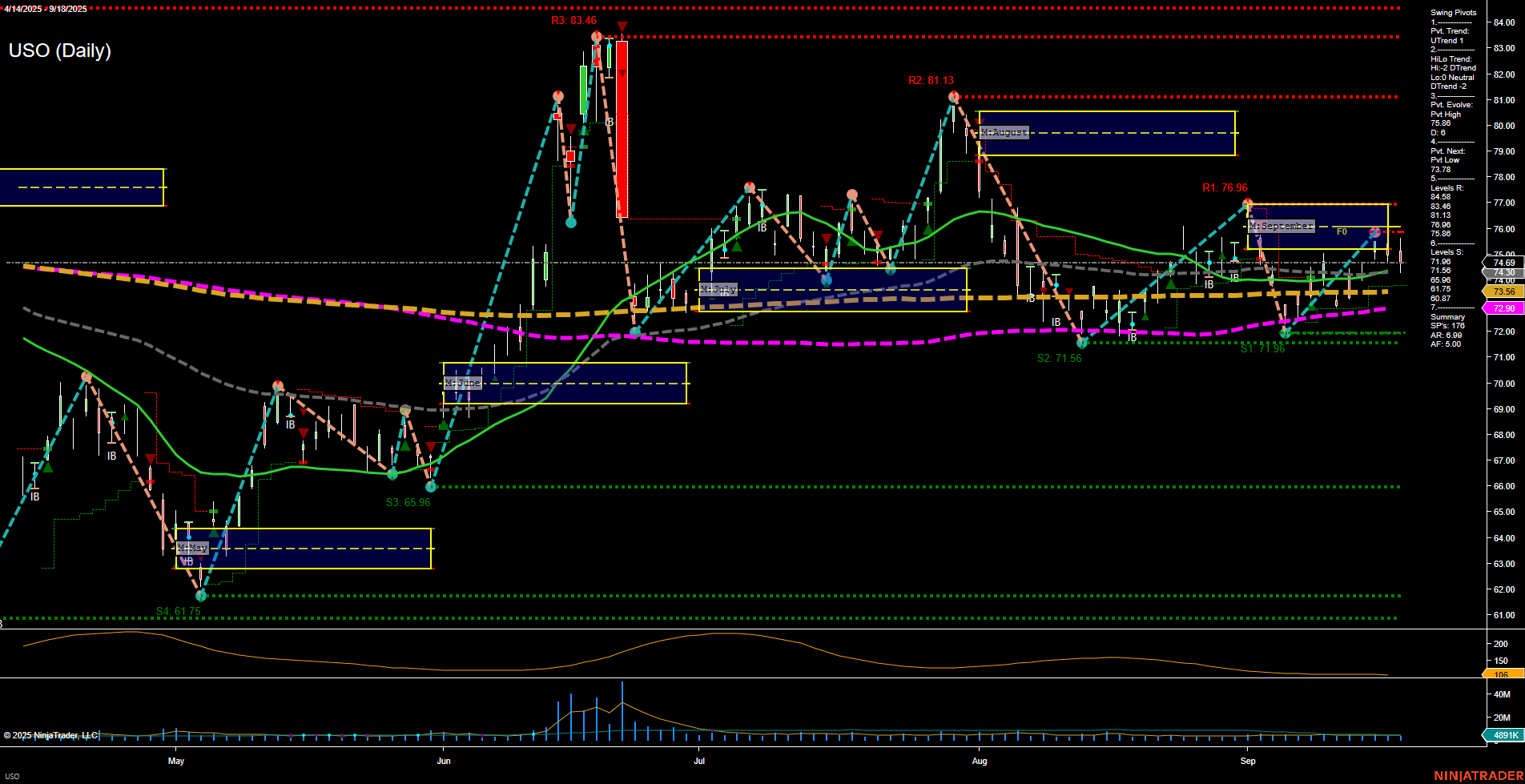

USO is currently trading in a consolidation phase, with price action showing medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend is up, but the intermediate-term HiLo trend remains down, reflecting a market that is attempting to recover but still faces overhead resistance. The most recent pivot high at 76.96 and pivot low at 73.78 define the immediate trading range, with significant resistance levels above at 76.96, 81.13, and 83.46, and support levels below at 71.96, 71.56, and 65.96. Benchmark moving averages show short-term uptrends (5, 10, and 20-day MAs), but intermediate and long-term averages (55, 100, 200-day) are still in downtrends, suggesting that any bullish momentum is tentative and not yet confirmed by longer-term participants. The ATR and volume metrics indicate moderate volatility and average trading activity. Overall, the chart reflects a market in transition, with neither bulls nor bears in clear control. The neutral stance across all timeframes suggests that swing traders should be attentive to potential breakout or breakdown scenarios, as the current consolidation could resolve in either direction depending on broader market catalysts or shifts in oil fundamentals.