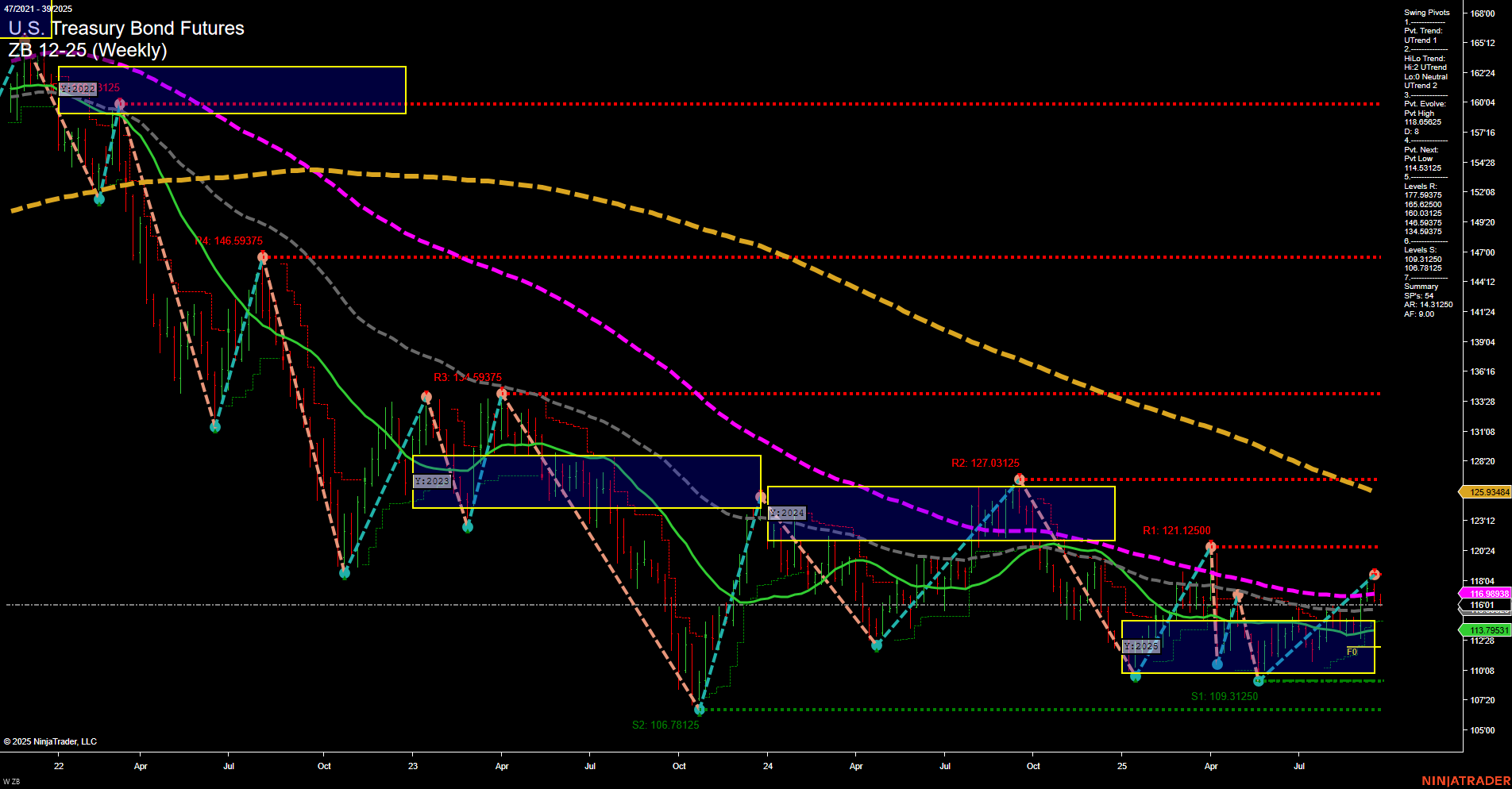

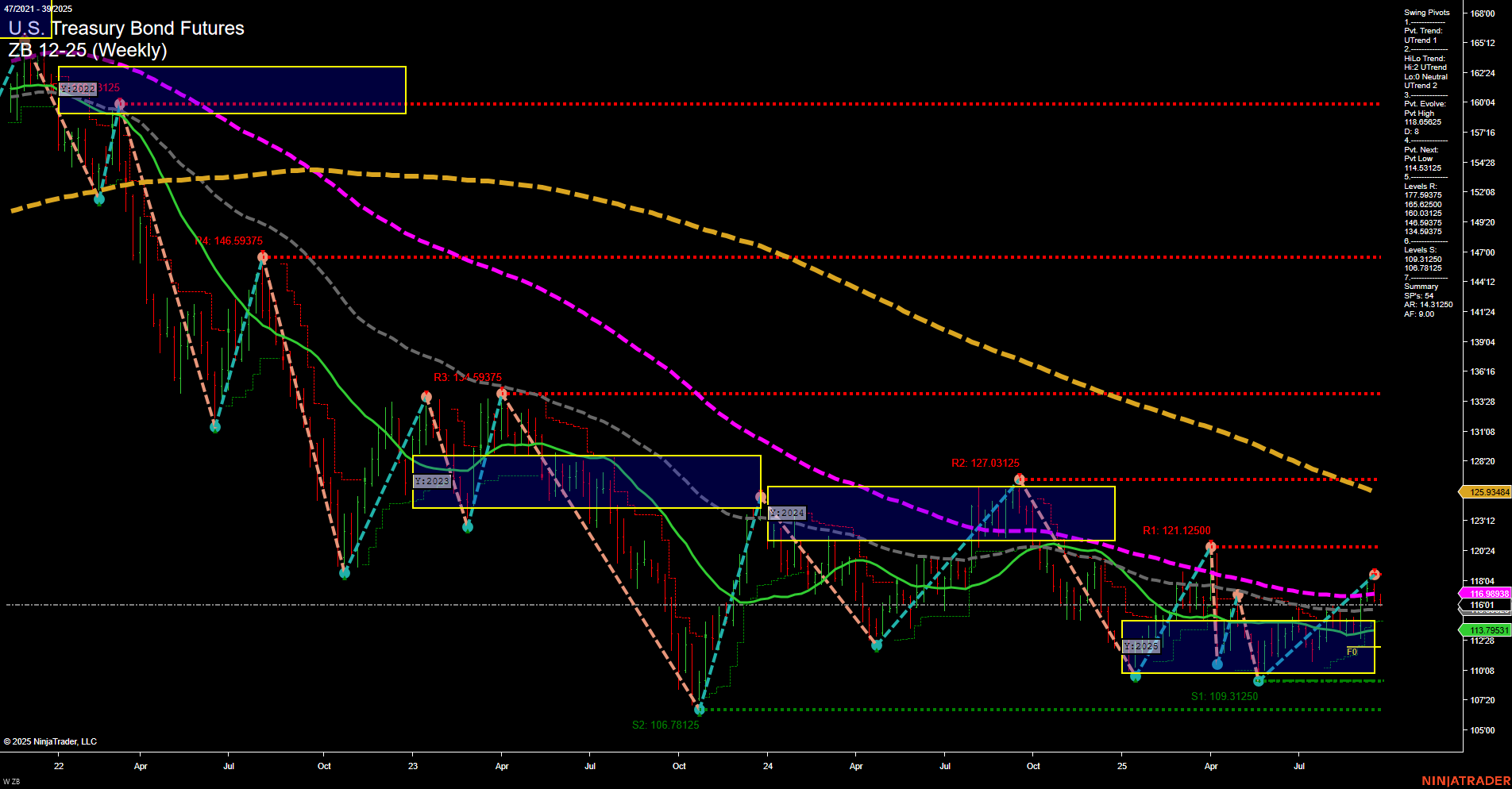

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Sep-26 07:22 CT

Price Action

- Last: 125’934,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 118’09375,

- 4. Pvt. Next: Pvt Low 114’53125,

- 5. Levels R: 177’59375, 146’59375, 127’03125, 121’12500, 118’09375,

- 6. Levels S: 109’31250, 106’78125, 100’78125.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 116’09381 Up Trend,

- (Intermediate-Term) 10 Week: 116’09381 Up Trend,

- (Long-Term) 20 Week: 113’79351 Up Trend,

- (Long-Term) 55 Week: 118’074 Down Trend,

- (Long-Term) 100 Week: 125’3125 Down Trend,

- (Long-Term) 200 Week: 146’59375 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Short- and intermediate-term trends are bullish, supported by upward momentum in the 5, 10, and 20-week moving averages, and confirmed by the current swing pivot uptrend. Price has recently moved above key support levels and is approaching resistance, with the next major resistance at 127’03125 and support at 114’53125. However, the long-term trend remains bearish, as indicated by the 55, 100, and 200-week moving averages, which are still trending down. The price is currently consolidating within a neutral zone, suggesting a potential pause or base-building phase after a prior downtrend. The market is showing signs of a possible recovery, but faces significant overhead resistance and remains below long-term moving averages, indicating that any sustained rally will need to overcome these levels to shift the broader trend. Volatility and choppy price action may persist as the market tests these key areas.

Chart Analysis ATS AI Generated: 2025-09-26 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.