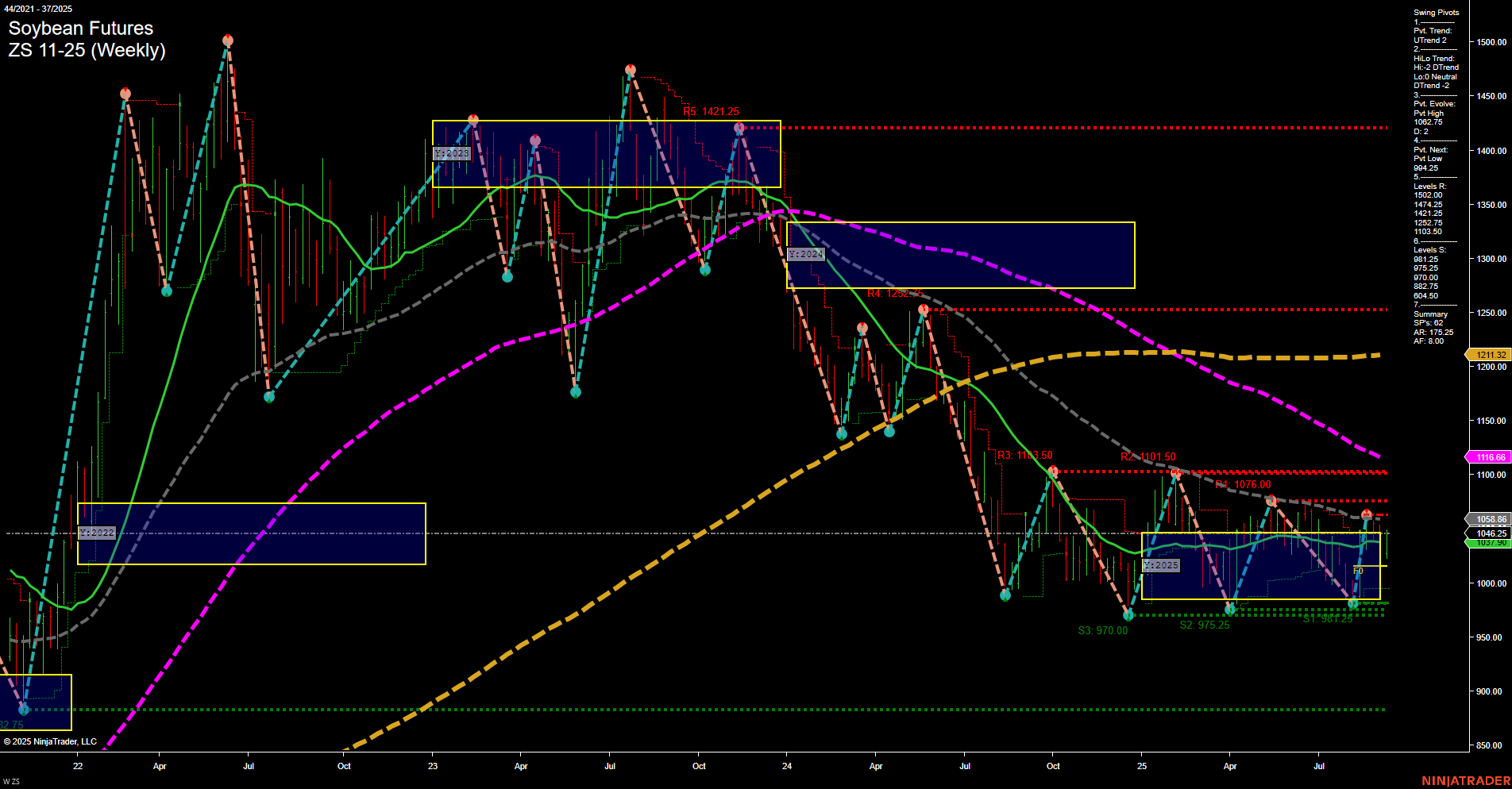

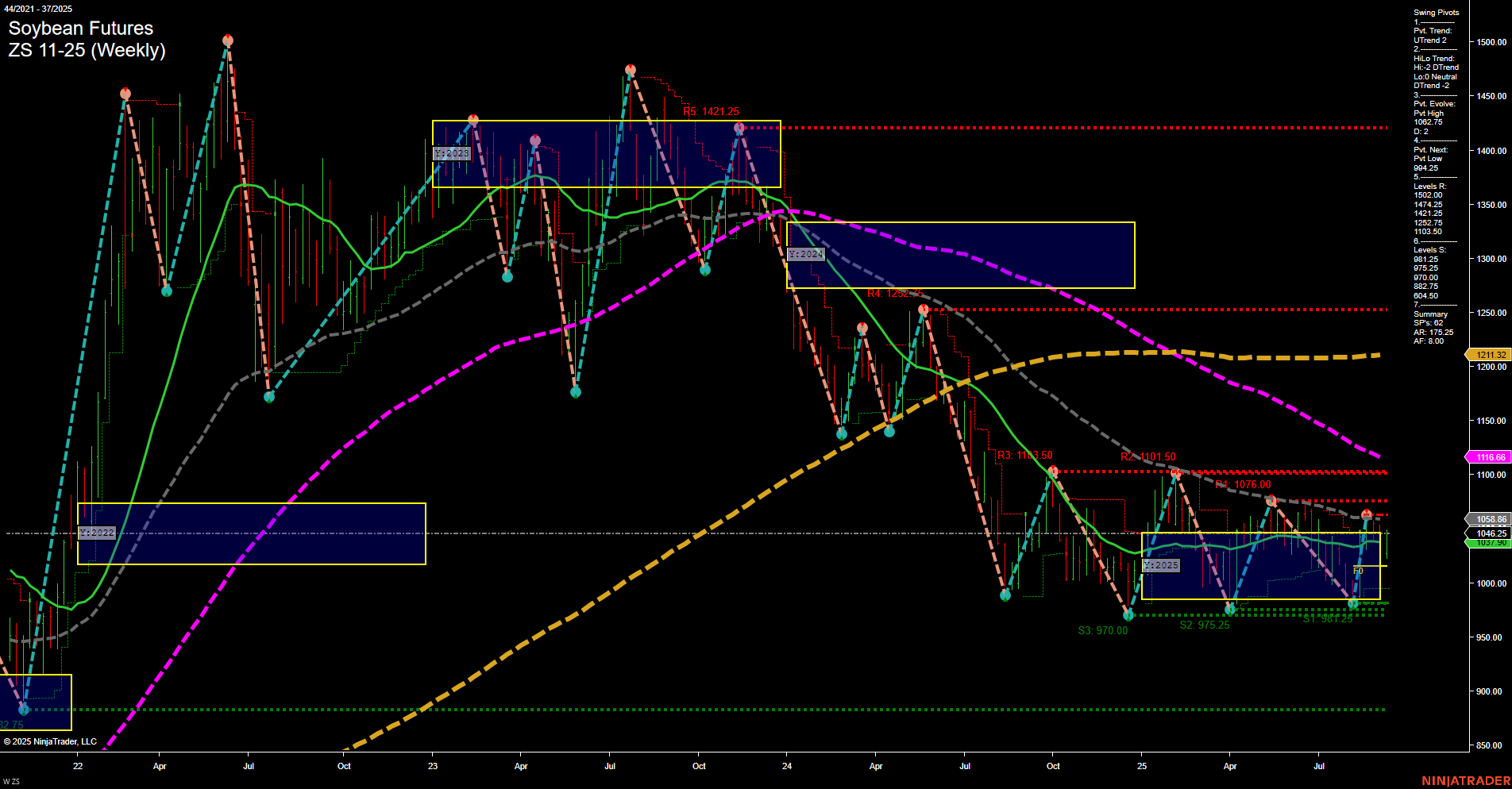

ZS Soybean Futures Weekly Chart Analysis: 2025-Sep-14 18:12 CT

Price Action

- Last: 1045.25,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 67%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -11%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1045.25,

- 4. Pvt. Next: Pvt low 970.00,

- 5. Levels R: 1421.25, 1242.25, 1222.25, 1101.50, 1076.00, 1110.50,

- 6. Levels S: 975.25, 970.00, 870.00, 862.75, 804.50.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1058.88 Up Trend,

- (Intermediate-Term) 10 Week: 1058.88 Up Trend,

- (Long-Term) 20 Week: 1058.88 Up Trend,

- (Long-Term) 55 Week: 1116.66 Down Trend,

- (Long-Term) 100 Week: 1211.32 Down Trend,

- (Long-Term) 200 Week: 1222.21 Down Trend.

Recent Trade Signals

- 11 Sep 2025: Long ZS 11-25 @ 1034.75 Signals.USAR.TR120

- 09 Sep 2025: Long ZS 11-25 @ 1031.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

Soybean futures are showing a notable short-term recovery, with price action breaking above the weekly session fib grid (WSFG) neutral zone and confirming an uptrend in both the WSFG and short-term swing pivots. Recent long trade signals reinforce this bullish short-term momentum. However, the intermediate-term picture remains bearish, as the monthly session fib grid (MSFG) trend is down and the HiLo swing trend is also in a downtrend, suggesting that rallies may face resistance and could be corrective within a broader consolidation. Long-term indicators are mixed: while the yearly session fib grid (YSFG) trend is up, major moving averages (55, 100, 200 week) are still trending down, indicating that the market is in a transitional phase. Key resistance levels are clustered above, with 1101.50 and 1076.00 as immediate hurdles, while support is firm around 970.00–975.25. The overall structure suggests a market attempting to base and recover, but still facing headwinds from higher timeframe trends. Volatility and choppy price action are likely as the market tests these key levels.

Chart Analysis ATS AI Generated: 2025-09-14 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.