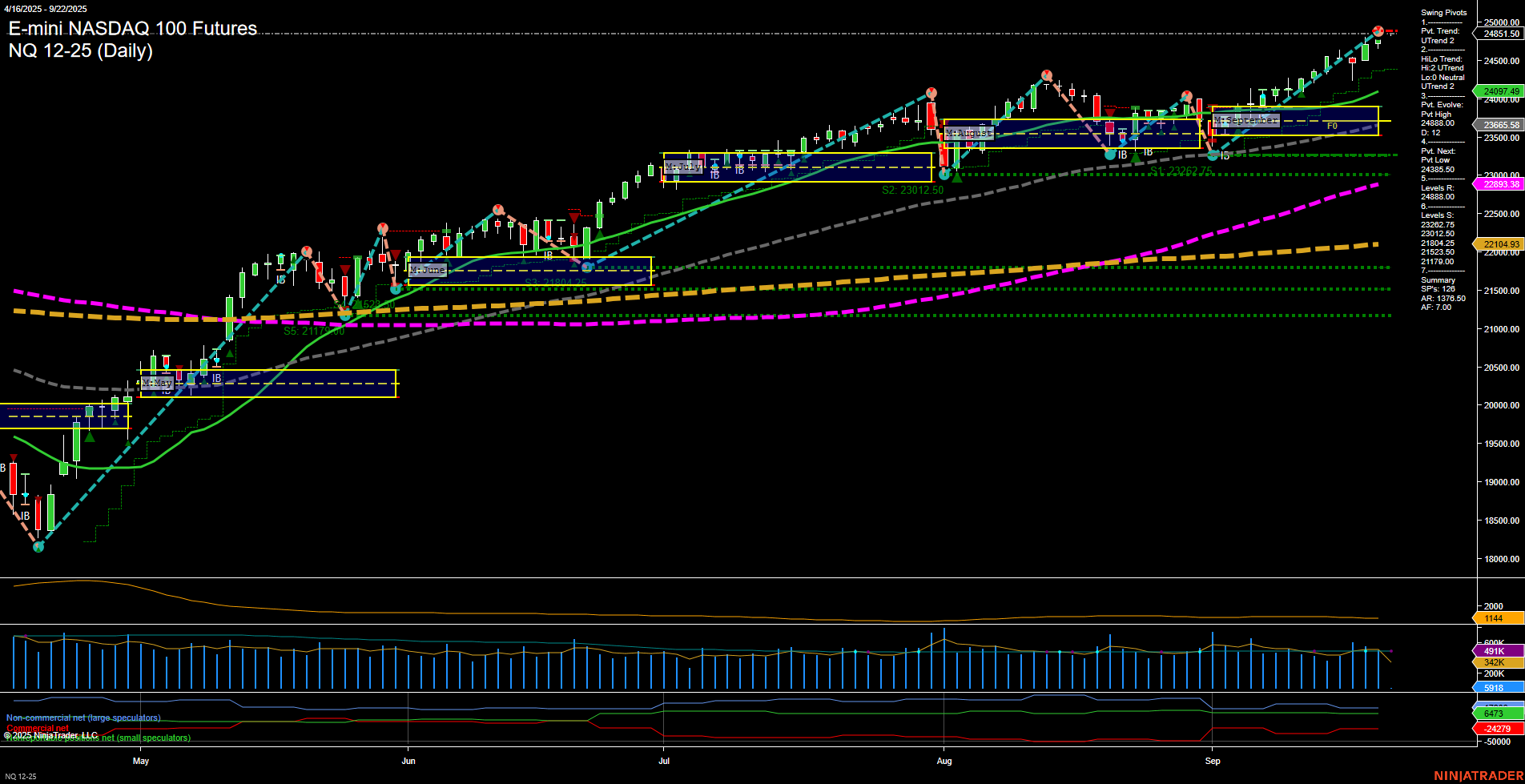

The NQ E-mini NASDAQ 100 Futures daily chart is demonstrating a strong bullish structure across all timeframes. Price action remains robust, with the last close at 24,851.50 and medium-sized bars reflecting steady, average momentum. The market is trading well above all key moving averages, with each benchmark (5, 10, 20, 55, 100, and 200 day) in a clear uptrend, confirming broad-based strength. Swing pivot analysis shows the short-term and intermediate-term trends are both up, with the most recent pivot high at 24,808.00 and the next significant support at 23,665.58. Resistance is layered just above current price, but the market has consistently made higher highs and higher lows, indicating persistent buying interest. The ATR and VOLMA values suggest healthy volatility and participation, supporting the ongoing trend. Recent trade signals confirm the bullish bias, with a long entry triggered on September 18th. The market is also trading above the NTZ/F0% levels on the weekly, monthly, and yearly session fib grids, reinforcing the upward momentum. Overall, the technical landscape points to a continuation of the uptrend, with no immediate signs of exhaustion or reversal. The environment remains favorable for trend-following swing strategies, as the market continues to reward buying on pullbacks within the established bullish channel.