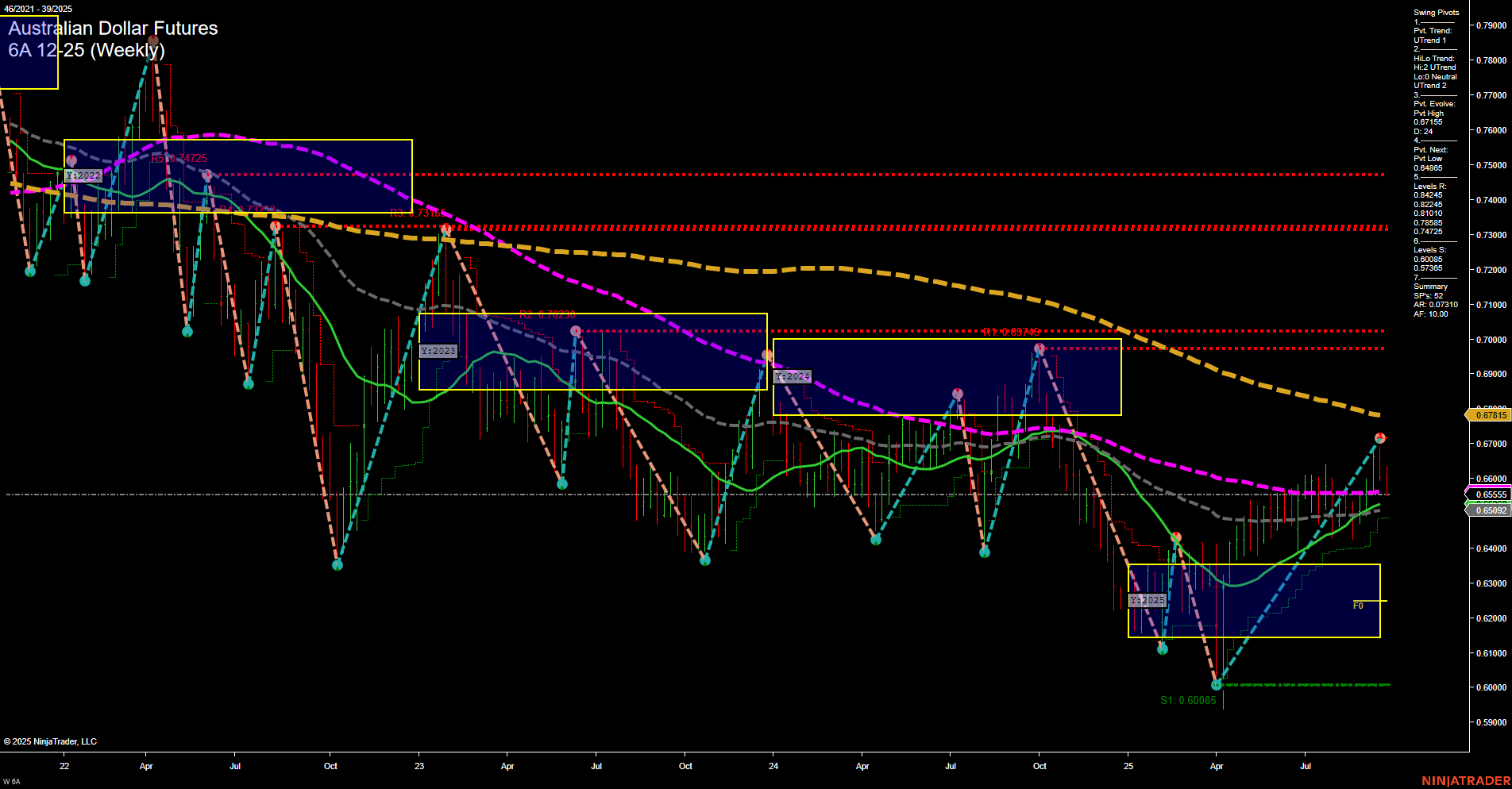

The 6A Australian Dollar Futures weekly chart shows a market that has recently shifted to an upward swing, with both short-term and intermediate-term swing pivot trends in an uptrend. Price action is currently around 0.6537, with medium-sized bars and average momentum, indicating a steady but not aggressive move. The price is trading above the 5, 10, 20, and 55-week moving averages, all of which are in uptrends, supporting the bullish tone in the short and intermediate term. However, the 100 and 200-week moving averages remain in a downtrend, suggesting that the longer-term structure is still neutral and has not fully transitioned to a bullish phase. The WSFG, MSFG, and YSFG all indicate a neutral bias, with price action consolidating near the center of the yearly and session fib grids, and no clear breakout or breakdown from the NTZ (neutral zone). The most recent swing high at 0.67145 serves as a key resistance, while the next major support is at 0.60952, highlighting a wide range for potential price movement. The recent short signal at 0.6537 suggests some caution for immediate upside, possibly indicating a pullback or pause after the recent rally. Overall, the chart reflects a market in transition, with bullish momentum in the short and intermediate term, but longer-term resistance and neutral grid signals tempering the outlook. The market appears to be in a recovery phase, testing higher levels after a significant low, but still facing overhead resistance from longer-term moving averages and previous swing highs. This environment is typical of a market emerging from a base, with potential for further upside if resistance levels are cleared, but also vulnerable to retracements if momentum stalls.