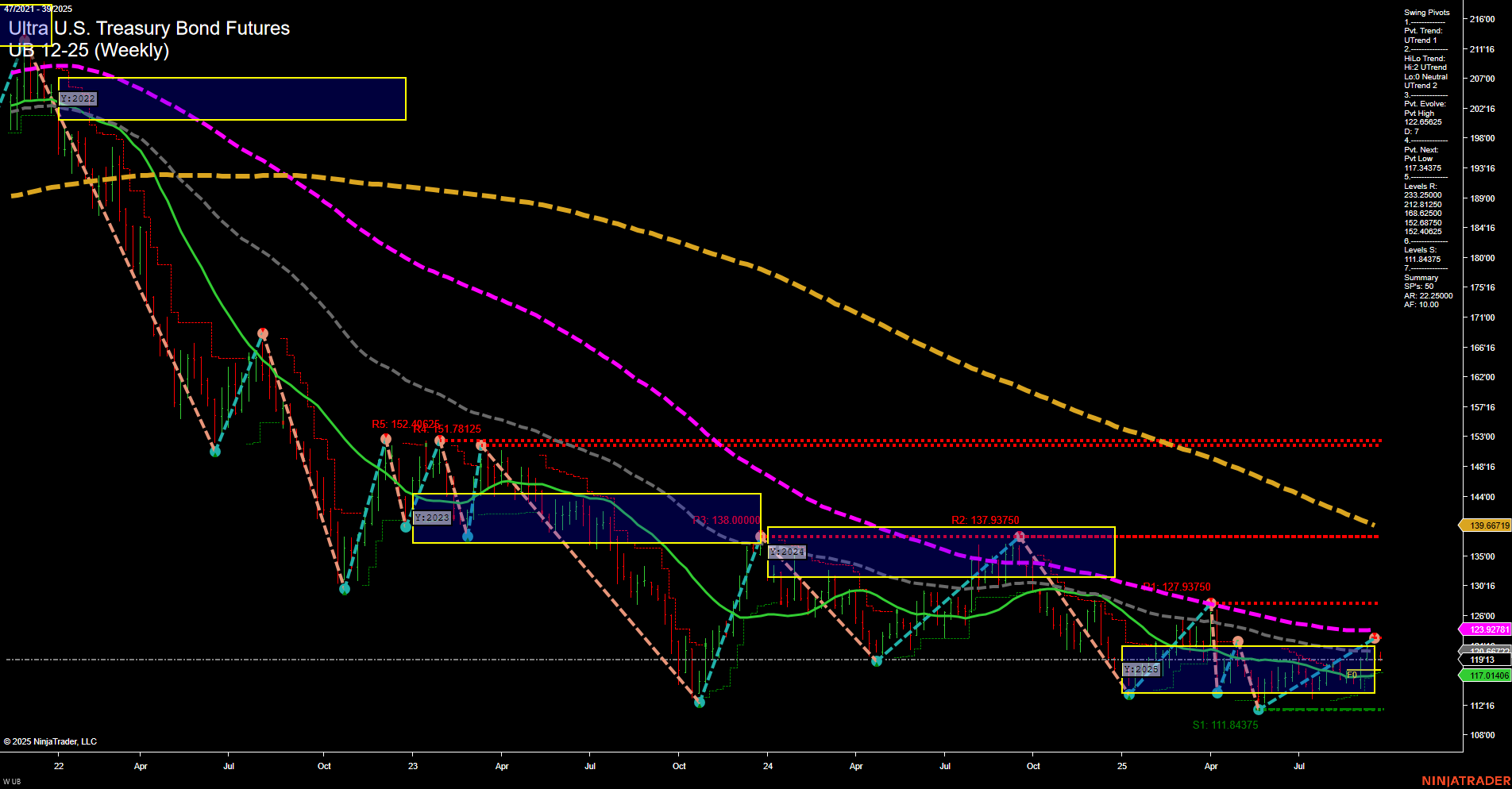

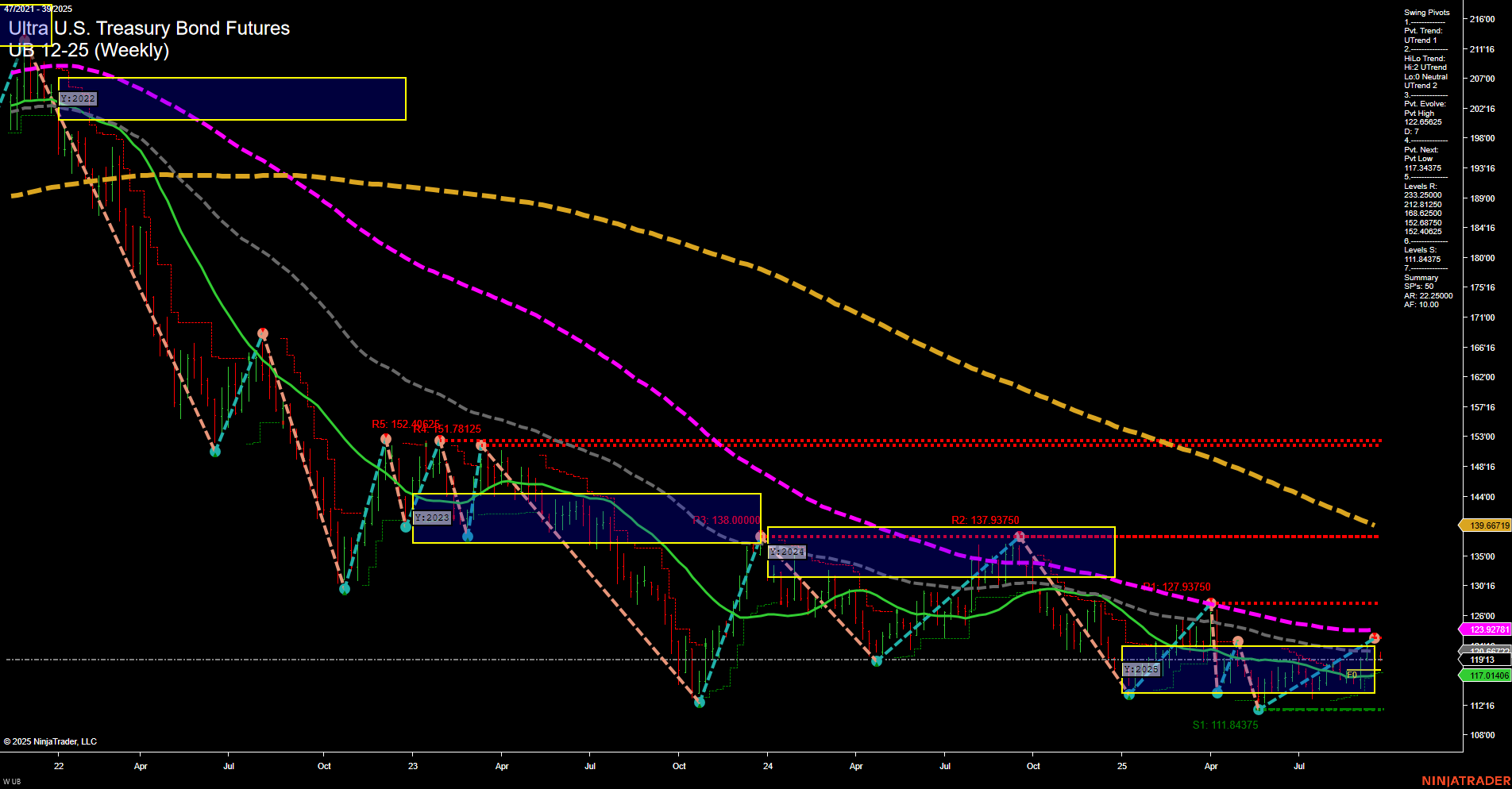

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Sep-26 07:20 CT

Price Action

- Last: 119'13,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -6%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 82%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 127.0625,

- 4. Pvt. Next: Pvt Low 117.34375,

- 5. Levels R: 152.40625, 151.78125, 138.0000, 137.93750, 127.93750,

- 6. Levels S: 117.01406, 111.84375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 123.92781 Down Trend,

- (Intermediate-Term) 10 Week: 123.92781 Down Trend,

- (Long-Term) 20 Week: 123.92781 Down Trend,

- (Long-Term) 55 Week: 139.06719 Down Trend,

- (Long-Term) 100 Week: 151.78125 Down Trend,

- (Long-Term) 200 Week: 172.40625 Down Trend.

Recent Trade Signals

- 25 Sep 2025: Short UB 12-25 @ 119.25 Signals.USAR.TR120

- 25 Sep 2025: Short UB 12-25 @ 119.46875 Signals.USAR-WSFG

- 22 Sep 2025: Short UB 12-25 @ 119.28125 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently subdued with medium-sized bars and slow momentum, reflecting a period of consolidation after recent moves. Short-term technicals, including the WSFG trend and recent trade signals, point to a bearish bias, with price trading below the NTZ and multiple short signals triggered. However, intermediate-term metrics, such as the MSFG and swing pivot trends, indicate an upward bias, suggesting a possible countertrend rally or retracement within a broader downtrend. Long-term indicators, including all major moving averages and the YSFG, remain firmly bearish, with price well below key resistance levels and all benchmarks trending down. The market is currently testing support near 117'01406, with significant resistance overhead. This environment is characterized by choppy, range-bound action, with the potential for further downside if support fails, but also the possibility of short-term rallies as part of a larger corrective phase.

Chart Analysis ATS AI Generated: 2025-09-26 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.