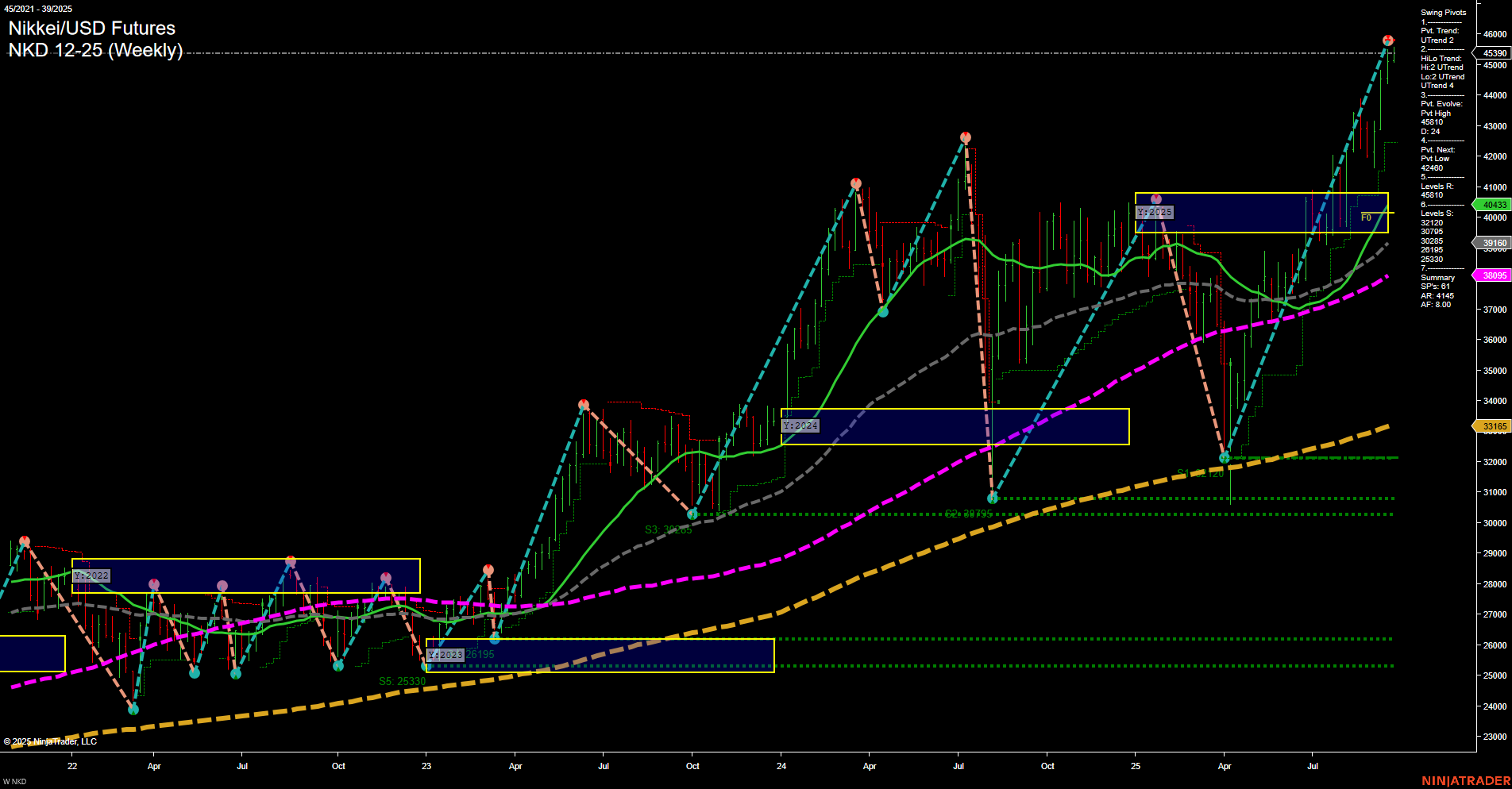

The NKD Nikkei/USD Futures are exhibiting strong upward momentum, with the latest weekly bar being large and momentum fast, indicating heightened volatility and active participation. Despite a short-term WSFG trend pointing down and price currently below the weekly NTZ center, the intermediate and long-term trends remain firmly bullish, as reflected by the MSFG and YSFG both showing price well above their respective NTZ centers and in uptrends. Swing pivots confirm an uptrend in both short and intermediate terms, with the most recent pivot high at 45,390 and the next significant support at 42,540. All benchmark moving averages from 5 to 200 weeks are trending upward, reinforcing the underlying strength of the market. The recent short signal at 45,220 suggests a potential short-term pullback or consolidation phase, but the broader structure remains supportive of higher prices. The market has shown a pattern of higher highs and higher lows, with strong support levels well below current prices, indicating resilience and a tendency for buyers to step in on dips. Overall, the technical landscape favors a bullish bias for swing traders on intermediate and long-term horizons, while the short-term may see some corrective action or consolidation before the next directional move.