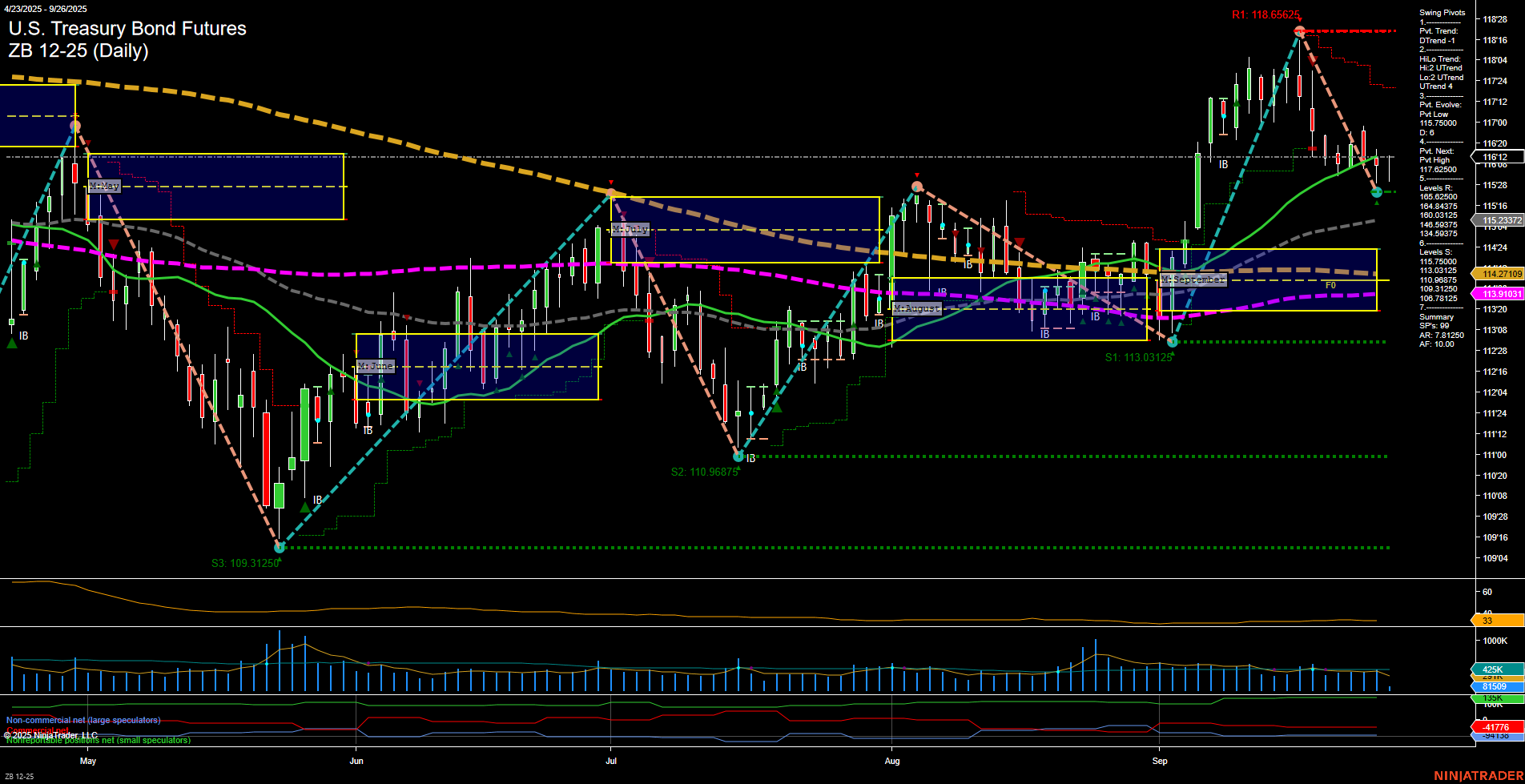

The ZB U.S. Treasury Bond Futures daily chart currently reflects a mixed environment for swing traders. Price action shows medium-sized bars and average momentum, with the last price at 116'12. Short-term signals are bearish, as indicated by a downtrend in both the 5-day and 10-day moving averages and a short-term pivot trend (DTrend). However, the intermediate-term outlook is more constructive, with the 20-day, 55-day, and 100-day moving averages all trending upward and the HiLo pivot trend in an uptrend, suggesting underlying support and potential for higher prices if the market can hold above key support levels. Resistance is layered above at 116'28, 117'26.5, and 118'65.25, while support is found at 115'07 and further below at 113'03.12. The ATR indicates moderate volatility, and volume remains steady. The market is currently consolidating within a neutral monthly and weekly session fib grid, with no clear directional bias from these frameworks. The long-term trend remains neutral, as the 200-day moving average is flat to slightly down. Overall, the market is in a consolidation phase after a recent pullback from swing highs, with short-term weakness but intermediate-term resilience. Swing traders should note the potential for further choppy price action as the market tests support and resistance levels, with the possibility of a trend continuation if intermediate-term support holds.