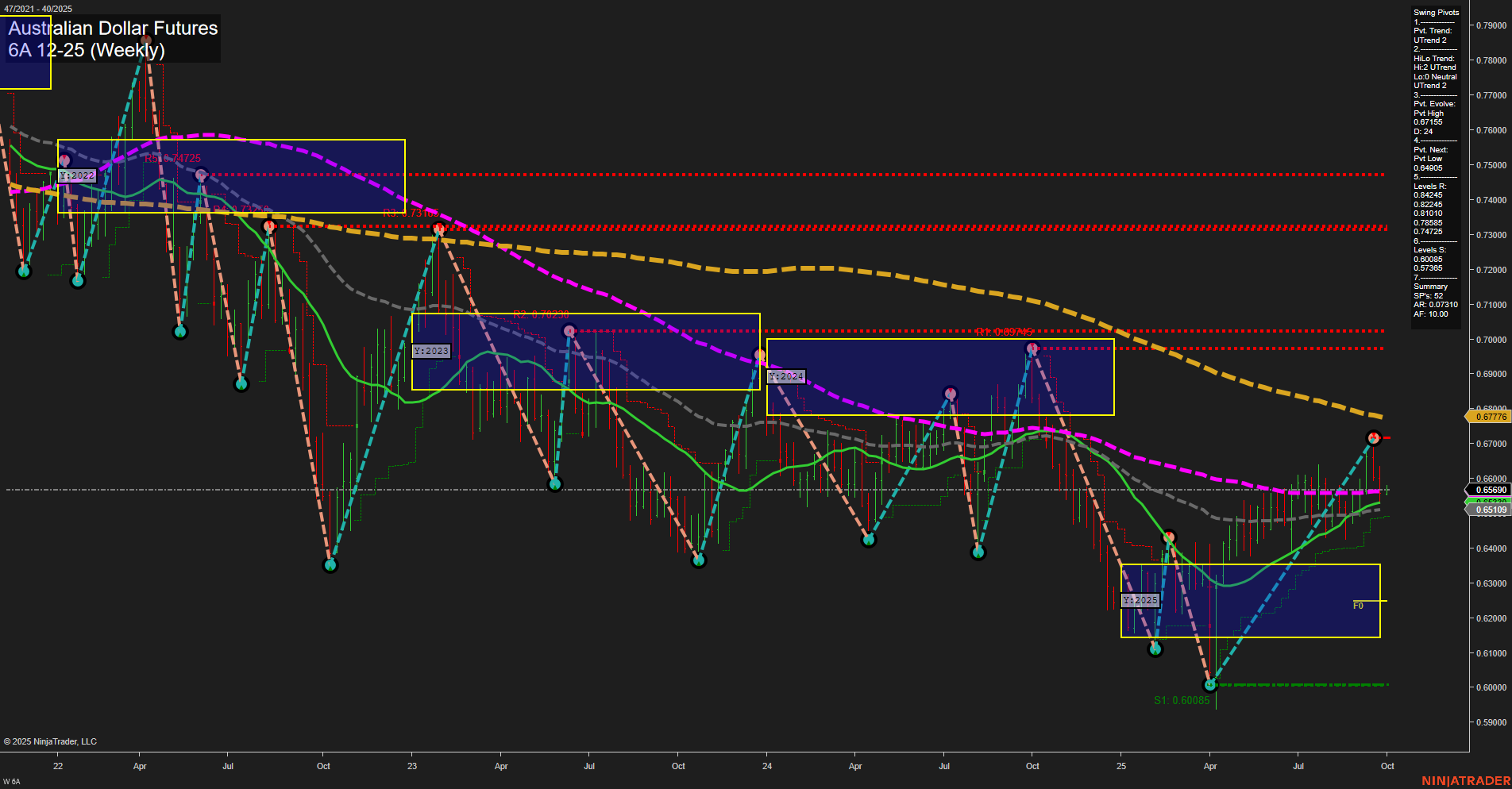

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Sep-29 07:00 CT

Price Action

- Last: 0.6576,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.6776,

- 4. Pvt. Next: Pvt low 0.6159,

- 5. Levels R: 0.6776, 0.6994, 0.7030, 0.7222, 0.7425, 0.7820,

- 6. Levels S: 0.6159, 0.6008.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.6559 Up Trend,

- (Intermediate-Term) 10 Week: 0.6519 Up Trend,

- (Long-Term) 20 Week: 0.6559 Up Trend,

- (Long-Term) 55 Week: 0.6519 Up Trend,

- (Long-Term) 100 Week: 0.6659 Down Trend,

- (Long-Term) 200 Week: 0.6776 Down Trend.

Recent Trade Signals

- 29 Sep 2025: Long 6A 12-25 @ 0.6576 Signals.USAR-WSFG

- 29 Sep 2025: Long 6A 12-25 @ 0.6577 Signals.USAR-MSFG

- 29 Sep 2025: Long 6A 12-25 @ 0.6577 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The Australian Dollar Futures (6A) weekly chart shows a recent shift in momentum, with price action moving off the major swing low at 0.6159 and establishing a new swing high at 0.6776. The short- and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and higher highs, and are confirmed by recent long trade signals. The price is currently trading above the 5, 10, 20, and 55-week moving averages, all of which are in uptrends, indicating sustained bullish momentum in the short to intermediate term. However, the 100- and 200-week moving averages remain in downtrends, suggesting that the longer-term structure is still neutral and that the market is in a transitional phase. The price is consolidating near the upper boundary of the yearly session fib grid, with resistance at 0.6776 and 0.6994, and support at 0.6159 and 0.6008. The overall environment is characterized by a recovery from prior lows, with the potential for further upside if resistance levels are breached, but longer-term confirmation is still pending as the market tests key moving averages and resistance zones.

Chart Analysis ATS AI Generated: 2025-09-29 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.