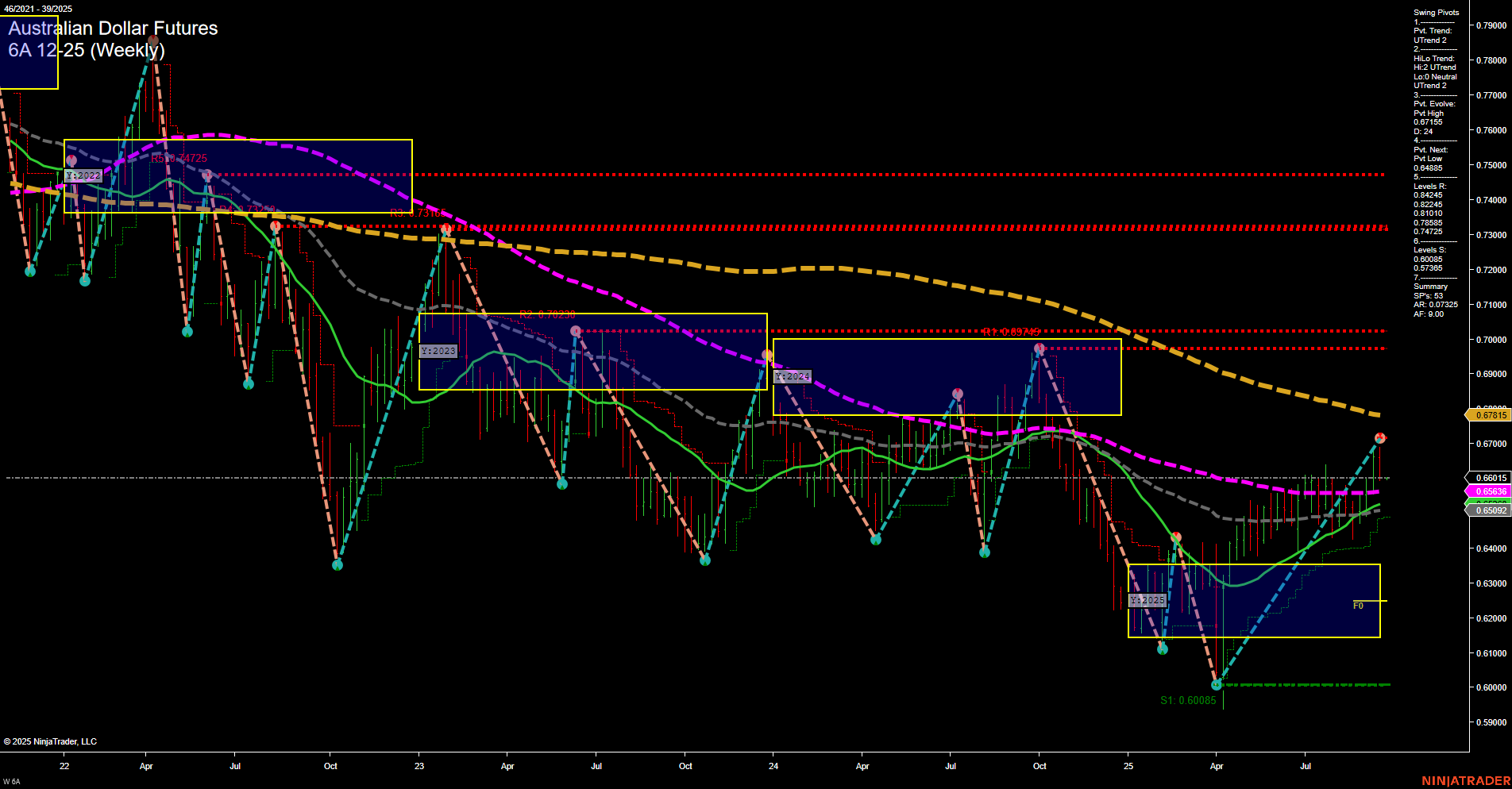

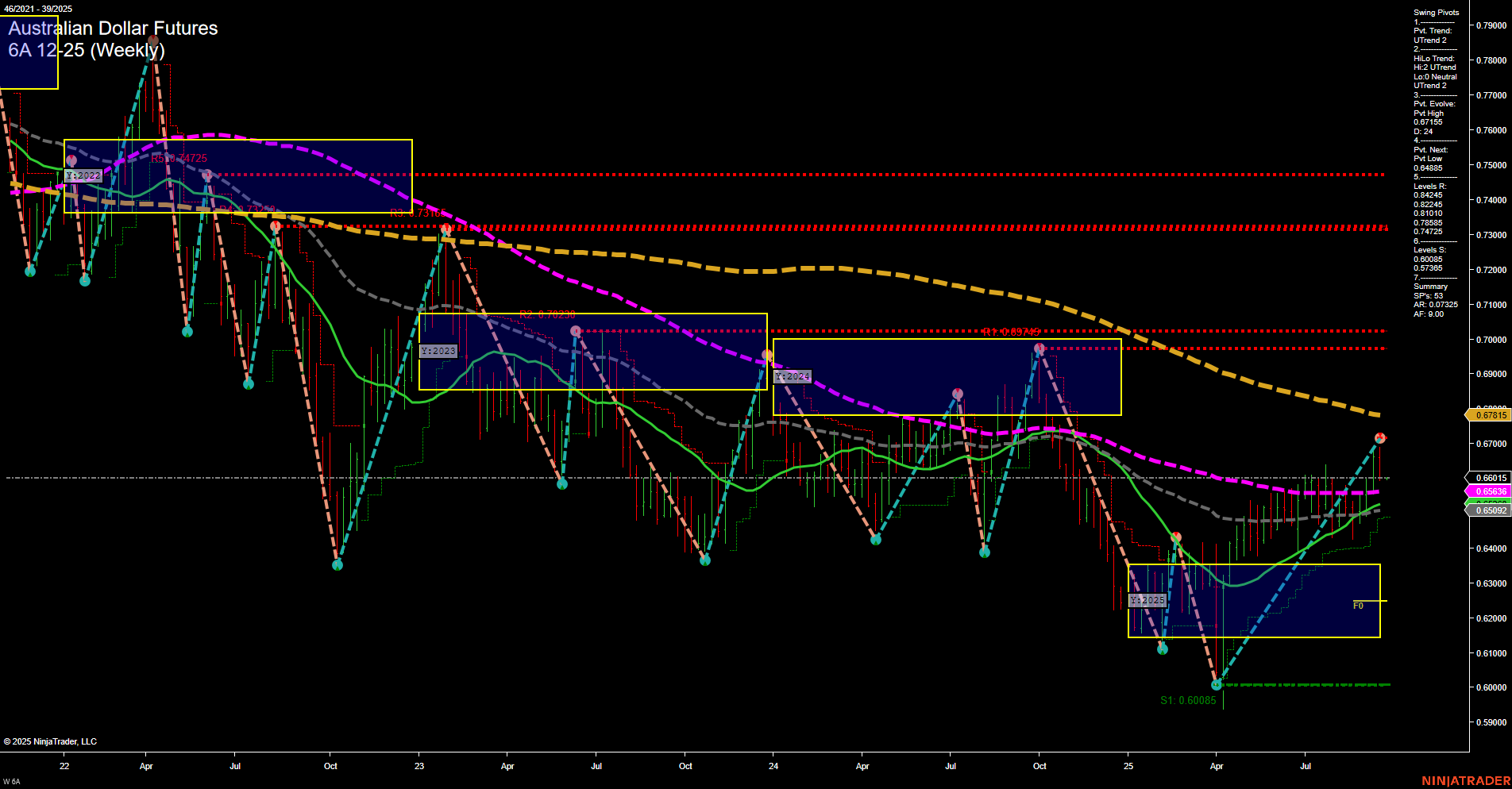

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Sep-21 18:00 CT

Price Action

- Last: 0.66485,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: U2D Neutral,

- 3. Pvt. Evolve: Pvt high 0.67145,

- 4. Pvt. Next: Pvt low 0.60085,

- 5. Levels R: 0.67145, 0.66885, 0.66245, 0.64825, 0.64205, 0.62845,

- 6. Levels S: 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65092 Up Trend,

- (Intermediate-Term) 10 Week: 0.65535 Up Trend,

- (Long-Term) 20 Week: 0.65913 Up Trend,

- (Long-Term) 55 Week: 0.65015 Up Trend,

- (Long-Term) 100 Week: 0.69015 Down Trend,

- (Long-Term) 200 Week: 0.67815 Down Trend.

Recent Trade Signals

- 18 Sep 2025: Short 6A 12-25 @ 0.6648 Signals.USAR-WSFG

- 17 Sep 2025: Short 6A 12-25 @ 0.66615 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a market in transition, with price action currently near 0.66485 and average momentum. The short-term and intermediate-term trends are neutral, as indicated by the WSFG and MSFG grids, and the swing pivot summary shows an uptrend in the short-term pivot but a neutral intermediate-term HiLo trend. Price is testing a recent swing high resistance at 0.67145, with the next significant support at 0.60085, suggesting a broad trading range. All key weekly moving averages up to the 55-week are in uptrend, but the 100- and 200-week remain in downtrend, highlighting a longer-term bearish overhang despite recent upward movement. Recent trade signals have triggered short entries, reflecting potential resistance at current levels. Overall, the market is consolidating after a recovery from earlier lows, with no clear directional bias across timeframes, and is likely to remain range-bound unless a breakout or breakdown occurs.

Chart Analysis ATS AI Generated: 2025-09-21 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.