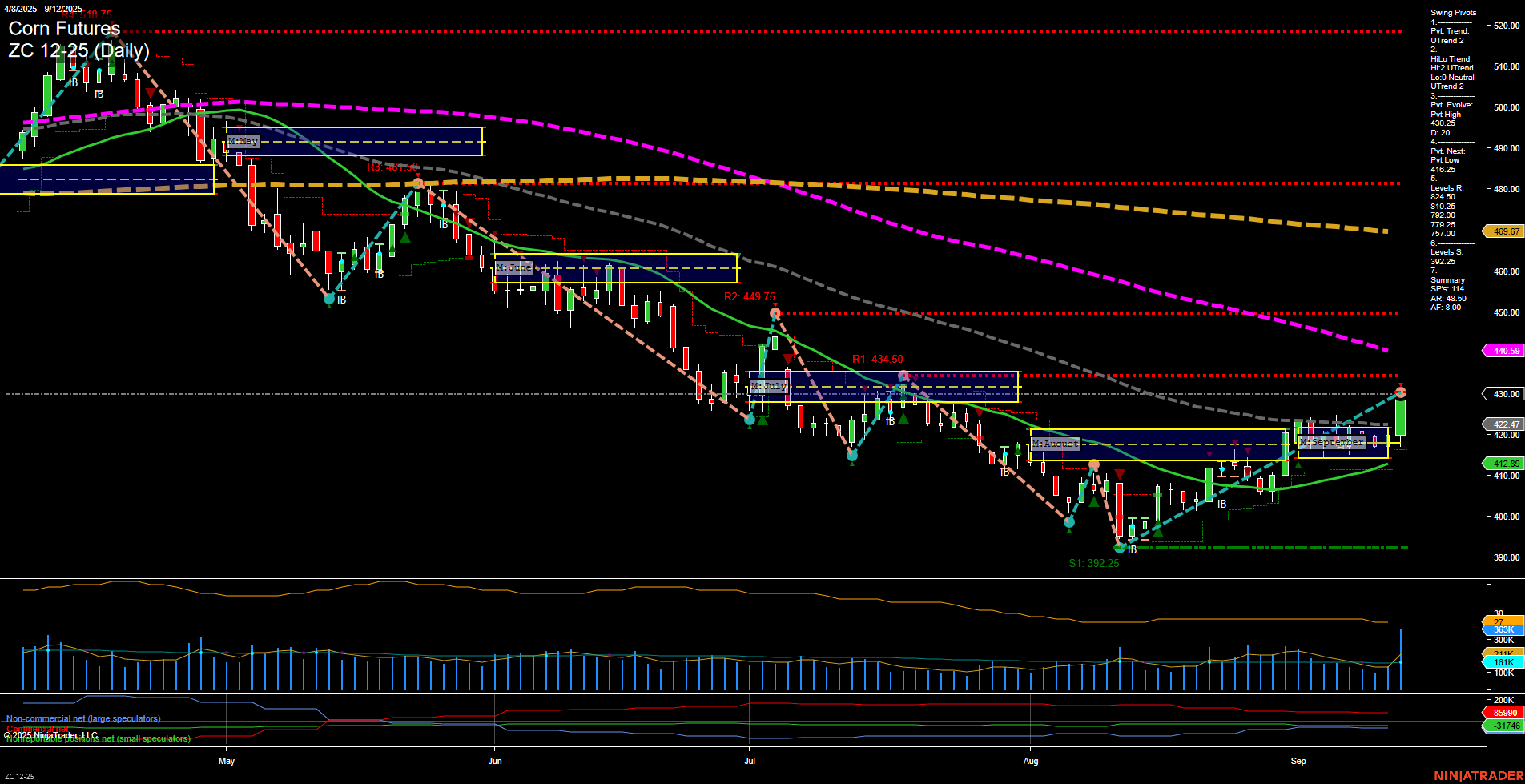

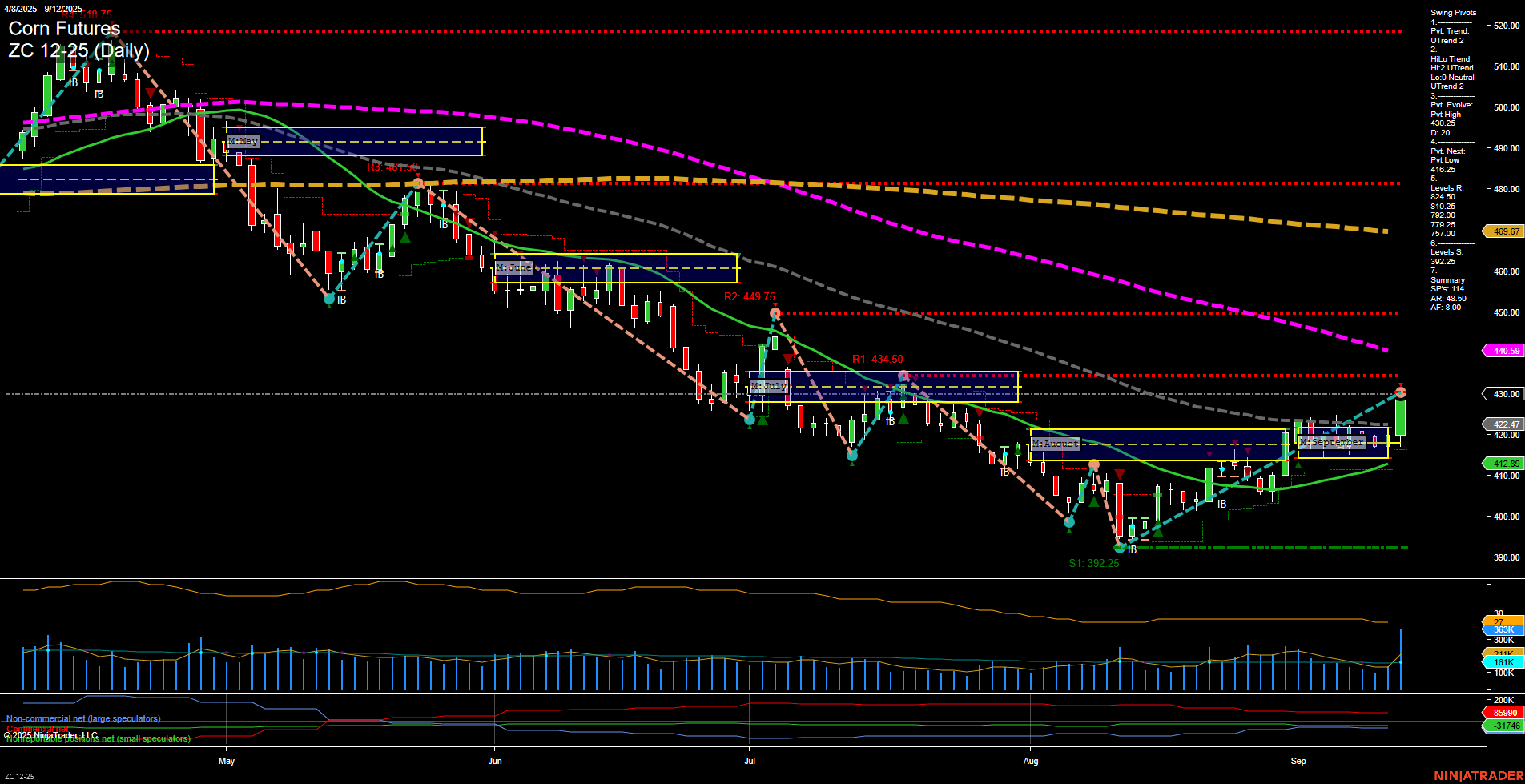

ZC Corn Futures Daily Chart Analysis: 2025-Sep-14 18:12 CT

Price Action

- Last: 423.00,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 80%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 31%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -42%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 430.25,

- 4. Pvt. Next: Pvt Low 416.25,

- 5. Levels R: 514.25, 480.65, 449.75, 434.50,

- 6. Levels S: 392.25.

Daily Benchmarks

- (Short-Term) 5 Day: 412.89 Up Trend,

- (Short-Term) 10 Day: 412.05 Up Trend,

- (Intermediate-Term) 20 Day: 422.47 Up Trend,

- (Intermediate-Term) 55 Day: 440.59 Down Trend,

- (Long-Term) 100 Day: 469.67 Down Trend,

- (Long-Term) 200 Day: 509.05 Down Trend.

Additional Metrics

Recent Trade Signals

- 12 Sep 2025: Long ZC 12-25 @ 423 Signals.USAR-MSFG

- 11 Sep 2025: Long ZC 12-25 @ 420.25 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures have staged a notable short-term and intermediate-term reversal, with price action breaking above key monthly and weekly session fib grid levels and confirming an uptrend in both swing pivots and short/intermediate moving averages. The recent large bullish bars and fast momentum, supported by strong volume, indicate a decisive move higher, likely fueled by short covering and renewed speculative interest. However, the long-term trend remains bearish, as price is still well below the 100- and 200-day moving averages, and the yearly session fib grid bias is negative. The market is currently testing resistance zones from prior swing highs, with 430.25 and 434.50 as immediate upside targets, while 416.25 and 392.25 serve as key support levels. The recent trade signals confirm the shift in short- and intermediate-term sentiment, but the broader context suggests this could be a countertrend rally within a larger downtrend. Volatility is elevated, and the market may encounter choppy price action as it approaches major resistance.

Chart Analysis ATS AI Generated: 2025-09-14 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.