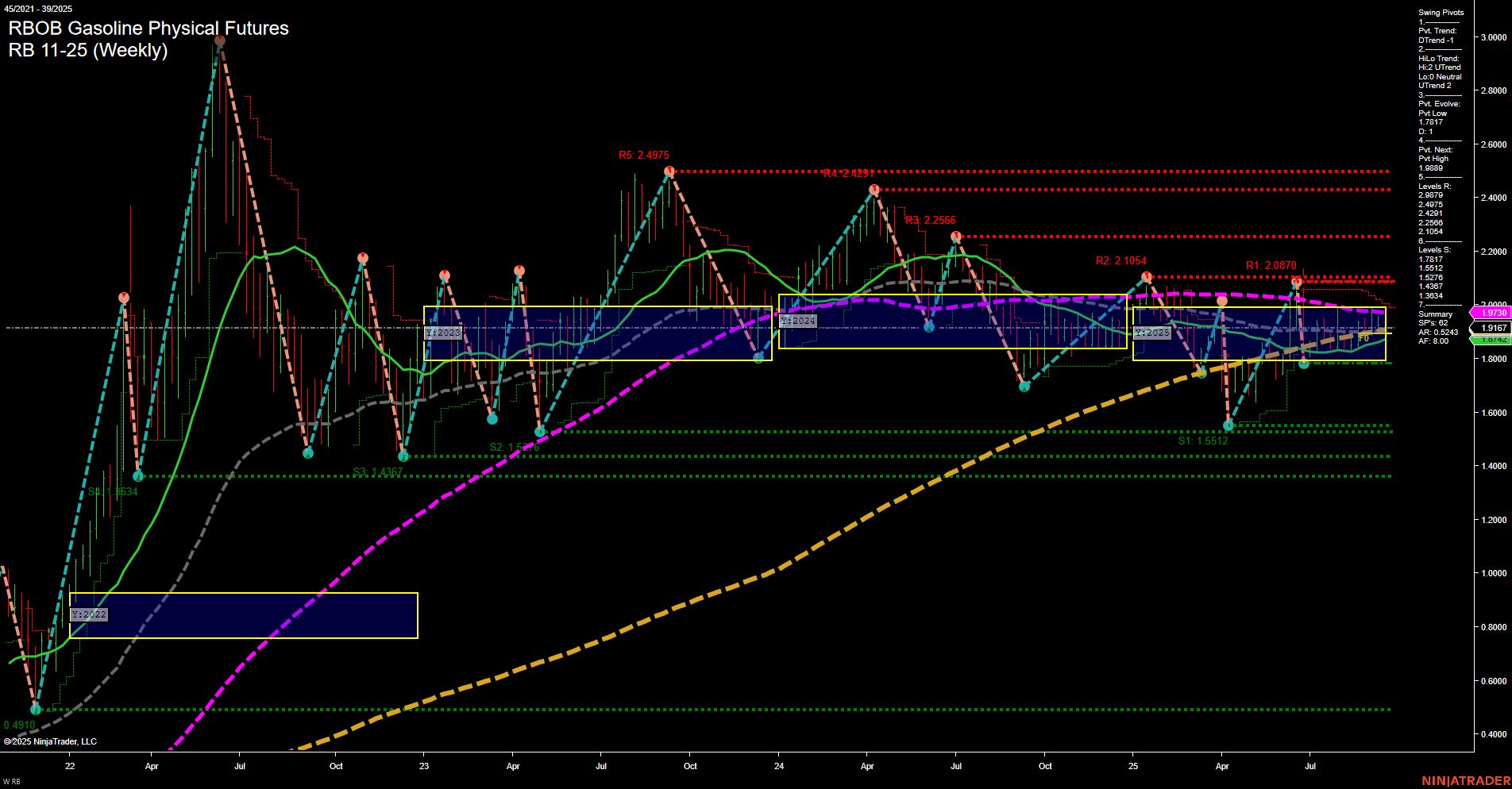

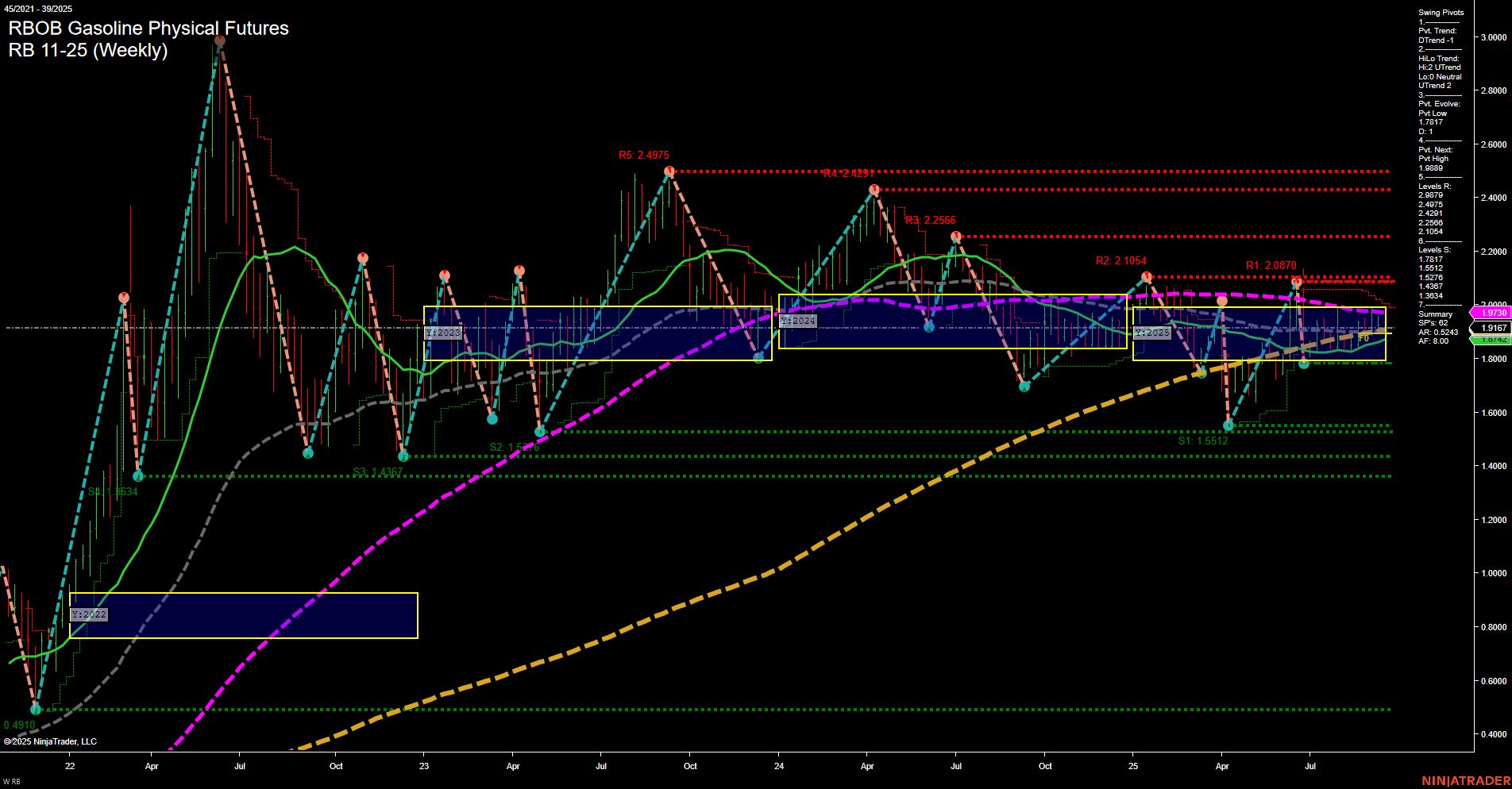

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Sep-21 18:10 CT

Price Action

- Last: 1.9730,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -31%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.9176,

- 4. Pvt. Next: Pvt high 1.9889,

- 5. Levels R: 2.4975, 2.4287, 2.2566, 2.1054, 2.0870,

- 6. Levels S: 1.9176, 1.8177, 1.6527, 1.4367, 1.1551, 0.4910.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.9730 Down Trend,

- (Intermediate-Term) 10 Week: 1.9876 Down Trend,

- (Long-Term) 20 Week: 1.9730 Up Trend,

- (Long-Term) 55 Week: 1.8976 Up Trend,

- (Long-Term) 100 Week: 1.9900 Up Trend,

- (Long-Term) 200 Week: 1.8247 Up Trend.

Recent Trade Signals

- 19 Sep 2025: Short RB 10-25 @ 1.987 Signals.USAR-WSFG

- 15 Sep 2025: Long RB 10-25 @ 1.9964 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline futures market is currently exhibiting a mixed but nuanced structure. Short-term momentum is slow and the price is trading below the weekly session fib grid (WSFG) neutral zone, with a clear downtrend in the short-term swing pivot and recent short signal, indicating bearish sentiment for the immediate horizon. However, the intermediate and long-term outlooks are more constructive: both the monthly and yearly session fib grids show price above their respective neutral zones, and the trends are up. The intermediate-term swing pivot trend is up, and the long-term moving averages are all in uptrends, suggesting underlying strength and a potential for higher prices over time. The market is consolidating within a broad range, with significant resistance overhead (notably at 2.0870 and above) and strong support below (notably at 1.9176 and 1.8177). This environment is typical of a market in transition, where short-term pullbacks may be countered by longer-term buying interest. Volatility is moderate, and the market is likely to remain choppy until a decisive breakout or breakdown occurs. Swing traders should note the divergence between short-term weakness and longer-term strength, as this could set up for either a deeper retracement or a resumption of the broader uptrend.

Chart Analysis ATS AI Generated: 2025-09-21 18:10 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.