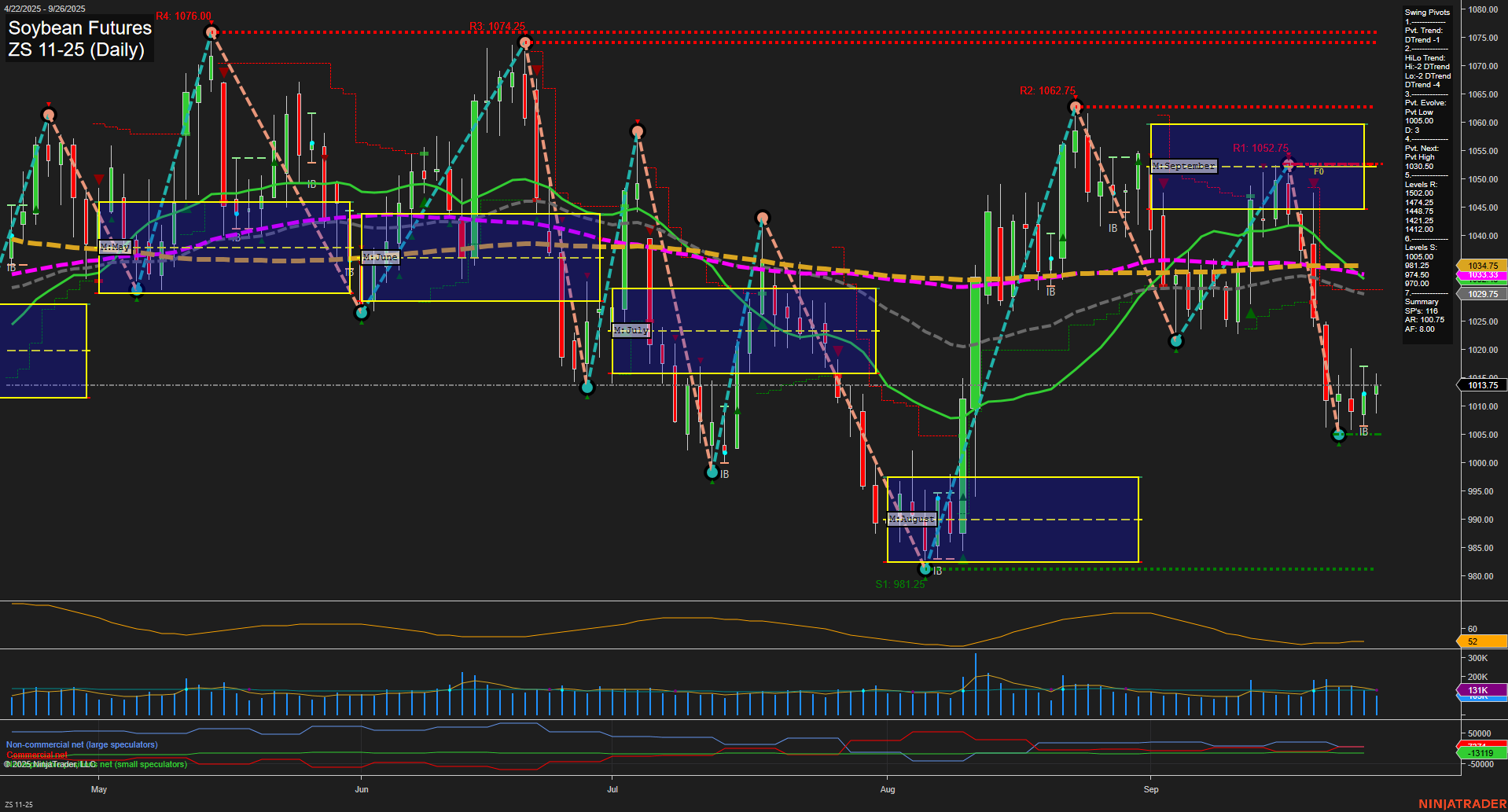

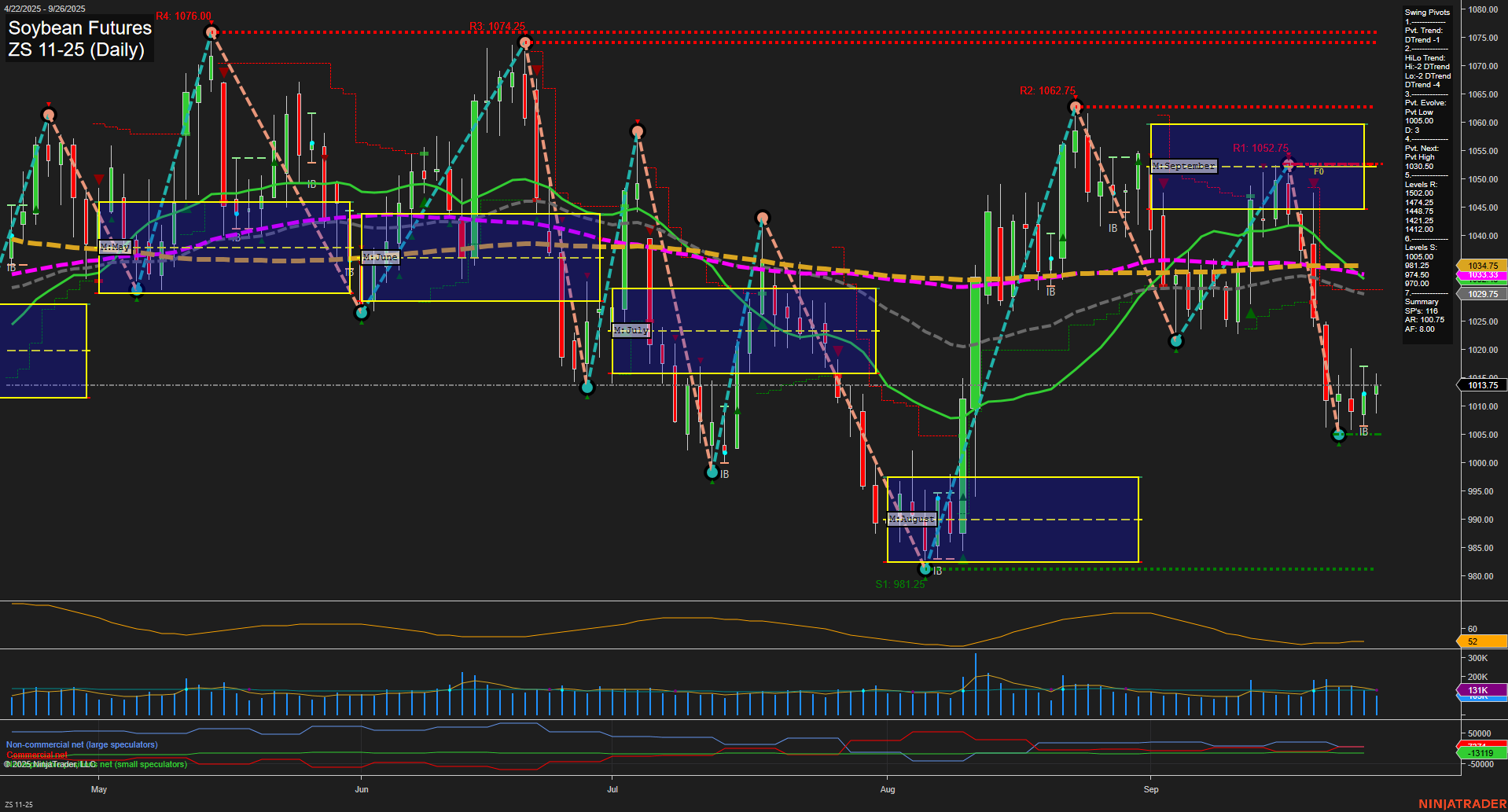

ZS Soybean Futures Daily Chart Analysis: 2025-Sep-28 18:16 CT

Price Action

- Last: 1013.75,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -40%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -67%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1005.00,

- 4. Pvt. Next: Pvt high 1052.75,

- 5. Levels R: 1052.75, 1074.25, 1076.00,

- 6. Levels S: 1005.00, 981.25.

Daily Benchmarks

- (Short-Term) 5 Day: 1029.75 Down Trend,

- (Short-Term) 10 Day: 1029.75 Down Trend,

- (Intermediate-Term) 20 Day: 1029.75 Down Trend,

- (Intermediate-Term) 55 Day: 1034.75 Down Trend,

- (Long-Term) 100 Day: 1047.25 Down Trend,

- (Long-Term) 200 Day: 1060.75 Down Trend.

Additional Metrics

Recent Trade Signals

- 22 Sep 2025: Short ZS 11-25 @ 1023.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

Soybean futures (ZS 11-25) are exhibiting a clear bearish structure across all timeframes. Price action is subdued with slow momentum and medium-sized bars, reflecting a lack of aggressive buying or selling but a persistent downward drift. All major session fib grids (weekly, monthly, yearly) show price below their respective NTZ/F0% levels, confirming a dominant downtrend. Swing pivot analysis highlights a short-term and intermediate-term downtrend, with the most recent pivot low at 1005.00 and resistance levels stacked well above current price, suggesting limited upward pressure. All benchmark moving averages (from 5-day to 200-day) are trending down, reinforcing the prevailing bearish sentiment. Volatility (ATR) is moderate, and volume remains steady but not elevated, indicating no panic selling or capitulation. The most recent trade signal was a short entry, aligning with the overall technical picture. In summary, the market is in a sustained downtrend, with no immediate signs of reversal or strong support, and any rallies are likely to encounter significant resistance.

Chart Analysis ATS AI Generated: 2025-09-28 18:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.