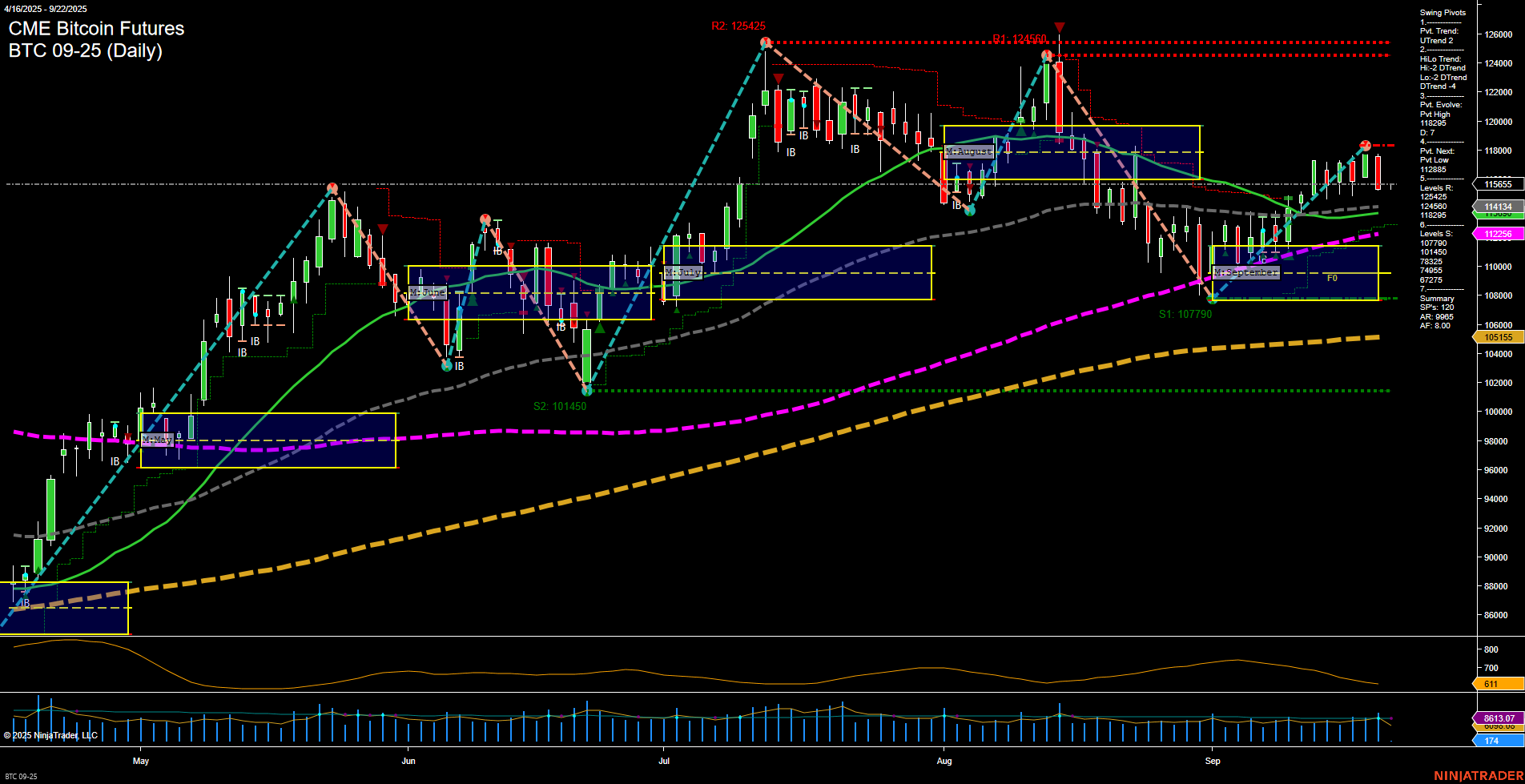

BTC CME Futures are currently in a complex swing environment. Price action shows medium-sized bars and average momentum, with the last price at 115,655. The short-term WSFG trend is down, with price below the weekly NTZ, indicating some near-term weakness or consolidation. However, the monthly and yearly session fib grids both show price above their respective NTZs and in uptrends, supporting a bullish intermediate and long-term outlook. Swing pivots indicate a short-term uptrend (UTrend), but the intermediate-term HiLo trend remains down, suggesting the market is in a recovery phase after a recent pullback. The most recent pivot high is at 118,269, with the next key pivot low at 112,885. Resistance is layered above at 124,525 and 124,450, while support is found at 107,790 and 101,450. All benchmark moving averages from short to long-term are trending up, reinforcing the underlying bullish structure. Volatility (ATR) is moderate, and volume remains healthy. Recent trade signals have triggered short entries, reflecting the short-term corrective move within a broader uptrend. Overall, the market is consolidating after a pullback, with short-term signals mixed but the intermediate and long-term structure remaining bullish. The setup suggests a market in transition, with potential for further upside if support holds and the short-term downtrend resolves.