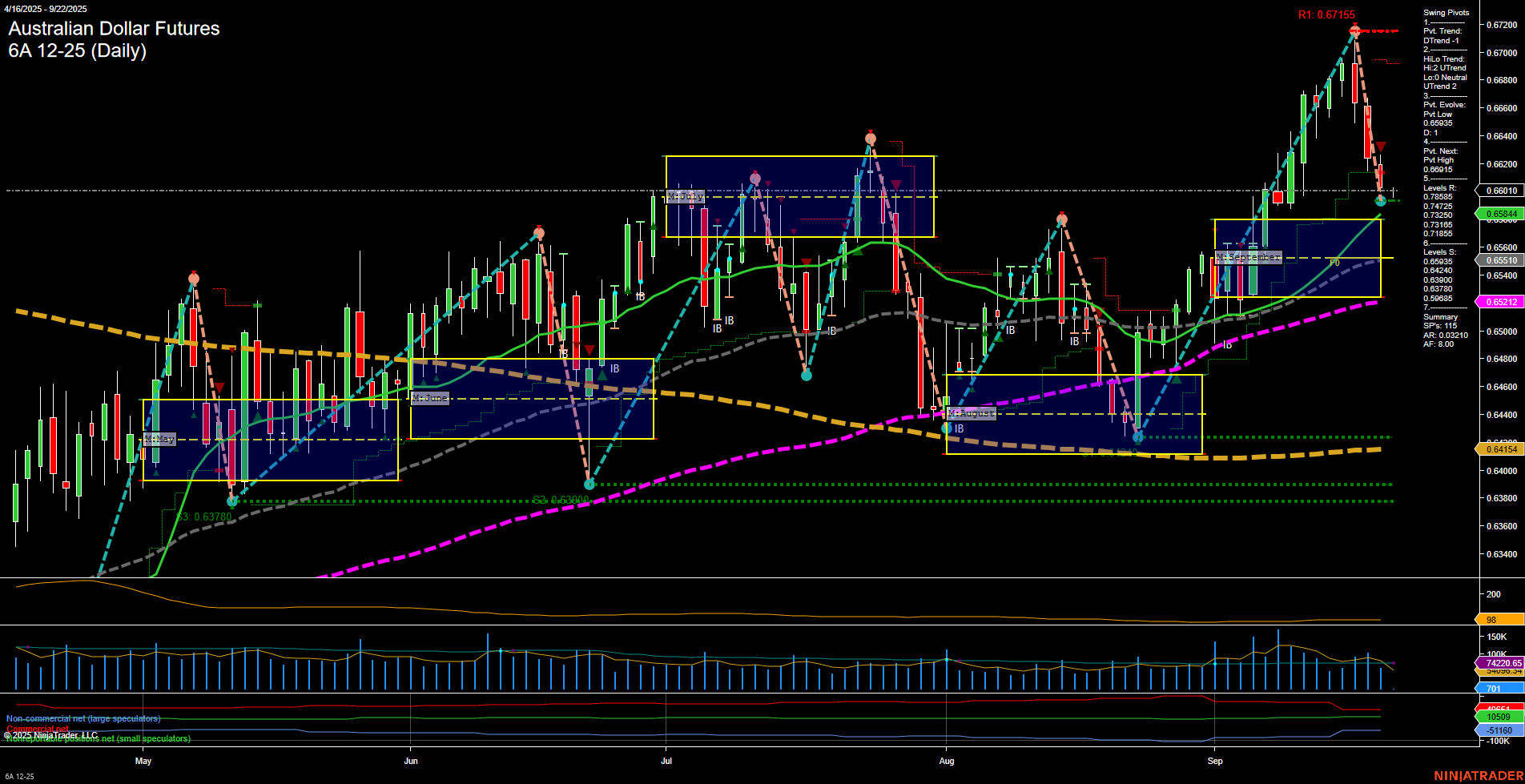

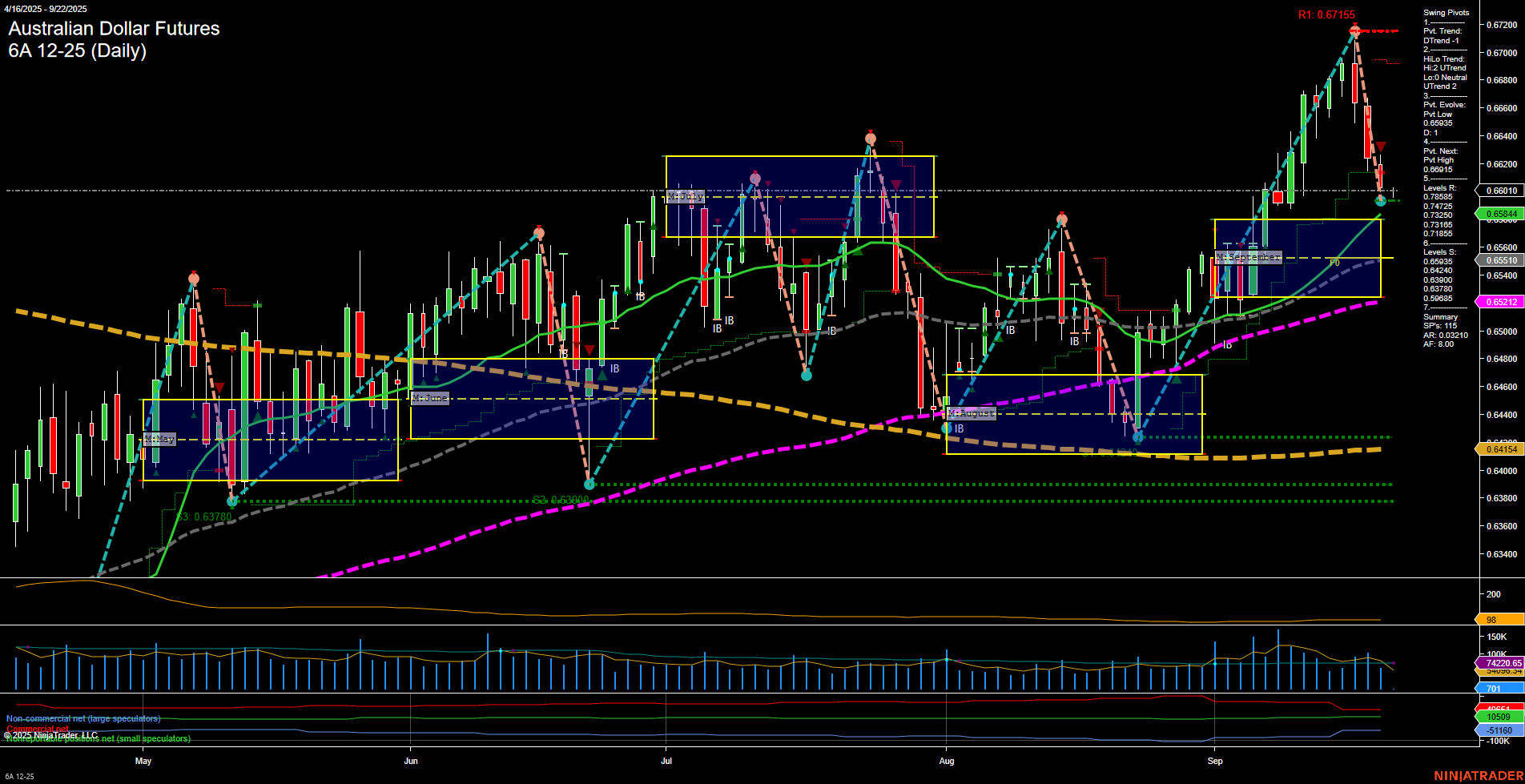

6A Australian Dollar Futures Daily Chart Analysis: 2025-Sep-21 18:00 CT

Price Action

- Last: 0.6610,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 0.66045,

- 4. Pvt. Next: Pvt High 0.66915,

- 5. Levels R: 0.67155, 0.66915, 0.66485, 0.66115, 0.66045,

- 6. Levels S: 0.65212, 0.64154, 0.63780.

Daily Benchmarks

- (Short-Term) 5 Day: 0.66410 Down Trend,

- (Short-Term) 10 Day: 0.66501 Down Trend,

- (Intermediate-Term) 20 Day: 0.65444 Up Trend,

- (Intermediate-Term) 55 Day: 0.65212 Up Trend,

- (Long-Term) 100 Day: 0.64154 Up Trend,

- (Long-Term) 200 Day: 0.65212 Up Trend.

Additional Metrics

Recent Trade Signals

- 18 Sep 2025: Short 6A 12-25 @ 0.6648 Signals.USAR-WSFG

- 17 Sep 2025: Short 6A 12-25 @ 0.66615 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The Australian Dollar Futures (6A) is currently experiencing a short-term pullback, as indicated by the recent swing pivot DTrend and consecutive short trade signals. Price has retreated from a recent swing high (0.67155) and is now testing support near 0.66045, with the 5 and 10-day moving averages both trending down. However, the intermediate and long-term moving averages remain in uptrends, suggesting the broader structure is still constructive. The ATR and volume metrics indicate moderate volatility and participation. The market is consolidating within the monthly and weekly session fib grids, with no clear directional bias from the session grids themselves. The overall setup reflects a corrective phase within a larger uptrend, with the potential for further downside in the short term before support levels or trend continuation patterns are tested. No strong breakout or reversal signals are present, and the environment remains neutral to choppy outside of the short-term bearish momentum.

Chart Analysis ATS AI Generated: 2025-09-21 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.