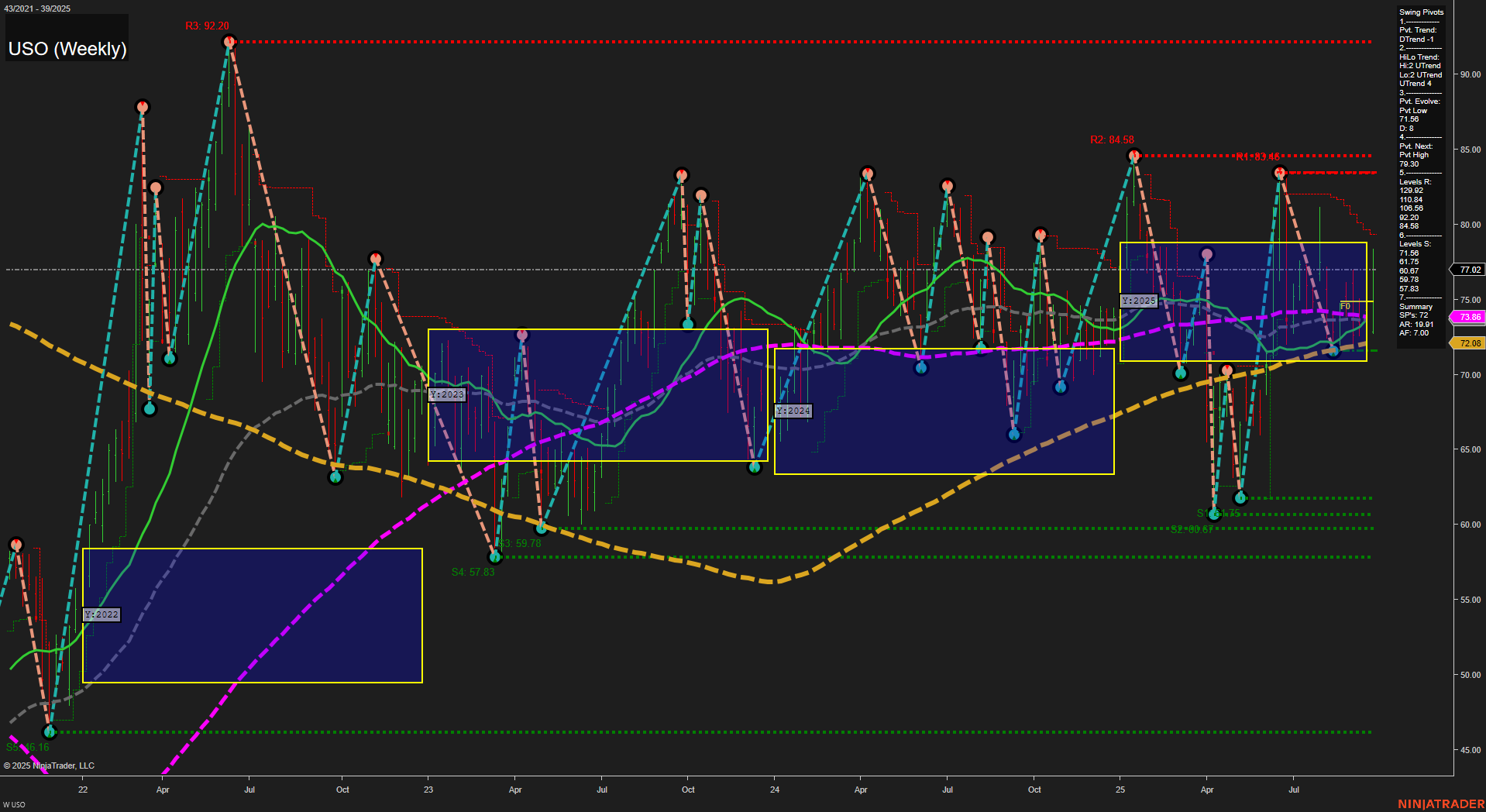

The USO weekly chart reflects a market in consolidation, with price action oscillating within a broad range defined by significant swing highs and lows. The most recent momentum is slow, and the bars are of medium size, indicating a lack of strong directional conviction. Short-term trends are neutral, as shown by the WSFG and the current swing pivot downtrend, while intermediate-term signals are more constructive, with the HiLo trend up and both the 5- and 10-week moving averages trending higher. Long-term benchmarks are mixed, with the 20- and 100-week averages flat, but the 55- and 200-week averages still in uptrends, suggesting underlying support. Key resistance levels are clustered in the low-to-mid 80s, while support is well below current price, in the mid-60s and lower. The chart structure shows repeated tests and rejections at resistance, with higher lows forming a base, but no clear breakout or breakdown. This environment is typical of a market awaiting a catalyst, with swing traders likely to focus on range-bound strategies until a decisive move emerges. Volatility remains contained, and the overall technical picture is one of equilibrium, with neither bulls nor bears in clear control.