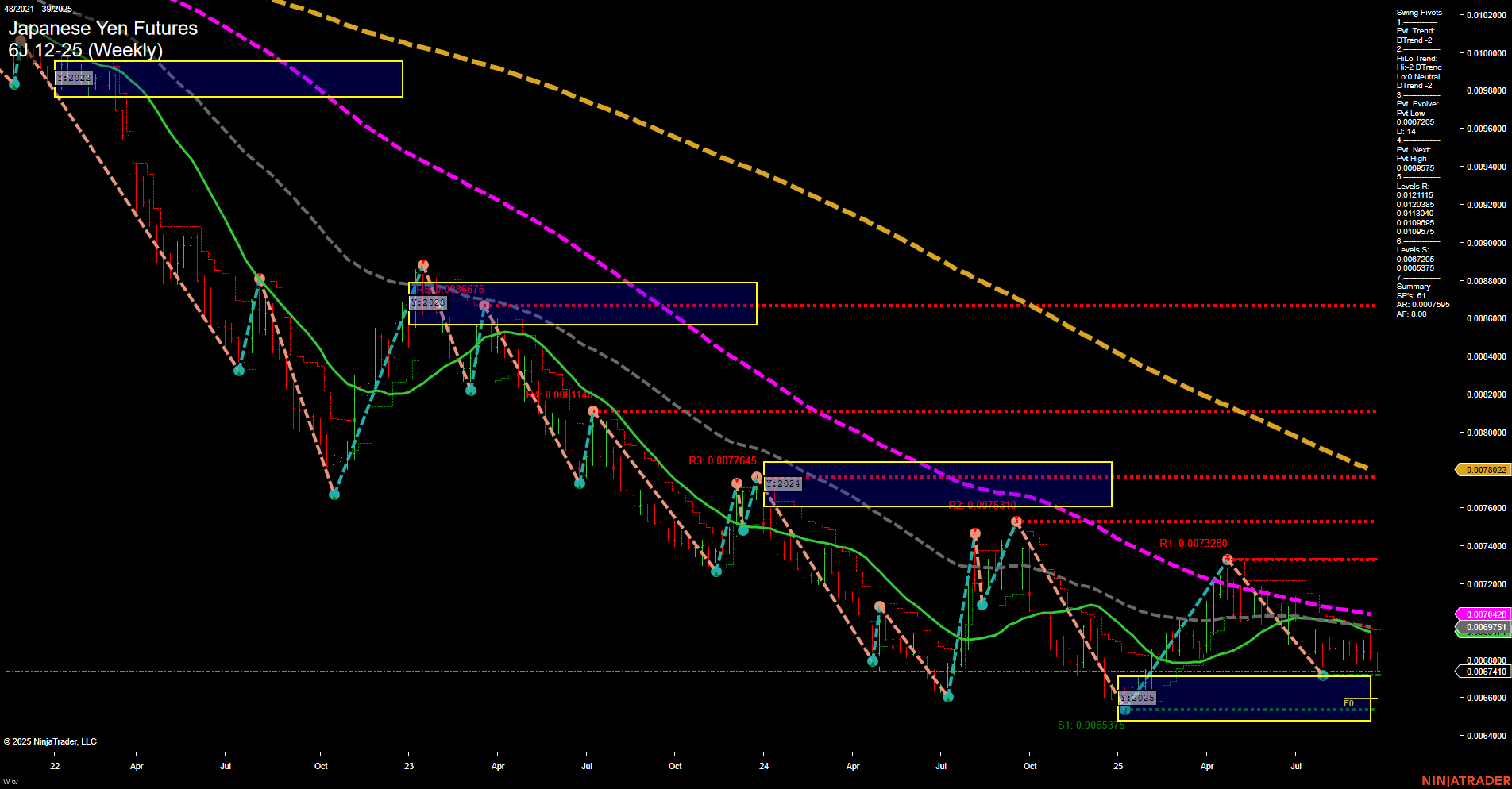

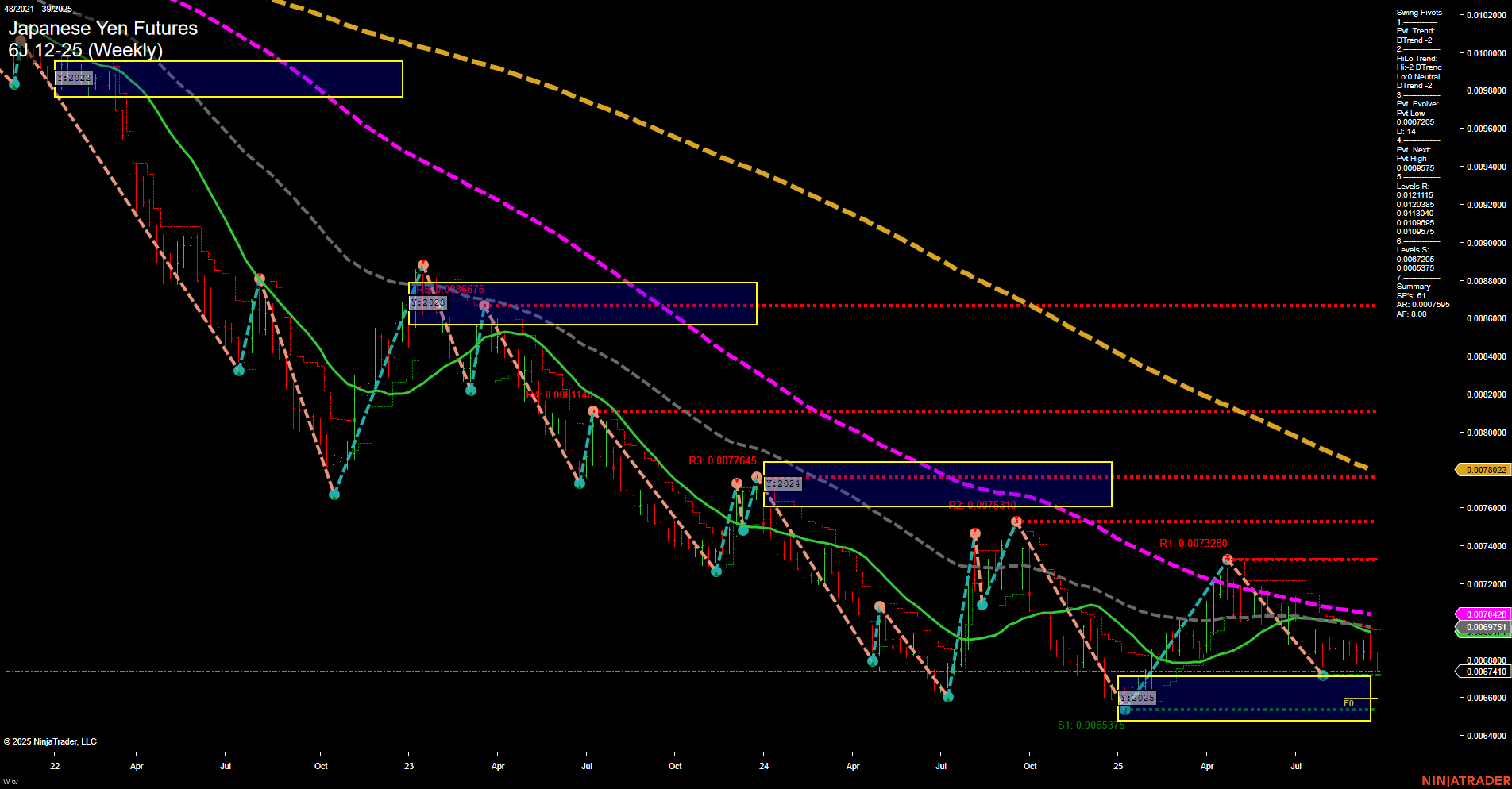

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Sep-26 07:03 CT

Price Action

- Last: 0.0069751,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -91%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -61%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 0.0065375,

- 4. Pvt. Next: Pvt High 0.0073280,

- 5. Levels R: 0.0081140, 0.0077645, 0.0075434, 0.0073280,

- 6. Levels S: 0.0067005, 0.0065375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0069751 Down Trend,

- (Intermediate-Term) 10 Week: 0.0070425 Down Trend,

- (Long-Term) 20 Week: 0.0070802 Down Trend,

- (Long-Term) 55 Week: 0.0077645 Down Trend,

- (Long-Term) 100 Week: 0.0081140 Down Trend,

- (Long-Term) 200 Week: 0.0093205 Down Trend.

Recent Trade Signals

- 24 Sep 2025: Short 6J 12-25 @ 0.00678 Signals.USAR.TR720

- 24 Sep 2025: Short 6J 12-25 @ 0.0068005 Signals.USAR-WSFG

- 24 Sep 2025: Short 6J 12-25 @ 0.006818 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The Japanese Yen futures (6J) weekly chart continues to reflect a dominant bearish structure in both the short- and intermediate-term outlooks. Price action is subdued, with small bars and slow momentum, indicating a lack of strong buying interest and a prevailing downward drift. The WSFG and MSFG both show price well below their respective NTZ/F0% levels, confirming persistent downside pressure. Swing pivots reinforce this, with both short-term and intermediate-term trends in decline, and the most recent pivot evolving at a new low. Resistance levels remain stacked above, while support is clustered near recent lows, suggesting limited downside before a potential test of support. All benchmark moving averages from 5-week to 200-week are trending down, underscoring the entrenched bearish sentiment. Recent trade signals are all short, aligning with the prevailing trend. However, the yearly session fib grid (YSFG) shows a slight upward bias, hinting at possible long-term stabilization or a base-building phase, but this is not yet confirmed by price or moving averages. Overall, the market remains in a bearish phase with no clear signs of reversal, though long-term participants may watch for any emerging basing patterns or shifts in momentum.

Chart Analysis ATS AI Generated: 2025-09-26 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.