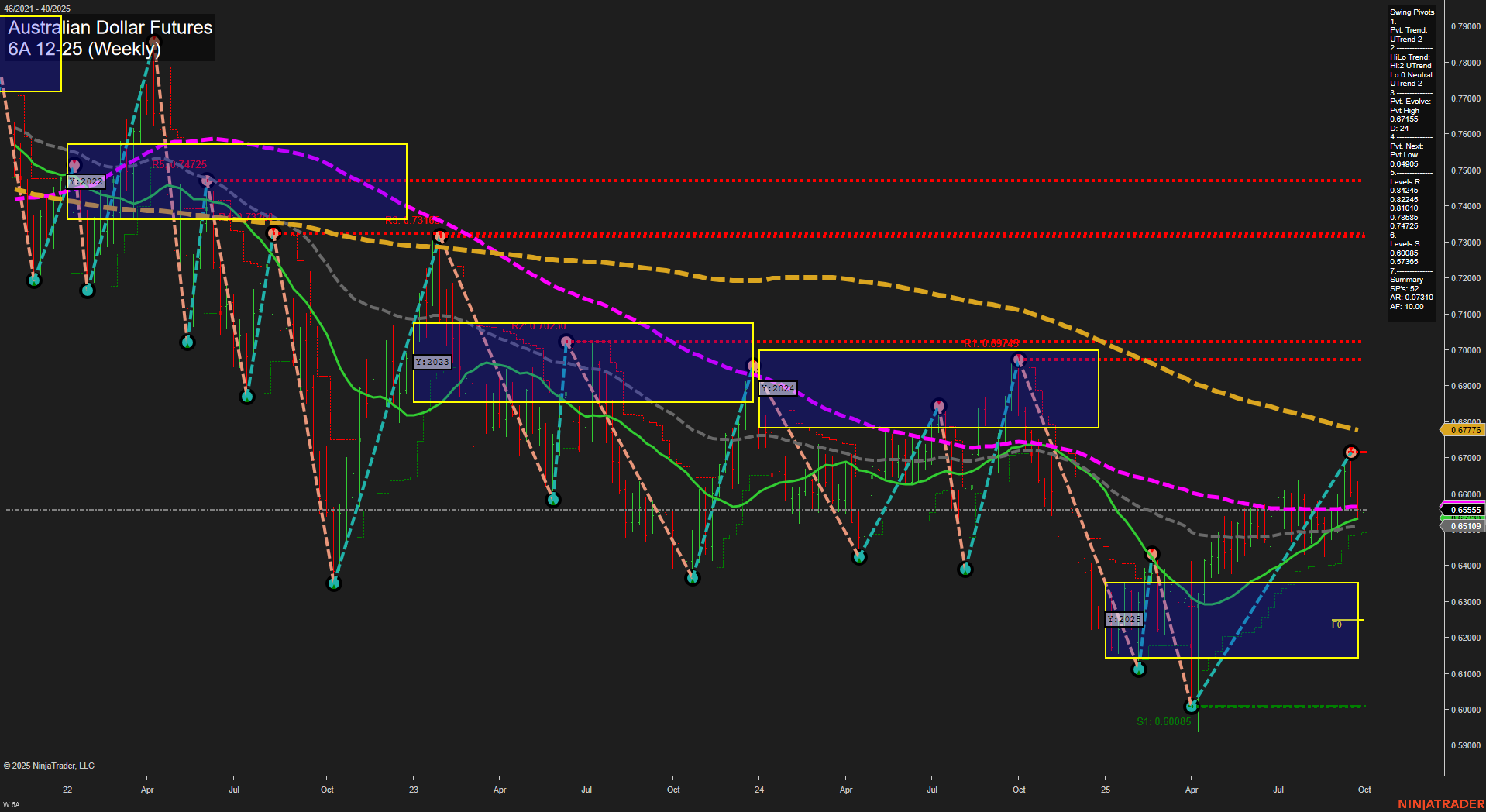

The 6A Australian Dollar Futures weekly chart shows a market in transition. Price action has recently seen a medium-sized move with average momentum, and the last price sits at 0.6537. Both short-term and intermediate-term swing pivot trends are up, supported by rising 5 and 10 week moving averages, as well as a 20 week MA that is also trending higher. However, the longer-term 55, 100, and 200 week moving averages remain in a downtrend, indicating that the broader bearish structure is still intact. The most recent swing pivot high at 0.6776 acts as a key resistance, with several resistance levels stacked above the current price, while the next major support is much lower at 0.60085. The neutral bias across the session fib grids (weekly, monthly, yearly) suggests a lack of strong directional conviction at these higher timeframes, and the market is currently consolidating after a recovery from the yearly lows. A recent short signal (26 Sep 2025) at 0.6537 highlights potential for a pullback or pause in the uptrend, possibly as the market tests overhead resistance and digests recent gains. The overall structure suggests a bullish bias in the short and intermediate term, but with caution warranted due to the prevailing long-term downtrend and significant resistance overhead. The market appears to be in a corrective phase within a larger bearish cycle, with the potential for further consolidation or a retest of lower support if resistance holds.