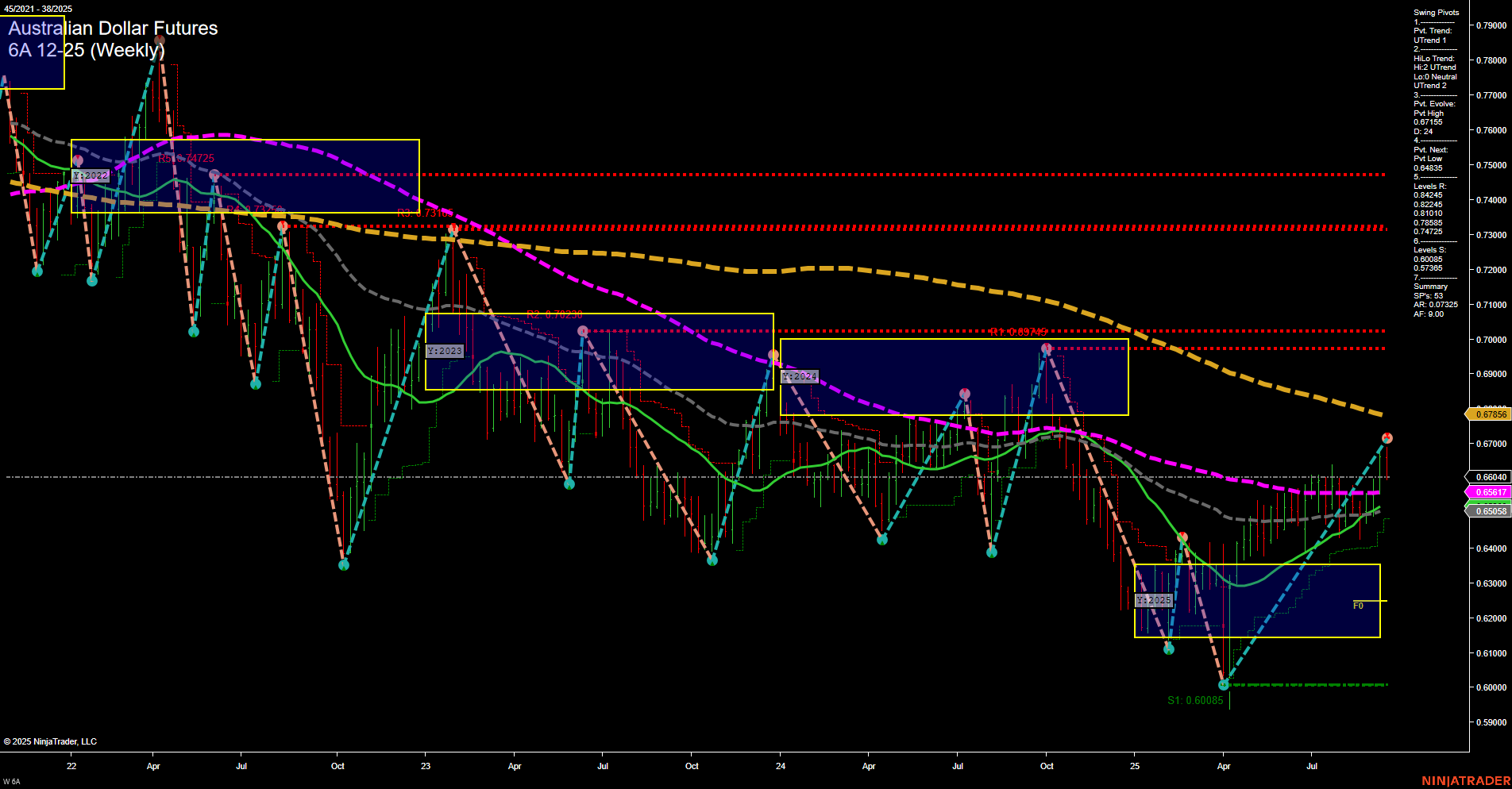

The Australian Dollar Futures (6A) weekly chart shows a strong upward move in recent weeks, with large bars and fast momentum pushing price to a new swing high at 0.67145. Both short-term and intermediate-term swing pivot trends are up, reflecting a recovery from the major swing low at 0.60085. However, the price is now encountering significant resistance levels, with the most immediate at 0.68435 and 0.68215, while support remains distant at 0.60085. Benchmark moving averages (5, 10, 20, and 55 week) are all in uptrends, confirming the intermediate-term bullish structure, but the 100 and 200 week MAs remain in downtrends, indicating that the longer-term trend is still neutral to bearish. The recent short trade signals suggest a potential pause or pullback after the strong rally, possibly as price tests overhead resistance and the upper bounds of the yearly session fib grid. Overall, the chart reflects a market in transition: the intermediate-term trend is bullish, but the long-term structure is still neutral, with price at a critical inflection point. The market is consolidating gains after a sharp rally, and traders are watching for either a breakout above resistance or a retracement toward support. Volatility remains elevated, and the next few weeks will be key in determining whether the recent uptrend can sustain or if a deeper pullback will develop.