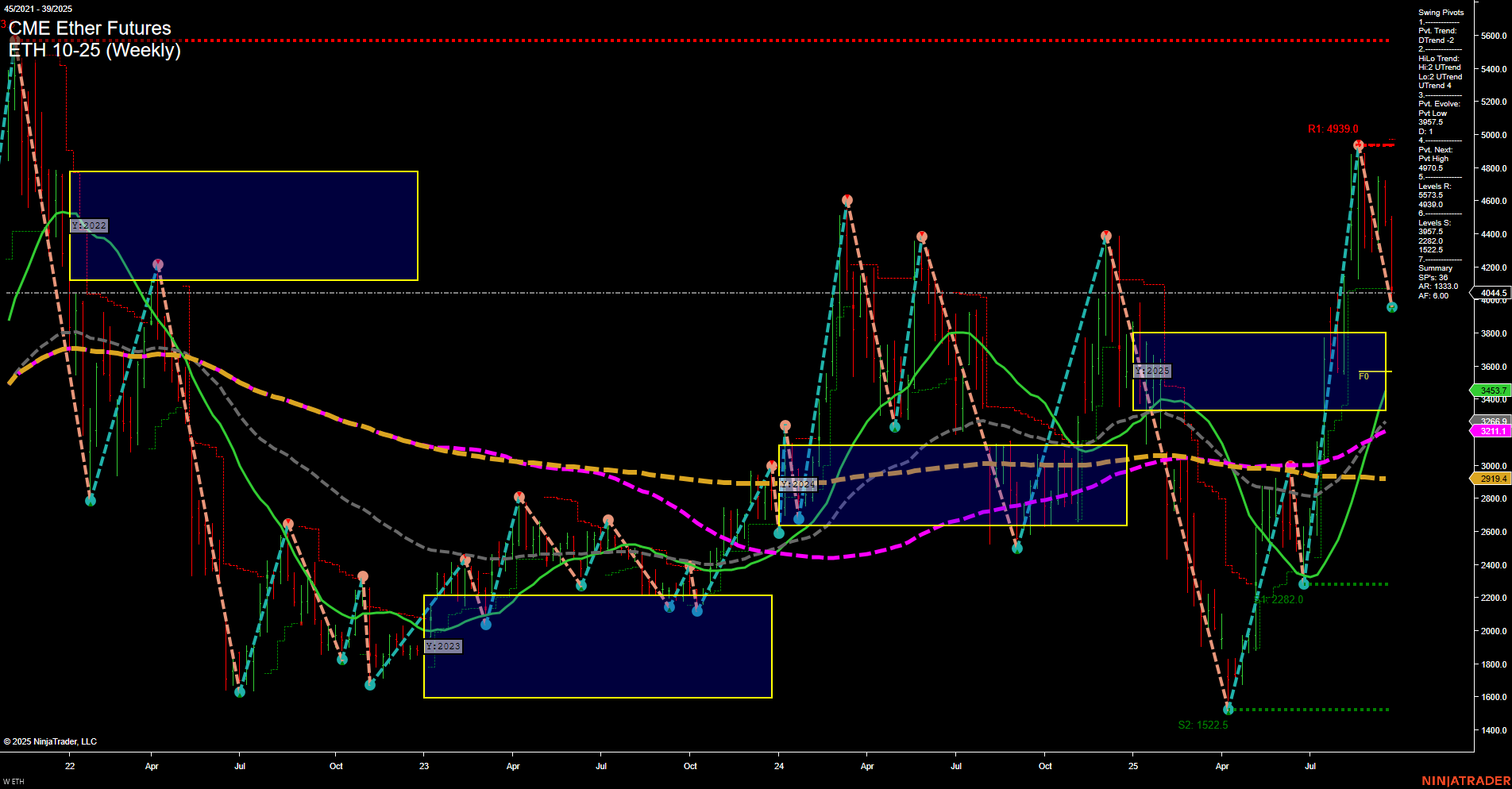

The current weekly chart for ETH CME Ether Futures shows a strong short-term bearish momentum, with large bars and fast price movement to the downside. Both the Weekly and Monthly Session Fib Grids (WSFG and MSFG) indicate price is below their respective NTZ/F0% levels, confirming a downward trend in the short and intermediate timeframes. However, the Yearly Session Fib Grid (YSFG) remains positive, with price above the yearly NTZ/F0% and an upward trend, suggesting the broader long-term structure is still bullish. Swing pivots highlight a recent pivot high at 4939.0 and a next potential pivot low at 2282.0, with resistance levels stacked above and significant support at 2282.0 and 1522.5. The moving averages reinforce this mixed outlook: short-term benchmarks (5 and 10 week) are trending down, while all long-term benchmarks (20, 55, 100, 200 week) are trending up, indicating underlying strength despite the current pullback. Recent trade signals have triggered short entries, aligning with the short-term and intermediate-term bearish trends. Overall, the market is experiencing a corrective phase within a larger bullish structure, with volatility and large price swings. Swing traders should note the potential for further downside in the short term, but the long-term uptrend remains intact, suggesting this could be a retracement within a broader bullish cycle.