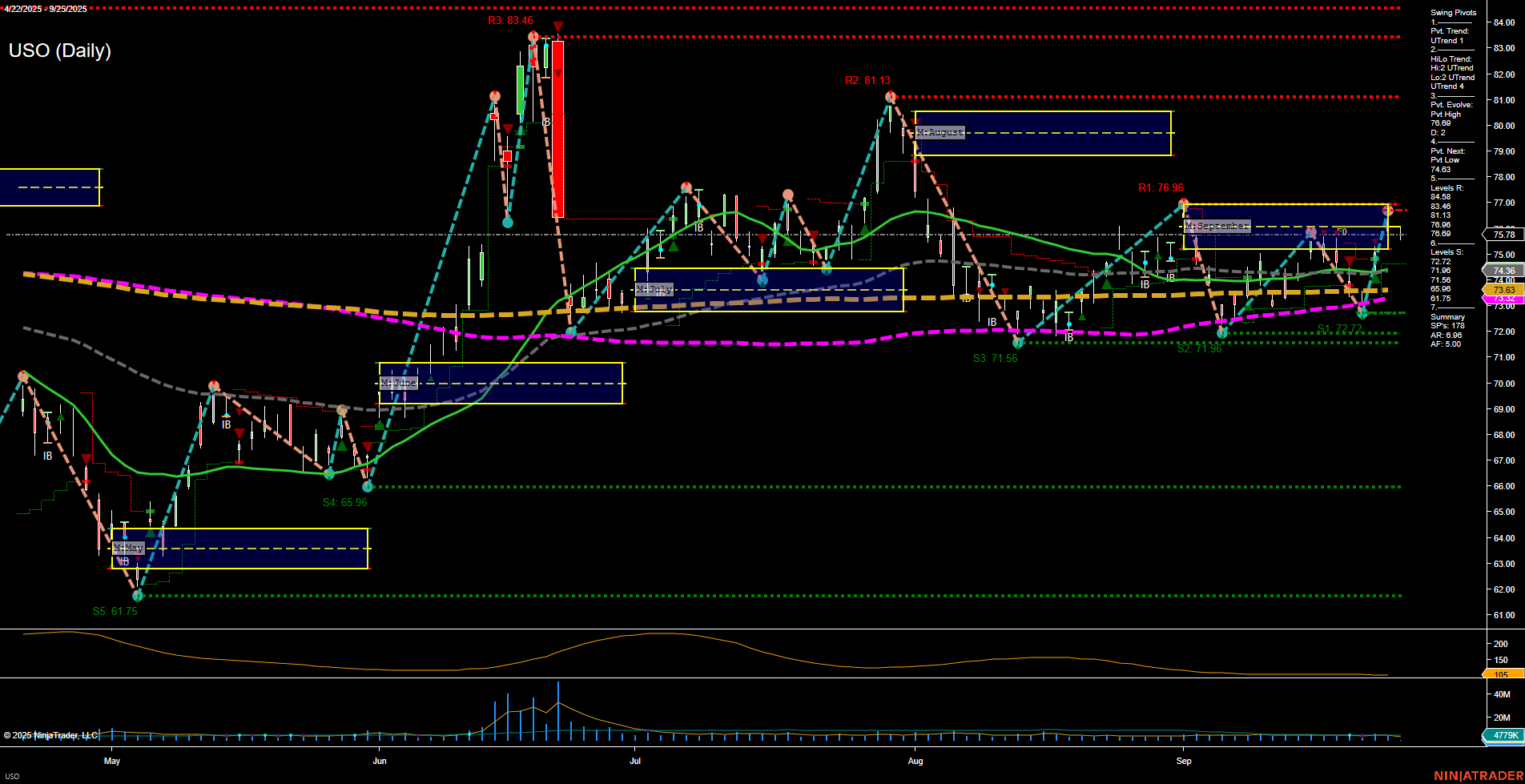

USO is currently exhibiting a bullish structure across all timeframes, with the last price at 74.36 and all benchmark moving averages trending upward. The short-term and intermediate-term swing pivot trends are both in an uptrend, with the most recent pivot high at 76.96 and the next potential pivot low at 74.63, suggesting the market is testing resistance near recent highs. Multiple resistance levels are stacked above, notably at 76.96, 81.13, 83.46, and 84.86, while support is layered at 75.00, 71.96, and 71.56, providing a well-defined range for price action. The ATR indicates moderate volatility, and volume remains steady, supporting the current trend. The neutral bias on the session fib grids (weekly, monthly, yearly) suggests a lack of strong directional conviction from broader market participants, but the prevailing uptrend in pivots and moving averages points to continued bullish momentum. The chart reflects a market that has recently recovered from a pullback, with higher lows and a series of swing highs, indicating trend continuation rather than reversal. No clear breakout or breakdown is present, but the structure favors further upside as long as support levels hold and momentum remains intact.