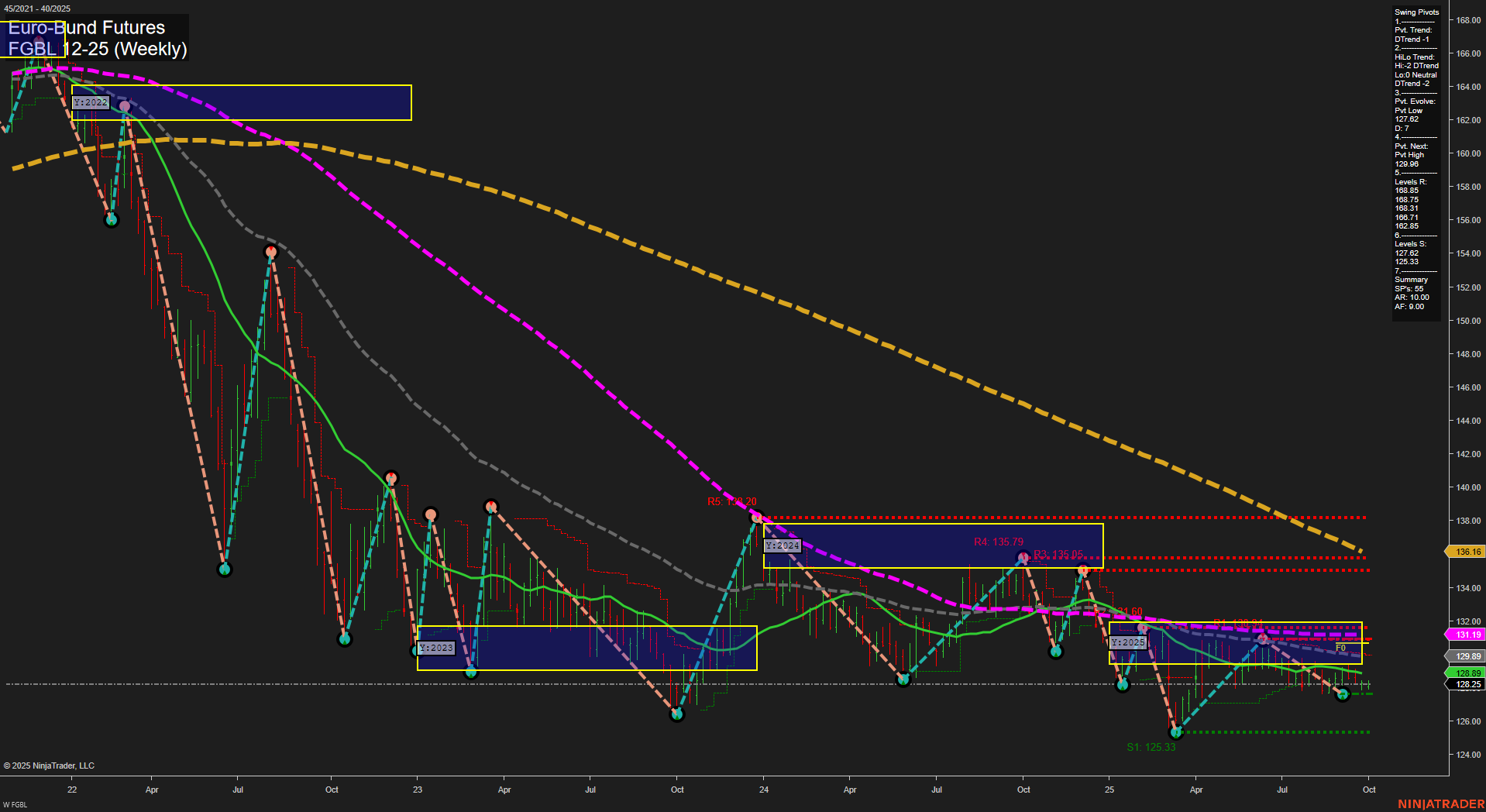

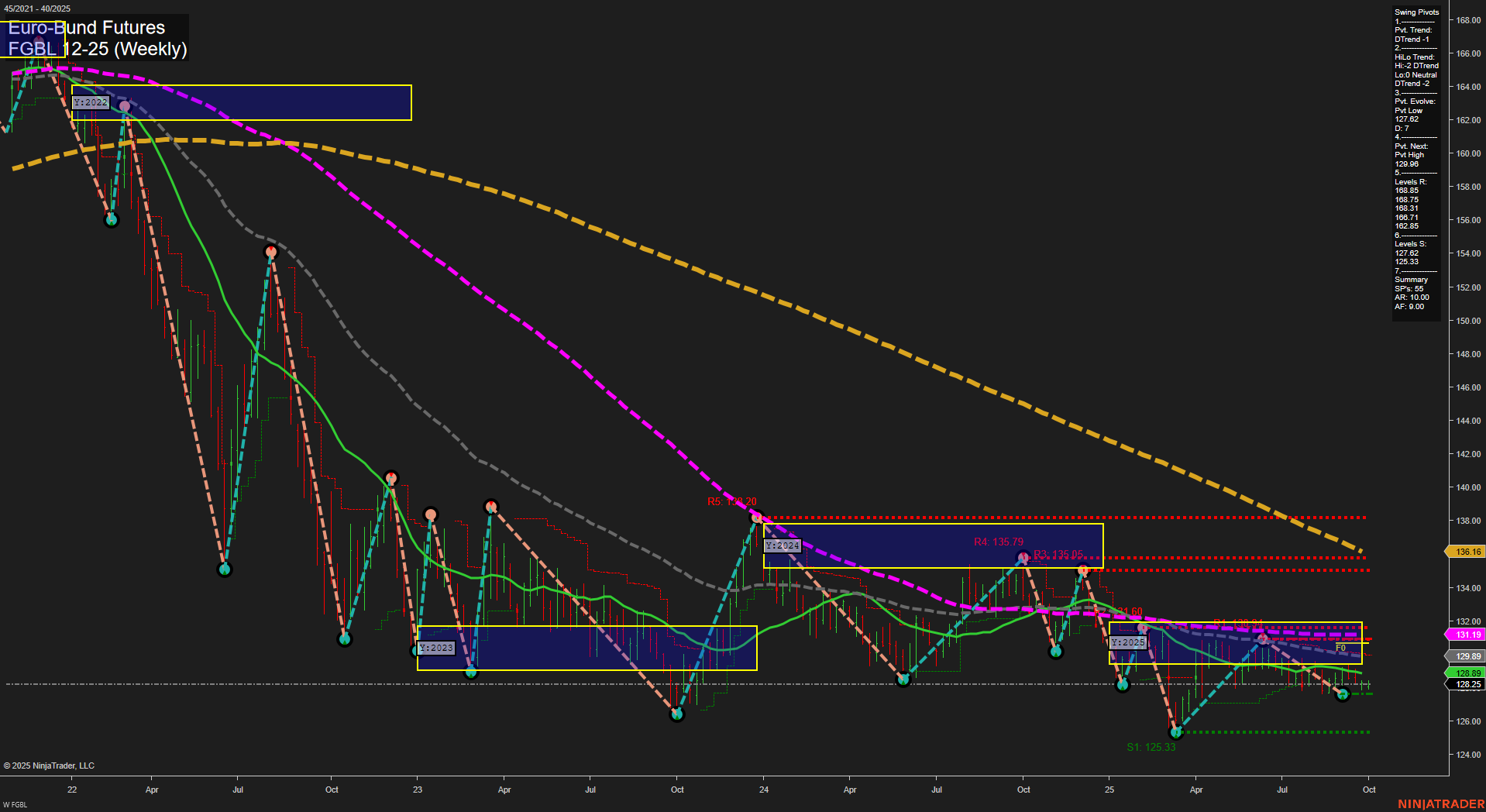

FGBL Euro-Bund Futures Weekly Chart Analysis: 2025-Sep-28 18:07 CT

Price Action

- Last: 128.25,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -19%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 127.02,

- 4. Pvt. Next: Pvt High 129.89,

- 5. Levels R: 135.79, 135.05, 132.71, 132.23, 129.89,

- 6. Levels S: 127.03, 127.02, 125.33.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 128.89 Down Trend,

- (Intermediate-Term) 10 Week: 129.19 Down Trend,

- (Long-Term) 20 Week: 130.21 Down Trend,

- (Long-Term) 55 Week: 136.16 Down Trend,

- (Long-Term) 100 Week: 132.00 Down Trend,

- (Long-Term) 200 Week: 153.95 Down Trend.

Recent Trade Signals

- 26 Sep 2025: Short FGBL 12-25 @ 128.17 Signals.USAR-MSFG

- 26 Sep 2025: Long FGBL 12-25 @ 128.32 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The FGBL Euro-Bund Futures weekly chart shows a market in a prolonged downtrend, with all major long-term and intermediate-term moving averages trending lower and price trading below key yearly and monthly session fib grid levels. Short-term action is mixed: while the weekly session fib grid (WSFG) trend is up and price is just above the NTZ center, momentum is slow and bars are small, indicating a lack of conviction. Swing pivots confirm a dominant downtrend in both short and intermediate timeframes, with the most recent pivot low at 127.02 and resistance clustered above at 129.89 and higher. The recent trade signals reflect this indecision, with both a short and a long signal triggered in close proximity, suggesting choppy, range-bound conditions. Overall, the market remains under pressure with rallies being sold, and any short-term bounces are struggling to gain traction against the prevailing bearish backdrop. The technical structure points to continued consolidation near the lows, with risk of further downside unless a sustained move above key resistance levels materializes.

Chart Analysis ATS AI Generated: 2025-09-28 18:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.