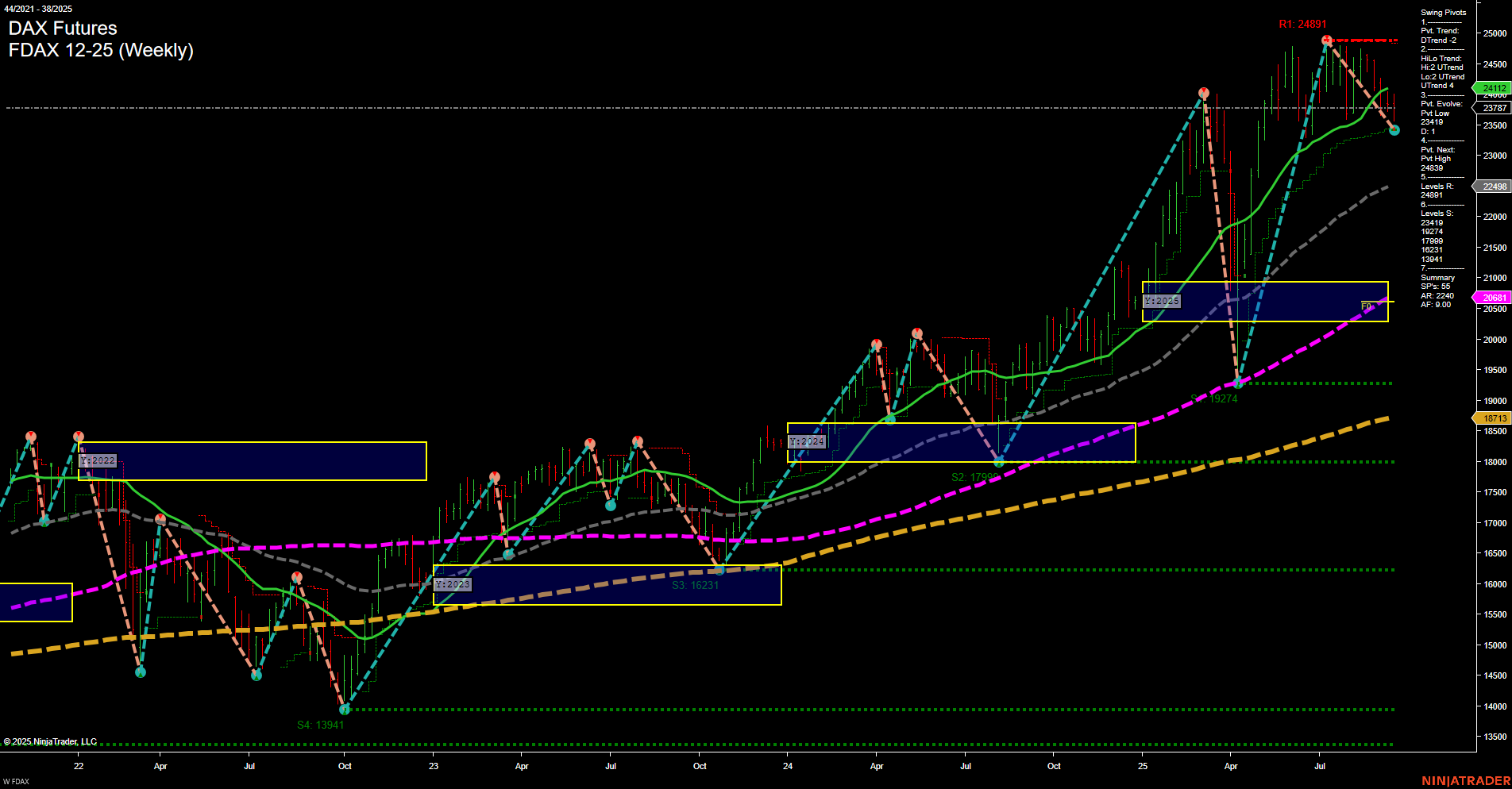

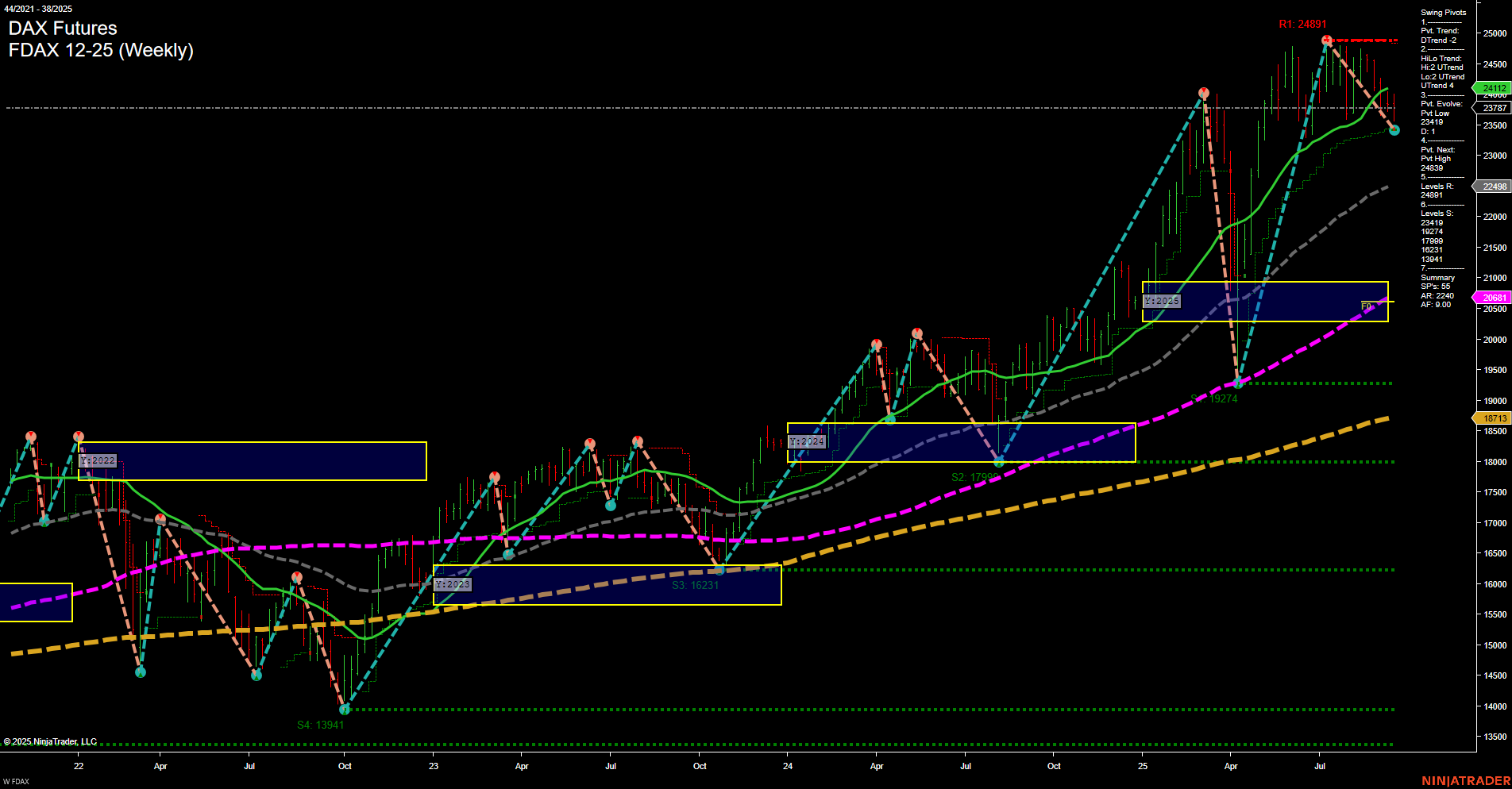

FDAX DAX Futures Weekly Chart Analysis: 2025-Sep-19 07:08 CT

Price Action

- Last: 24,112,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -18%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -29%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 98%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 23,819,

- 4. Pvt. Next: Pvt high 24,891,

- 5. Levels R: 24,891,

- 6. Levels S: 23,819, 19,274, 16,231, 13,941.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 24,948 Down Trend,

- (Intermediate-Term) 10 Week: 24,488 Down Trend,

- (Long-Term) 20 Week: 22,948 Up Trend,

- (Long-Term) 55 Week: 20,681 Up Trend,

- (Long-Term) 100 Week: 20,500 Up Trend,

- (Long-Term) 200 Week: 18,713 Up Trend.

Recent Trade Signals

- 18 Sep 2025: Long FDAX 12-25 @ 23,748 Signals.USAR-WSFG

- 16 Sep 2025: Short FDAX 09-25 @ 23,610 Signals.USAR.TR120

- 15 Sep 2025: Short FDAX 09-25 @ 23,757 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The FDAX weekly chart shows a market in transition. Short-term momentum is slow and the price is trading below both the weekly and monthly session fib grid centers, with both WSFG and MSFG trends pointing down. This is confirmed by the short-term swing pivot trend (DTrend) and recent short signals, indicating a bearish short-term environment. However, the intermediate-term HiLo trend remains up, suggesting underlying support and a possible base forming above the last swing low at 23,819. The long-term picture is bullish, with the yearly session fib grid trend up and price well above all major long-term moving averages, which are all trending higher. The market is currently consolidating between the recent swing low (23,819) and resistance at the last swing high (24,891). This phase could represent a pullback within a larger uptrend, with the potential for either a continuation higher if support holds, or further retracement if short-term weakness persists. Volatility has moderated, and the market is digesting recent gains after a strong rally earlier in the year.

Chart Analysis ATS AI Generated: 2025-09-19 07:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.