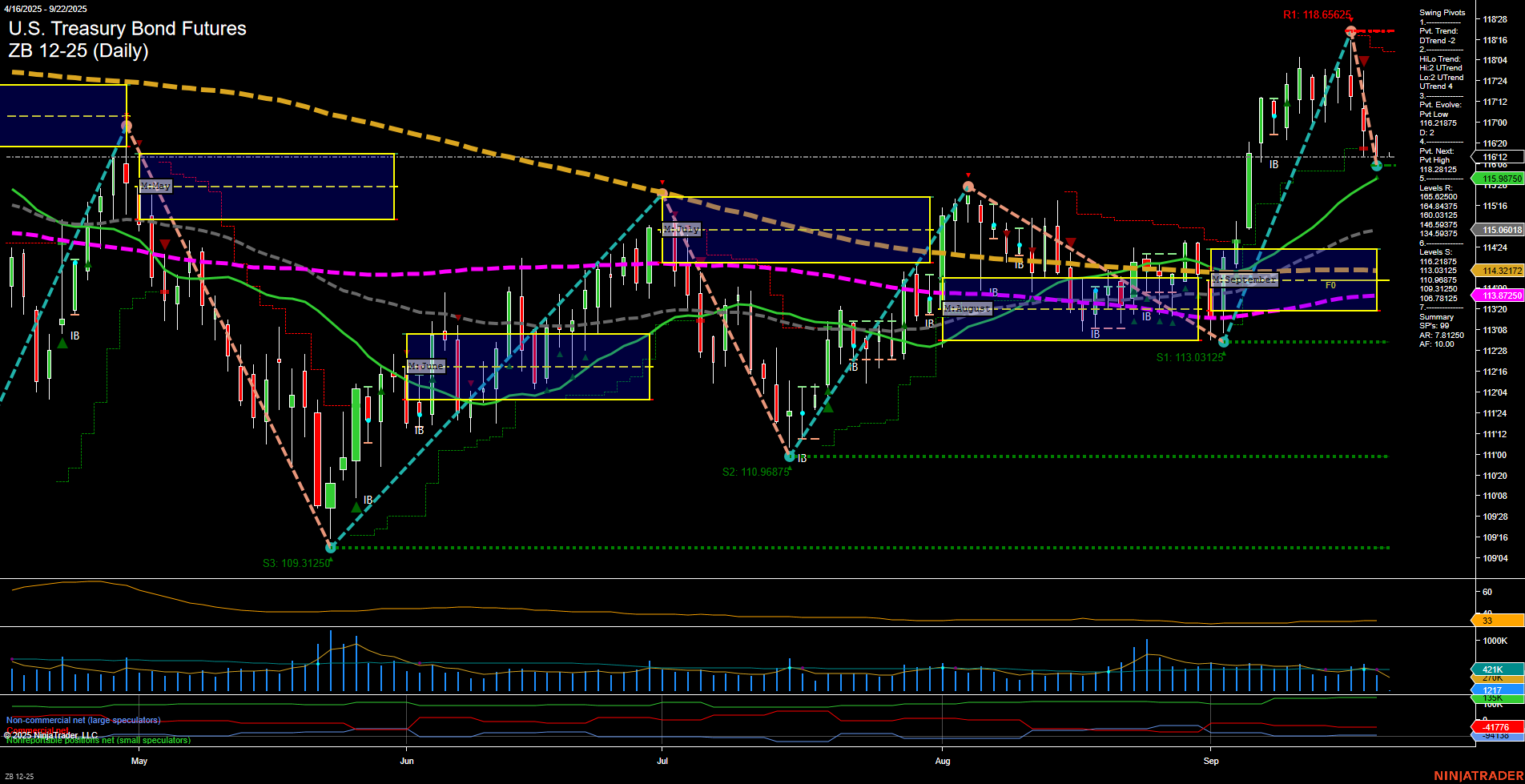

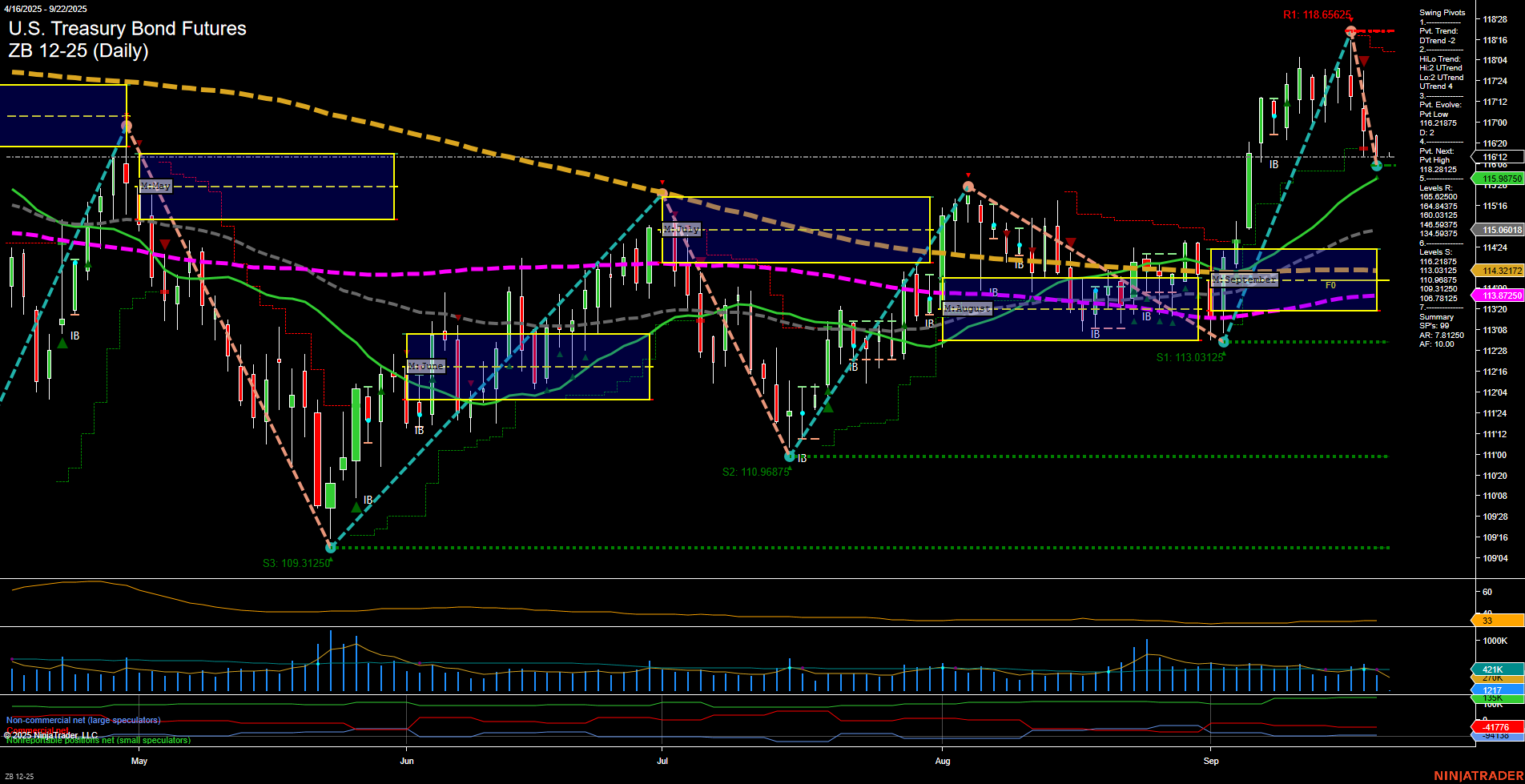

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Sep-21 18:14 CT

Price Action

- Last: 115.9875,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 118.65625,

- 4. Pvt. Next: Pvt Low 112.21875,

- 5. Levels R: 118.65625, 118.03125, 117.734, 117.094,

- 6. Levels S: 113.03125, 110.96875, 109.3125.

Daily Benchmarks

- (Short-Term) 5 Day: 116.12 Down Trend,

- (Short-Term) 10 Day: 116.12 Down Trend,

- (Intermediate-Term) 20 Day: 115.09 Up Trend,

- (Intermediate-Term) 55 Day: 114.32 Up Trend,

- (Long-Term) 100 Day: 114.84 Up Trend,

- (Long-Term) 200 Day: 117.59 Down Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart shows a recent sharp pullback from a swing high at 118.65625, with price now at 115.9875 and large, fast-moving bars indicating heightened volatility. Short-term momentum has shifted bearish, as confirmed by the downtrend in both the 5-day and 10-day moving averages, and the current swing pivot trend (DTrend). However, intermediate-term signals remain constructive, with the 20-day, 55-day, and 100-day moving averages all trending up, and the HiLo swing trend still in an uptrend, suggesting the broader move off the summer lows is intact. Key resistance sits overhead at 118.65625, while support is found at 113.03125 and below. The 200-day moving average is still in a downtrend, keeping the long-term outlook neutral. The current environment is characterized by a fast retracement after a strong rally, with the market testing whether this is a deeper pullback or the start of a larger reversal. Volume and ATR confirm increased activity and volatility, typical of inflection points. Swing traders will note the mixed signals: short-term pressure is to the downside, but the intermediate-term structure remains bullish unless key support levels break.

Chart Analysis ATS AI Generated: 2025-09-21 18:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.