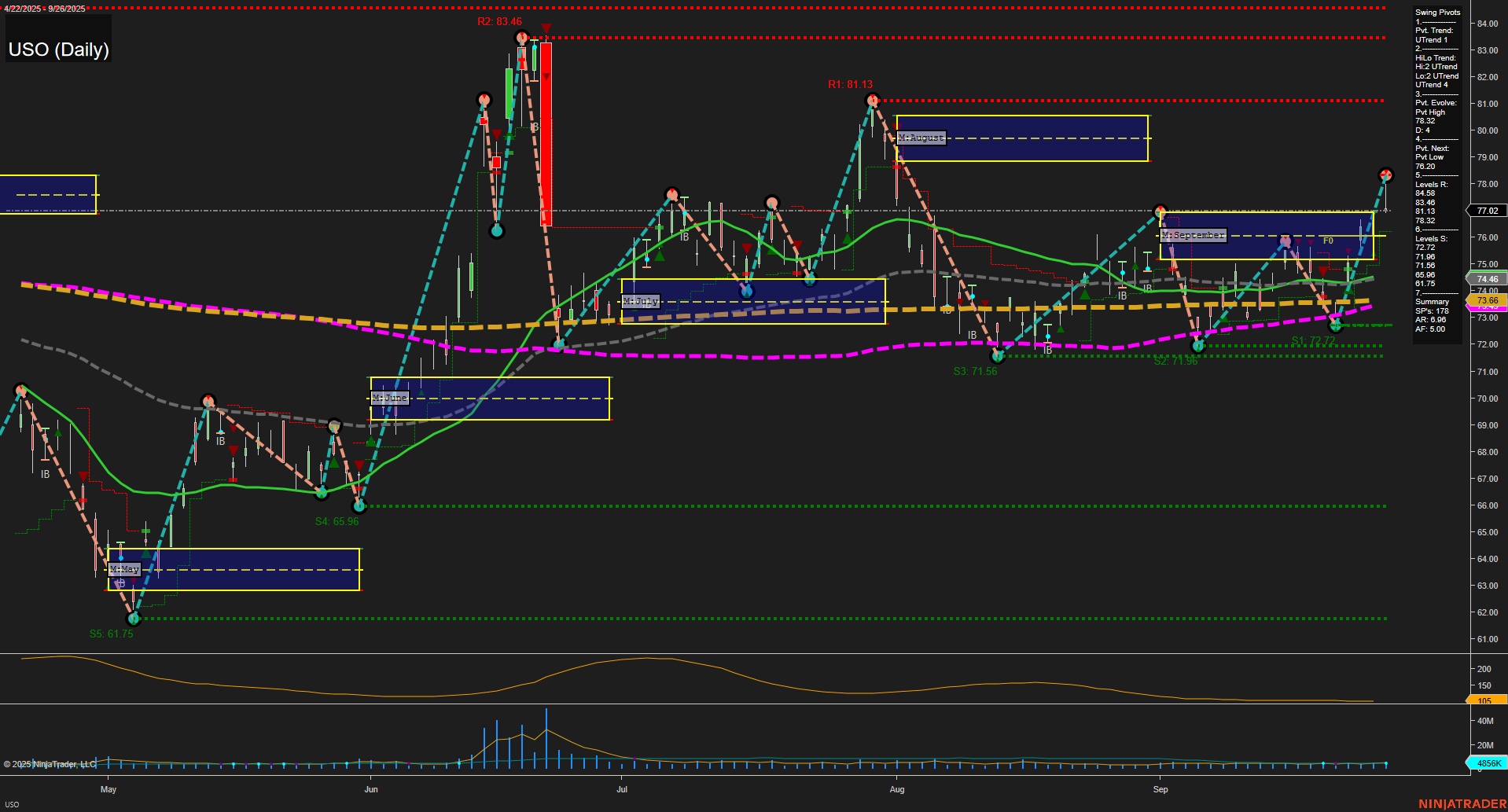

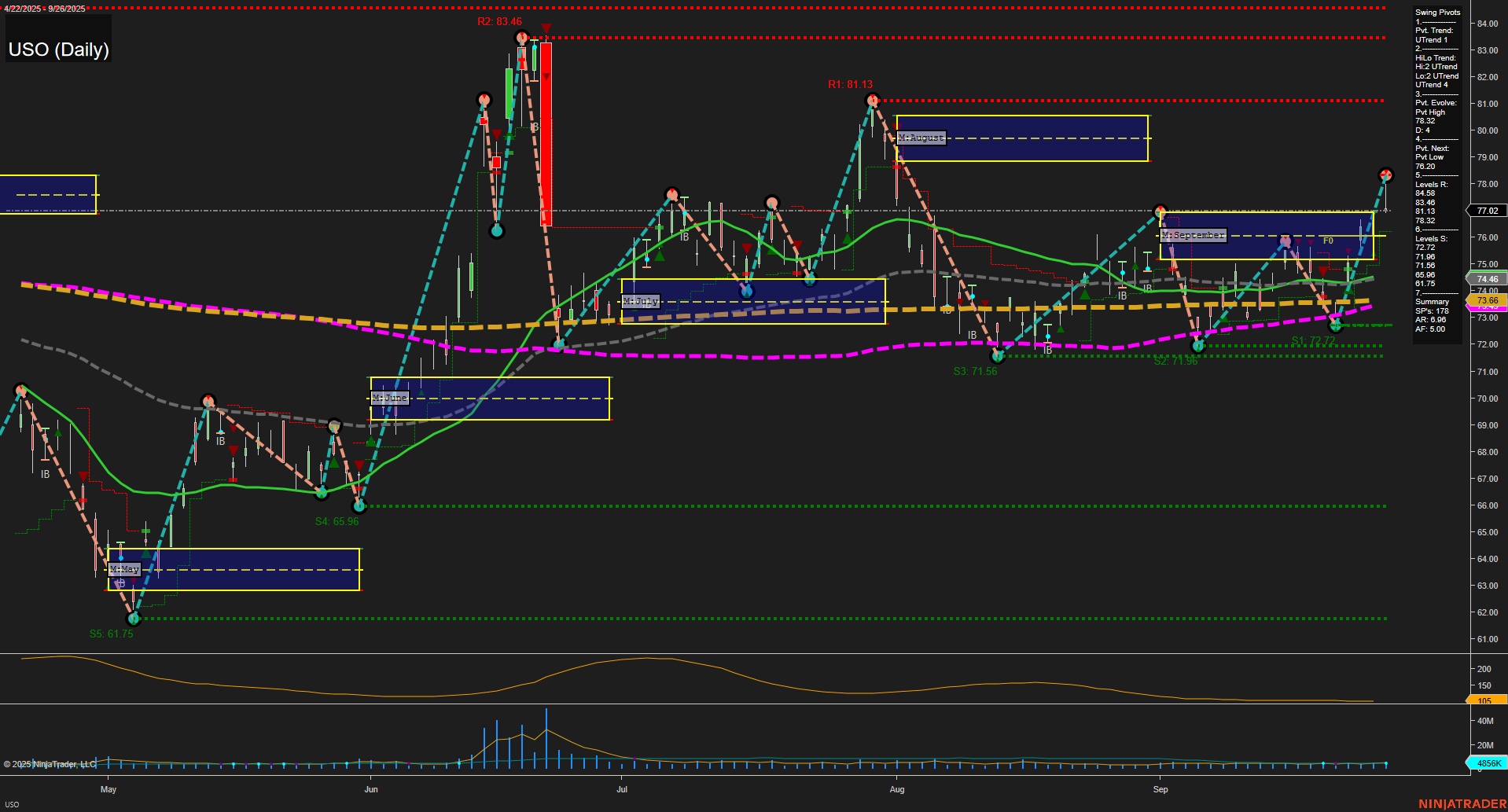

USO United States Oil Fund LP Daily Chart Analysis: 2025-Sep-28 18:13 CT

Price Action

- Last: 77.02,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 77.02,

- 4. Pvt. Next: Pvt Low 72.20,

- 5. Levels R: 83.46, 81.13, 77.02,

- 6. Levels S: 74.72, 71.56, 65.96, 61.75.

Daily Benchmarks

- (Short-Term) 5 Day: 74.46 Up Trend,

- (Short-Term) 10 Day: 73.76 Up Trend,

- (Intermediate-Term) 20 Day: 74.46 Up Trend,

- (Intermediate-Term) 55 Day: 74.46 Up Trend,

- (Long-Term) 100 Day: 74.46 Up Trend,

- (Long-Term) 200 Day: 74.46 Up Trend.

Additional Metrics

- ATR: 138,

- VOLMA: 2577640.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

USO is exhibiting a strong bullish structure across all timeframes, with the most recent price action breaking above prior resistance and establishing a new swing high at 77.02. The short-term and intermediate-term swing pivot trends are both in uptrends, supported by a cluster of moving averages (5, 10, 20, 55, 100, and 200 day) all trending upward and converging near the 74.46–73.76 range, which now acts as a key support zone. The ATR remains moderate, indicating steady but not excessive volatility, while volume is healthy and above the moving average, suggesting active participation in the current move. The price is currently testing the upper resistance levels, with the next significant resistance at 81.13 and 83.46, while support is well-defined at 74.72 and 71.56. The overall technical landscape points to a continuation of the bullish trend, with the market showing resilience after recent consolidations and pullbacks. No clear signs of exhaustion or reversal are present, and the structure favors trend continuation scenarios, especially if price holds above the 74.72–73.76 support cluster.

Chart Analysis ATS AI Generated: 2025-09-28 18:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.