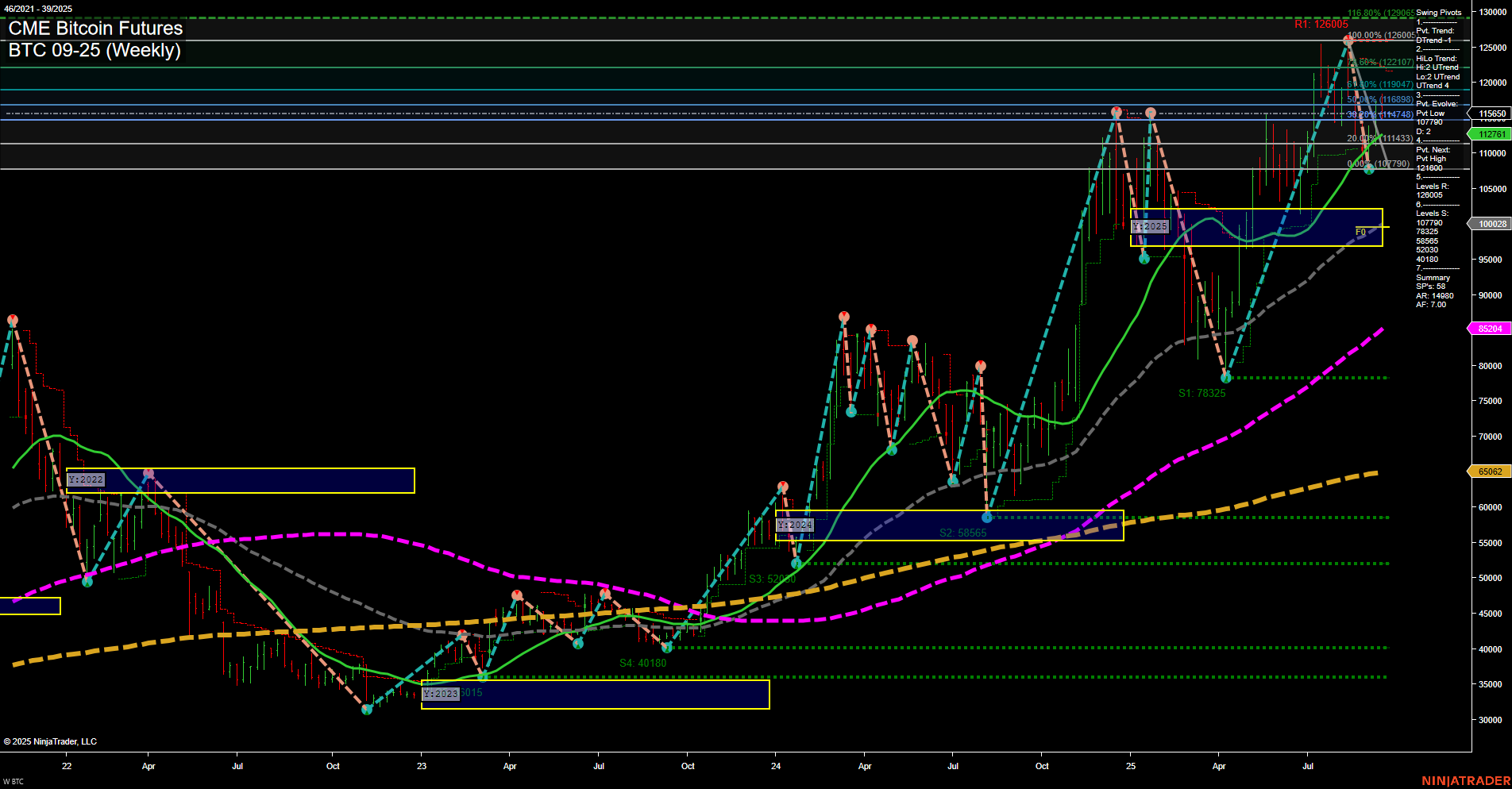

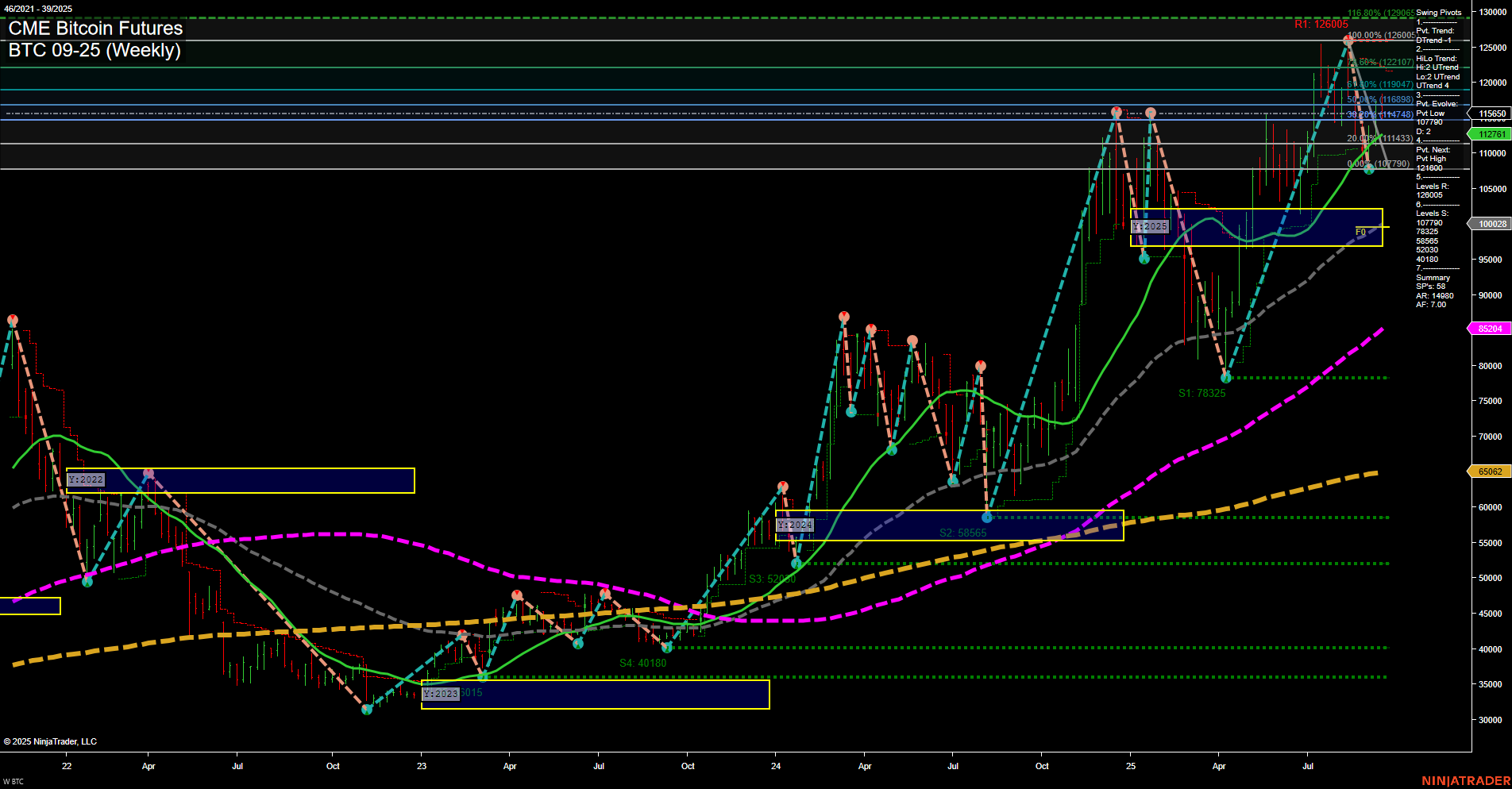

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Sep-21 18:02 CT

Price Action

- Last: 112761,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -16%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 54%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 61%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 110700,

- 4. Pvt. Next: Pvt high 121600,

- 5. Levels R: 126005, 122017, 121600, 117473,

- 6. Levels S: 110700, 100028, 78325, 58665, 52000, 40180.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 117461 Down Trend,

- (Intermediate-Term) 10 Week: 117433 Down Trend,

- (Long-Term) 20 Week: 104747 Up Trend,

- (Long-Term) 55 Week: 100015 Up Trend,

- (Long-Term) 100 Week: 85204 Up Trend,

- (Long-Term) 200 Week: 65062 Up Trend.

Recent Trade Signals

- 19 Sep 2025: Short BTC 09-25 @ 115705 Signals.USAR-WSFG

- 19 Sep 2025: Short BTC 09-25 @ 115705 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The current weekly chart for BTC CME Bitcoin Futures shows a strong, fast momentum move to the downside in the short term, with large bars and price action breaking below the WSFG NTZ center, confirming a short-term downtrend. This is reinforced by recent short trade signals and both the 5- and 10-week moving averages turning down. However, the intermediate- and long-term outlooks remain bullish, with the MSFG and YSFG both trending up and price holding above their respective NTZ centers. The HiLo trend and all long-term moving averages are still in uptrends, suggesting the broader bull cycle is intact. Key resistance levels are clustered above at 117473, 121600, 122017, and 126005, while support is found at 110700 and further below at 100028 and 78325. The market is currently experiencing a corrective pullback within a larger uptrend, typical of swing cycles after a strong rally. Volatility is elevated, and the structure suggests a test of lower support before any potential resumption of the uptrend. The overall setup is a classic swing retracement within a bullish macro context, with short-term traders favoring the downside while longer-term participants remain constructive.

Chart Analysis ATS AI Generated: 2025-09-21 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.