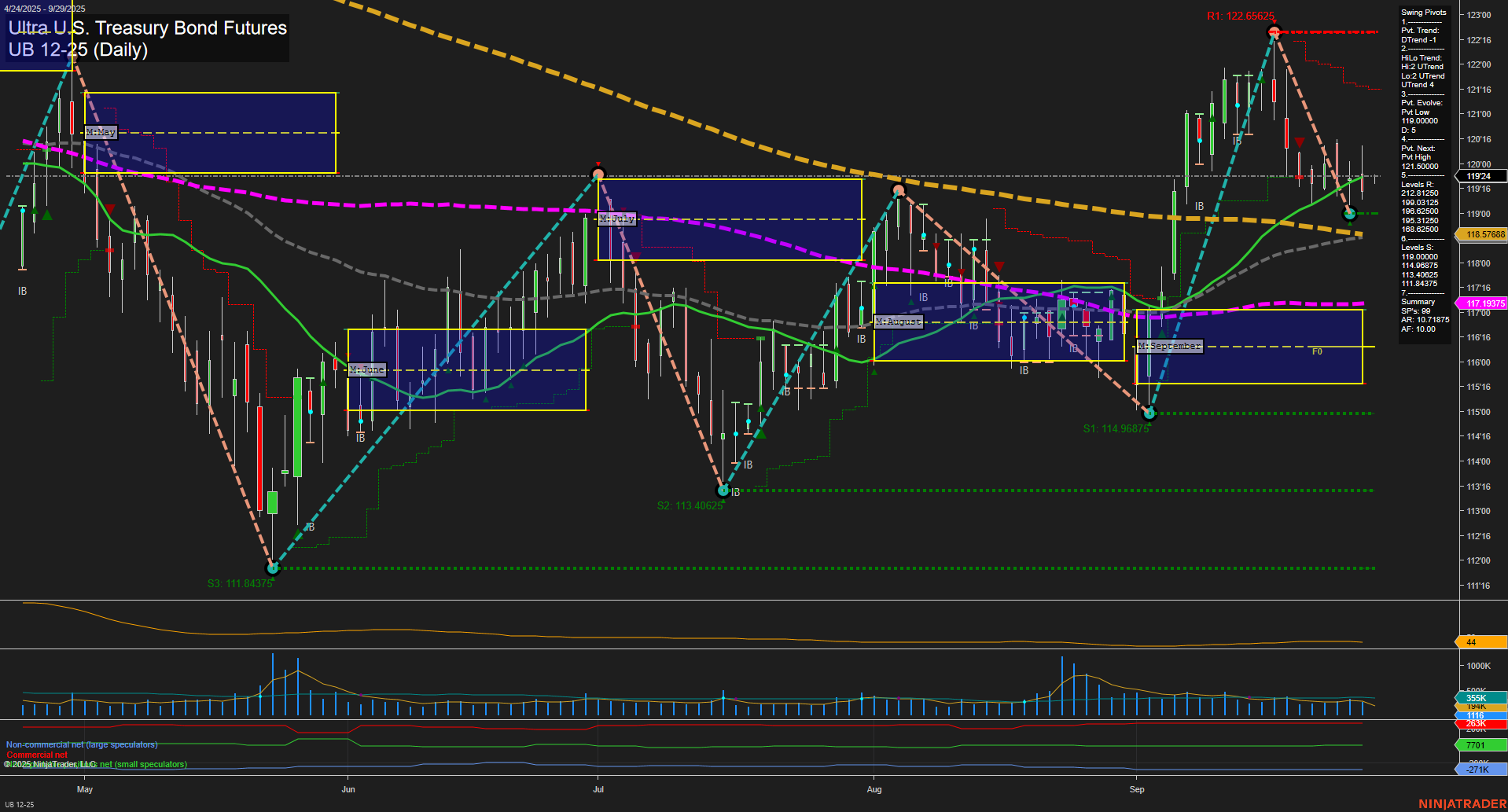

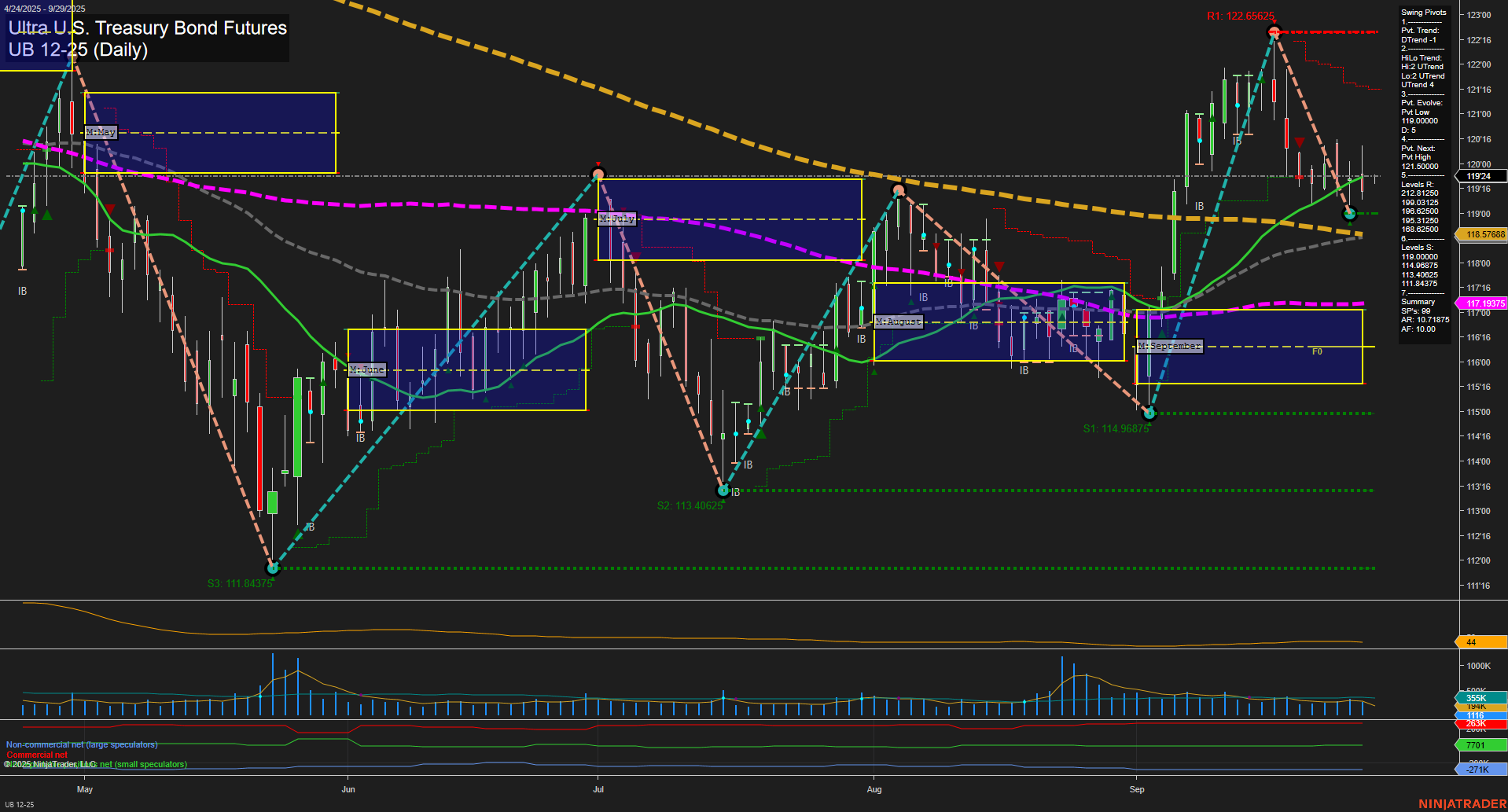

UB Ultra U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Sep-28 18:13 CT

Price Action

- Last: 119'24,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 73%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 119'00,

- 4. Pvt. Next: Pvt high 122'65625,

- 5. Levels R: 122'65625, 120'46875, 119'28125,

- 6. Levels S: 119'00, 118'625, 118'03125, 117'09375, 115'40625, 114'96875, 113'40625, 111'84375.

Daily Benchmarks

- (Short-Term) 5 Day: 119'25 Down Trend,

- (Short-Term) 10 Day: 119'28 Down Trend,

- (Intermediate-Term) 20 Day: 119'13 Up Trend,

- (Intermediate-Term) 55 Day: 118'25 Up Trend,

- (Long-Term) 100 Day: 117'19 Up Trend,

- (Long-Term) 200 Day: 118'57 Up Trend.

Additional Metrics

Recent Trade Signals

- 25 Sep 2025: Short UB 12-25 @ 119.25 Signals.USAR.TR120

- 25 Sep 2025: Short UB 12-25 @ 119.46875 Signals.USAR-WSFG

- 22 Sep 2025: Short UB 12-25 @ 119.28125 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures daily chart currently reflects a mixed environment for swing traders. Price action shows a slow momentum pullback from recent highs, with medium-sized bars and the last price at 119'24. Short-term signals and moving averages have shifted to a bearish stance, as confirmed by the DTrend in the short-term swing pivot and recent short trade signals. However, the intermediate and long-term trends remain bullish, supported by the uptrend in the 20, 55, 100, and 200-day moving averages, as well as the upward bias in both the monthly and yearly session fib grids. The market is consolidating above key support levels, with the next significant resistance at 122'65625 and support at 119'00. Volatility is moderate, and volume remains steady. The current setup suggests a short-term retracement within a broader uptrend, with the potential for further consolidation or a resumption of the upward move if support holds and momentum returns.

Chart Analysis ATS AI Generated: 2025-09-28 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.