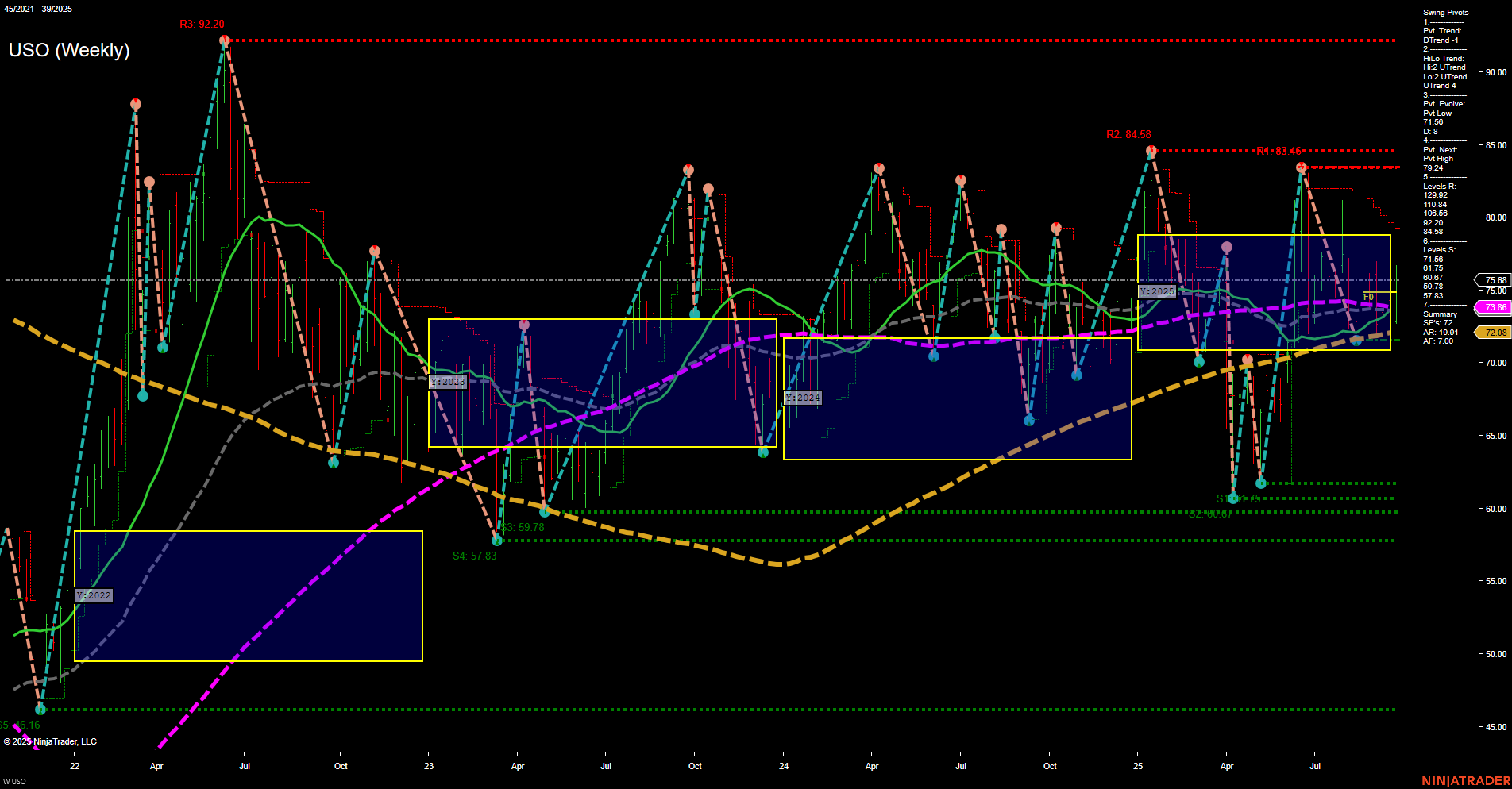

USO is currently trading in a broad consolidation range, with price action showing medium-sized bars and average momentum, indicating a lack of strong directional conviction. The short-term trend is neutral, as reflected by the WSFG and the most recent swing pivot trend (DTrend), suggesting a pause or potential transition phase. Intermediate-term signals are more constructive, with the HiLo trend in an uptrend and most moving averages (10, 20, 55, 100 week) trending higher, supporting a bullish bias for swing traders looking at multi-week setups. However, the 5-week and 200-week moving averages are in a downtrend, tempering the long-term outlook and keeping the overall long-term rating neutral. Key resistance levels are clustered in the upper 70s to low 90s, while support is well-defined in the low 60s, highlighting a wide trading band. The market has recently bounced from a significant swing low, but faces overhead resistance and remains within the yearly NTZ, suggesting further consolidation or range-bound action is likely until a decisive breakout or breakdown occurs. Volatility remains elevated, and the chart structure favors mean reversion and swing trading strategies over trend following in the current environment.