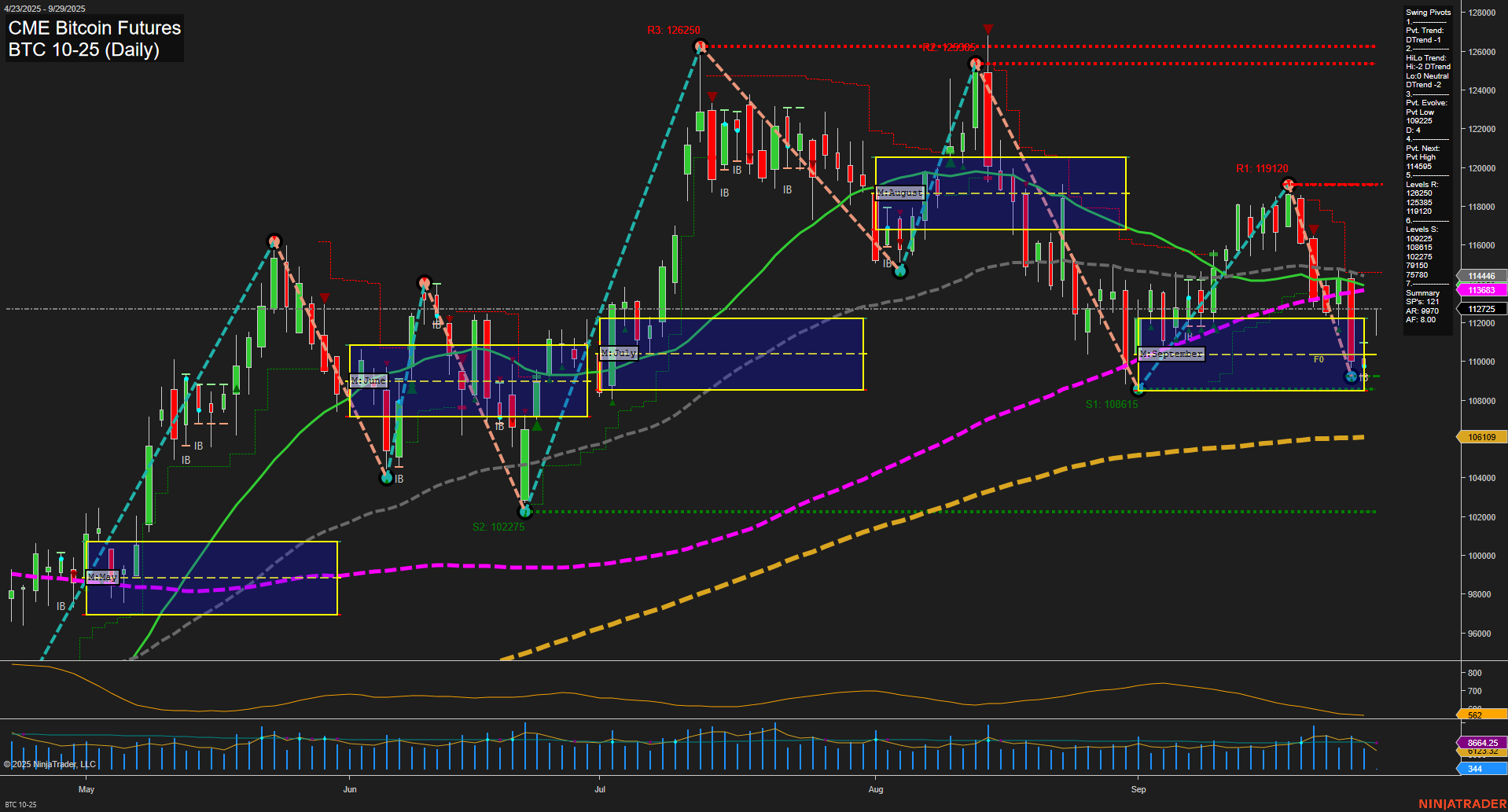

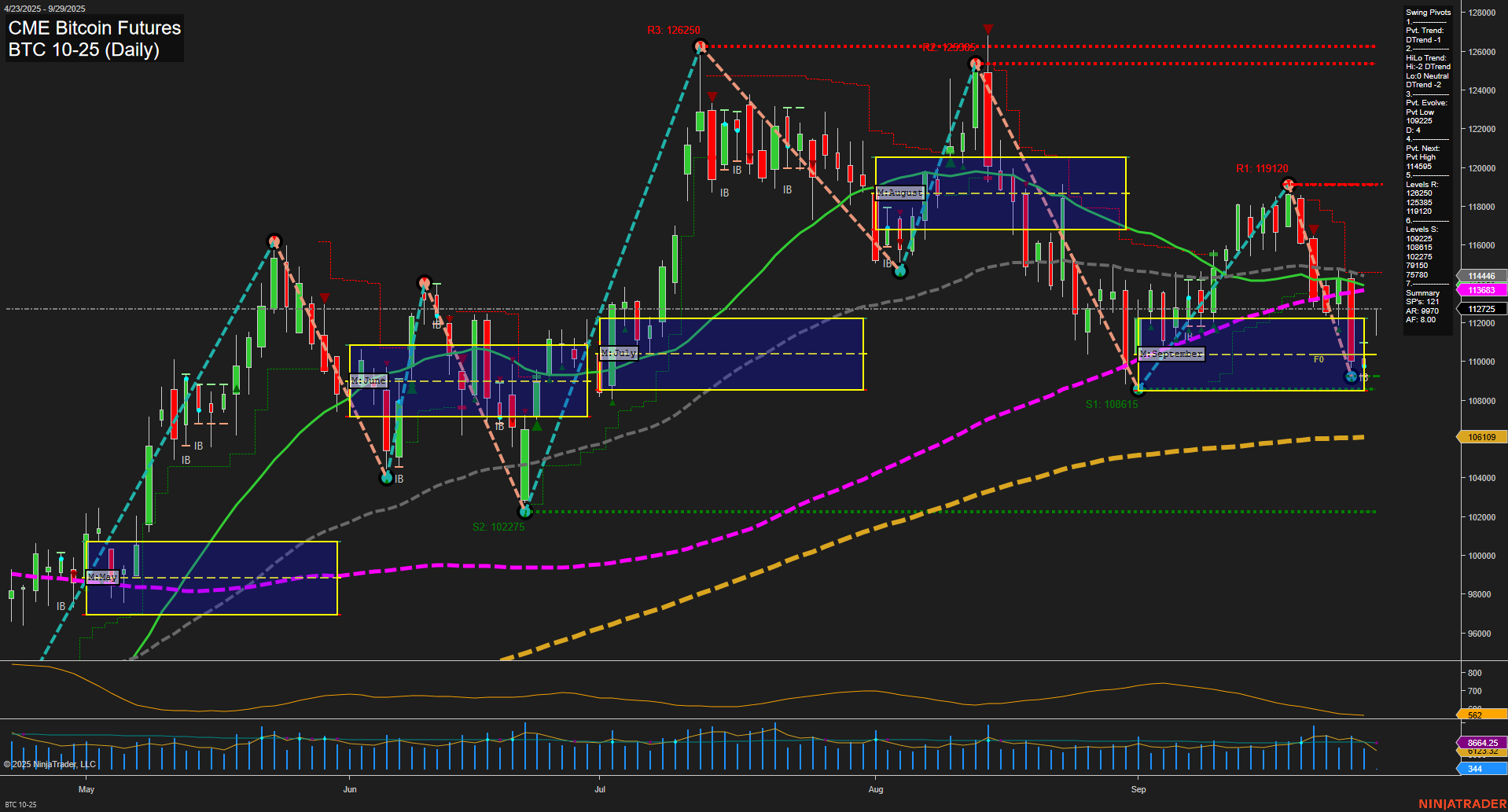

BTC CME Bitcoin Futures Daily Chart Analysis: 2025-Sep-28 18:03 CT

Price Action

- Last: 113635,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 50%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 23%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 47%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt low 108615,

- 4. Pvt. Next: Pvt high 114498,

- 5. Levels R: 119120, 114498,

- 6. Levels S: 108615, 102275.

Daily Benchmarks

- (Short-Term) 5 Day: 113635 Down Trend,

- (Short-Term) 10 Day: 114446 Down Trend,

- (Intermediate-Term) 20 Day: 115778 Down Trend,

- (Intermediate-Term) 55 Day: 116295 Down Trend,

- (Long-Term) 100 Day: 112725 Up Trend,

- (Long-Term) 200 Day: 106109 Up Trend.

Additional Metrics

Recent Trade Signals

- 24 Sep 2025: Long BTC 10-25 @ 113930 Signals.USAR.TR120

- 22 Sep 2025: Short BTC 09-25 @ 114505 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The current BTC CME futures chart shows a market in transition. Price action is consolidating near the lower end of the recent range, with medium-sized bars and average momentum, reflecting a pause after a recent swing down. The short-term trend is bearish, as confirmed by the swing pivot DTrend and all short-term and intermediate-term moving averages trending down. However, the intermediate-term HiLo trend is neutral, suggesting a potential inflection point or a wait-and-see approach for swing traders. Long-term structure remains bullish, with the 100 and 200-day moving averages still in uptrends and price holding above these levels. Key resistance is overhead at 114498 and 119120, while support is established at 108615 and 102275. The ATR and volume metrics indicate moderate volatility and participation. Recent trade signals show mixed short-term direction, highlighting the choppy and indecisive nature of the current environment. Overall, the market is in a corrective phase within a larger bullish context, with potential for further consolidation or a reversal if support levels hold and momentum shifts.

Chart Analysis ATS AI Generated: 2025-09-28 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.