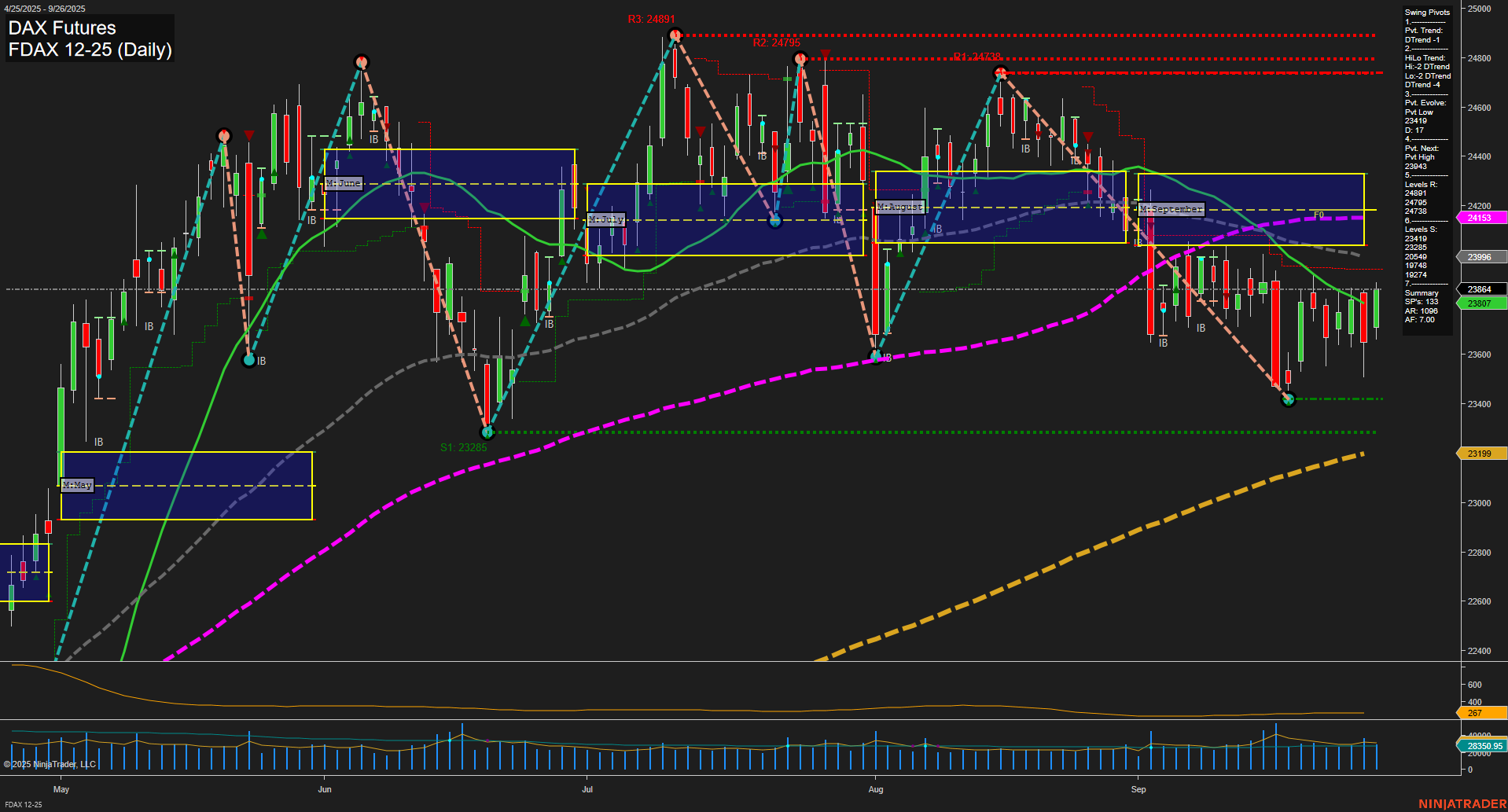

The FDAX daily chart shows a market in transition, with mixed signals across timeframes. Short-term price action is consolidating after a recent swing low at 23285, with momentum remaining slow and bars of medium size, suggesting indecision and a lack of strong directional conviction. The weekly session fib grid (WSFG) trend is up, with price above the NTZ center, but the monthly session fib grid (MSFG) is down, with price below the NTZ, indicating intermediate-term weakness. Both short-term and intermediate-term swing pivot trends are down, with resistance levels stacked above and support levels below, highlighting a range-bound environment. All short and intermediate-term moving averages are trending down, reinforcing the bearish bias in these timeframes, while the 200-day MA remains in an uptrend, supporting a longer-term bullish outlook. Recent trade signals have triggered long entries, reflecting attempts to catch a reversal or bounce from support. Volatility (ATR) and volume (VOLMA) are moderate, not signaling any major breakout or breakdown. Overall, the market is caught between a longer-term uptrend and intermediate-term corrective pressure, with short-term action neutral as the market tests key support and resistance levels. Swing traders should note the potential for choppy, range-bound conditions until a decisive breakout or breakdown occurs.