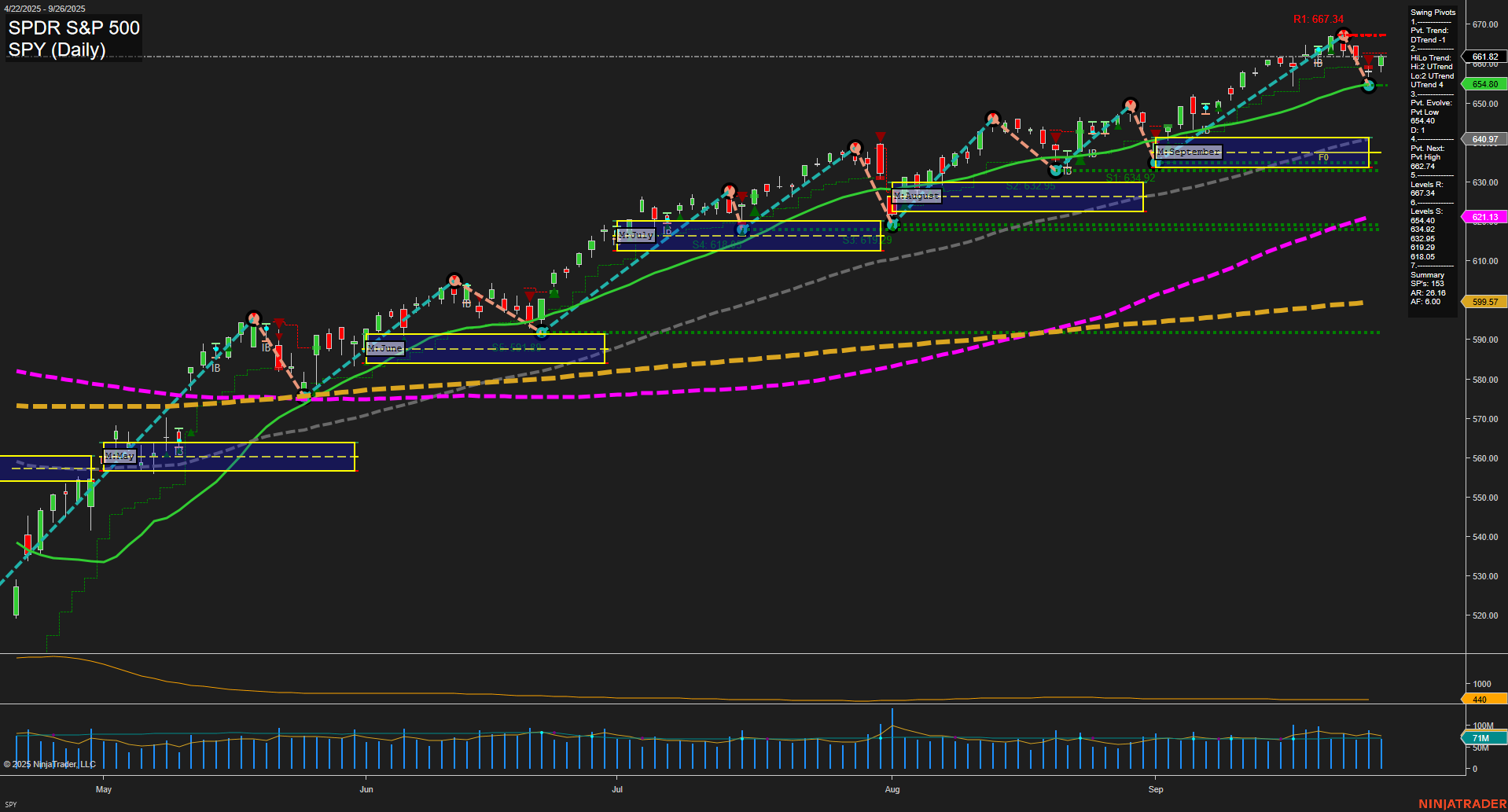

The SPY daily chart shows a recent shift in short-term momentum, with the latest swing pivot indicating a downtrend (DTrend) after reaching a new high at 667.34. Price has pulled back to 661.82, with medium-sized bars and average momentum, suggesting a pause or consolidation phase rather than a sharp reversal. The short-term moving averages (5 and 10 day) have turned down, reflecting this near-term weakness, while intermediate and long-term benchmarks (20, 55, 100, 200 day) remain in solid uptrends, supporting the broader bullish structure. Swing pivot support levels are layered below, with the nearest at 640.97, providing a cushion for further pullbacks. Resistance is defined by the recent high at 667.34. The ATR remains elevated, indicating persistent volatility, while volume is steady but not extreme. Both the weekly and monthly session fib grids are neutral, showing no clear directional bias in the short or intermediate term. From a futures swing trader’s perspective, the market is in a corrective or consolidative phase within a larger uptrend. The short-term trend is neutral as the market digests recent gains, but the intermediate and long-term outlooks remain bullish, supported by higher lows and strong moving average alignment. The current environment favors monitoring for signs of trend continuation or a deeper retracement, with key levels providing reference for potential inflection points.