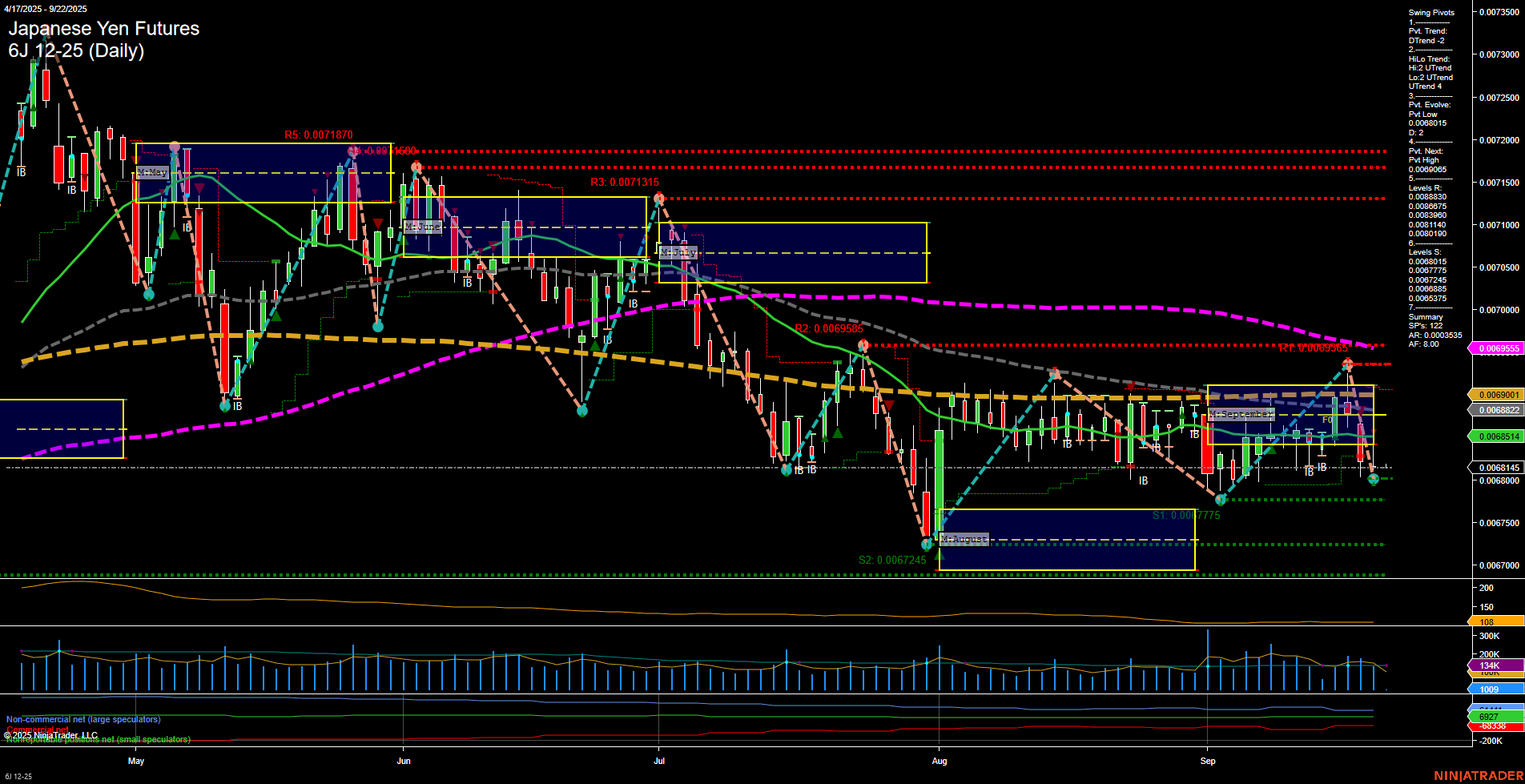

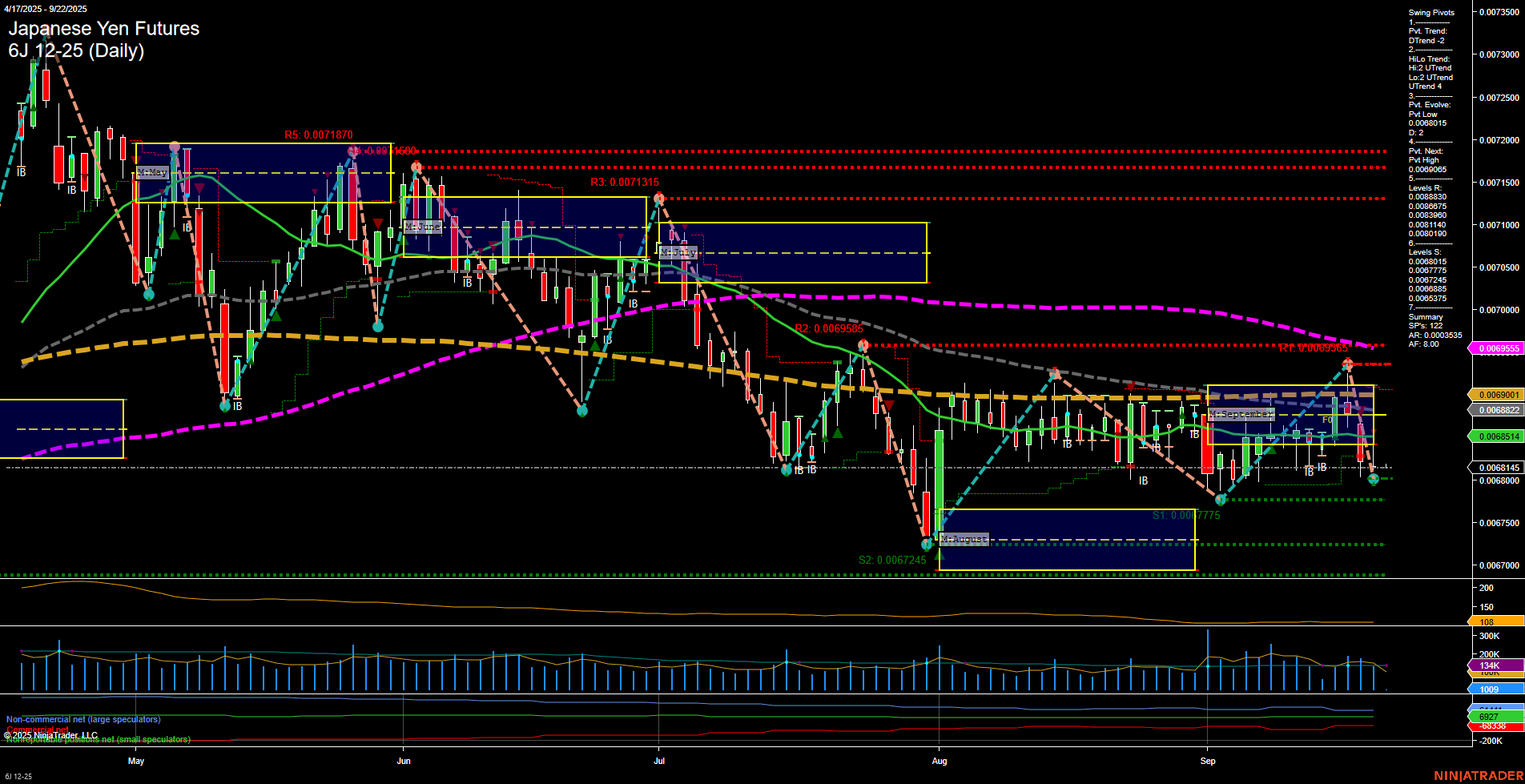

6J Japanese Yen Futures Daily Chart Analysis: 2025-Sep-21 18:01 CT

Price Action

- Last: 0.0068145,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -22%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -25%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 18%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 0.0068145,

- 4. Pvt. Next: Pvt high 0.0069065,

- 5. Levels R: 0.0073500, 0.0073000, 0.0071870, 0.0071315, 0.0069585, 0.0069065,

- 6. Levels S: 0.0068145, 0.0067775, 0.0067245.

Daily Benchmarks

- (Short-Term) 5 Day: 0.0068901 Down Trend,

- (Short-Term) 10 Day: 0.0068822 Down Trend,

- (Intermediate-Term) 20 Day: 0.0068514 Down Trend,

- (Intermediate-Term) 55 Day: 0.0069535 Down Trend,

- (Long-Term) 100 Day: 0.0069555 Down Trend,

- (Long-Term) 200 Day: 0.0070835 Down Trend.

Additional Metrics

Recent Trade Signals

- 19 Sep 2025: Short 6J 12-25 @ 0.0068175 Signals.USAR-MSFG

- 19 Sep 2025: Short 6J 12-25 @ 0.006821 Signals.USAR-WSFG

- 18 Sep 2025: Short 6J 12-25 @ 0.006868 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The Japanese Yen futures (6J) daily chart shows a market under pressure in the short and intermediate term, with price action characterized by slow momentum and medium-sized bars. The price is currently trading below both the weekly and monthly session fib grid NTZ centers, confirming a downward bias and trend for both timeframes. Swing pivot analysis indicates a short-term downtrend (DTrend) with the most recent pivot low at 0.0068145, while the intermediate-term HiLo trend remains up, suggesting some underlying support but not enough to reverse the prevailing weakness. Resistance levels are stacked above, with significant barriers at 0.0069065 and higher, while support is close by at 0.0068145 and 0.0067775. All benchmark moving averages from short to long term are trending down, reinforcing the bearish structure. Recent trade signals have all triggered short entries, aligning with the current technical setup. Volatility (ATR) and volume (VOLMA) are moderate, indicating steady but not extreme trading conditions. The long-term yearly fib grid remains up, but with price below all major moving averages, the overall environment is best described as bearish in the short and intermediate term, with the long-term trend neutralizing as the market consolidates near key support. The chart suggests a market in a corrective or continuation phase after a failed rally, with no clear signs of reversal yet.

Chart Analysis ATS AI Generated: 2025-09-21 18:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.