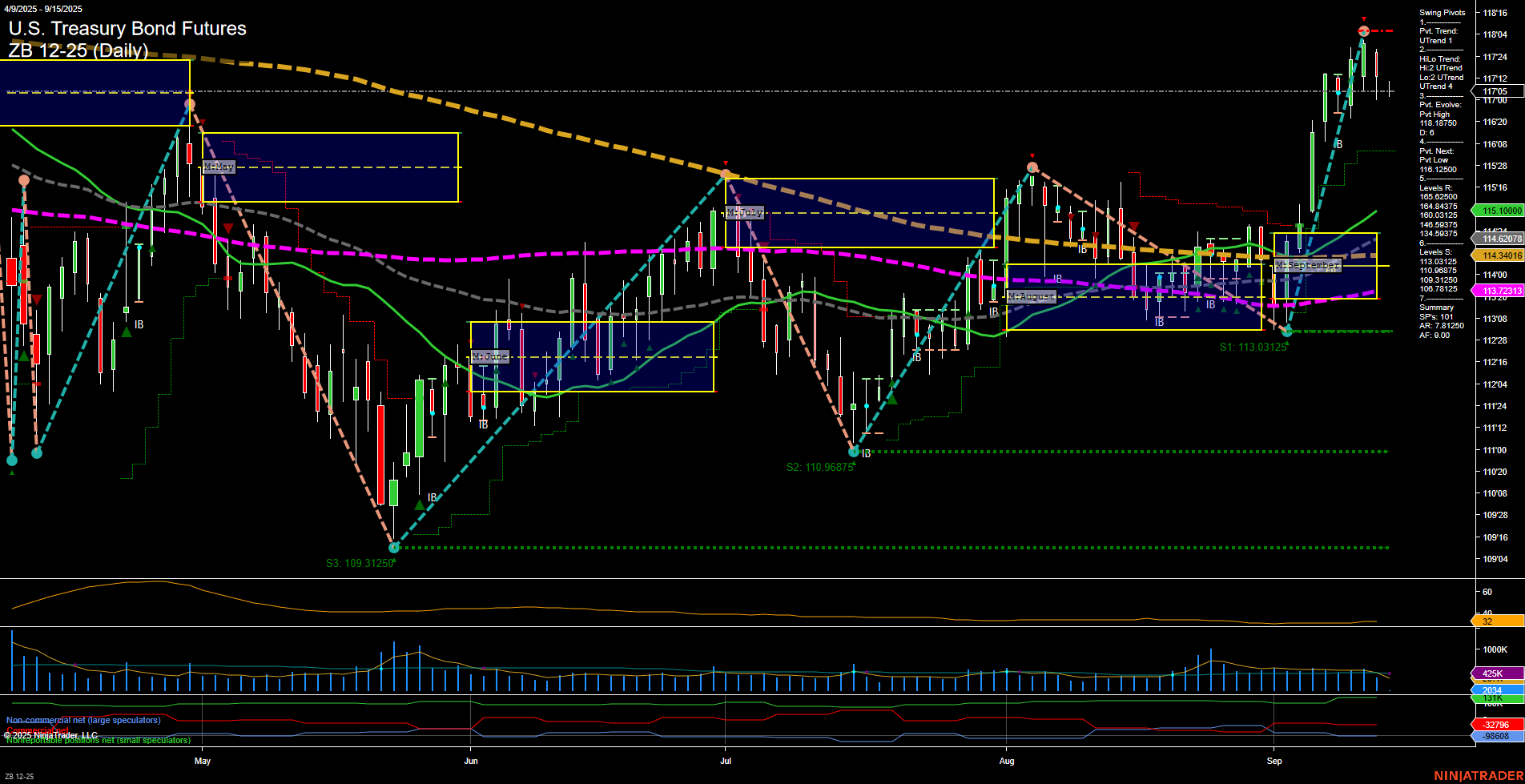

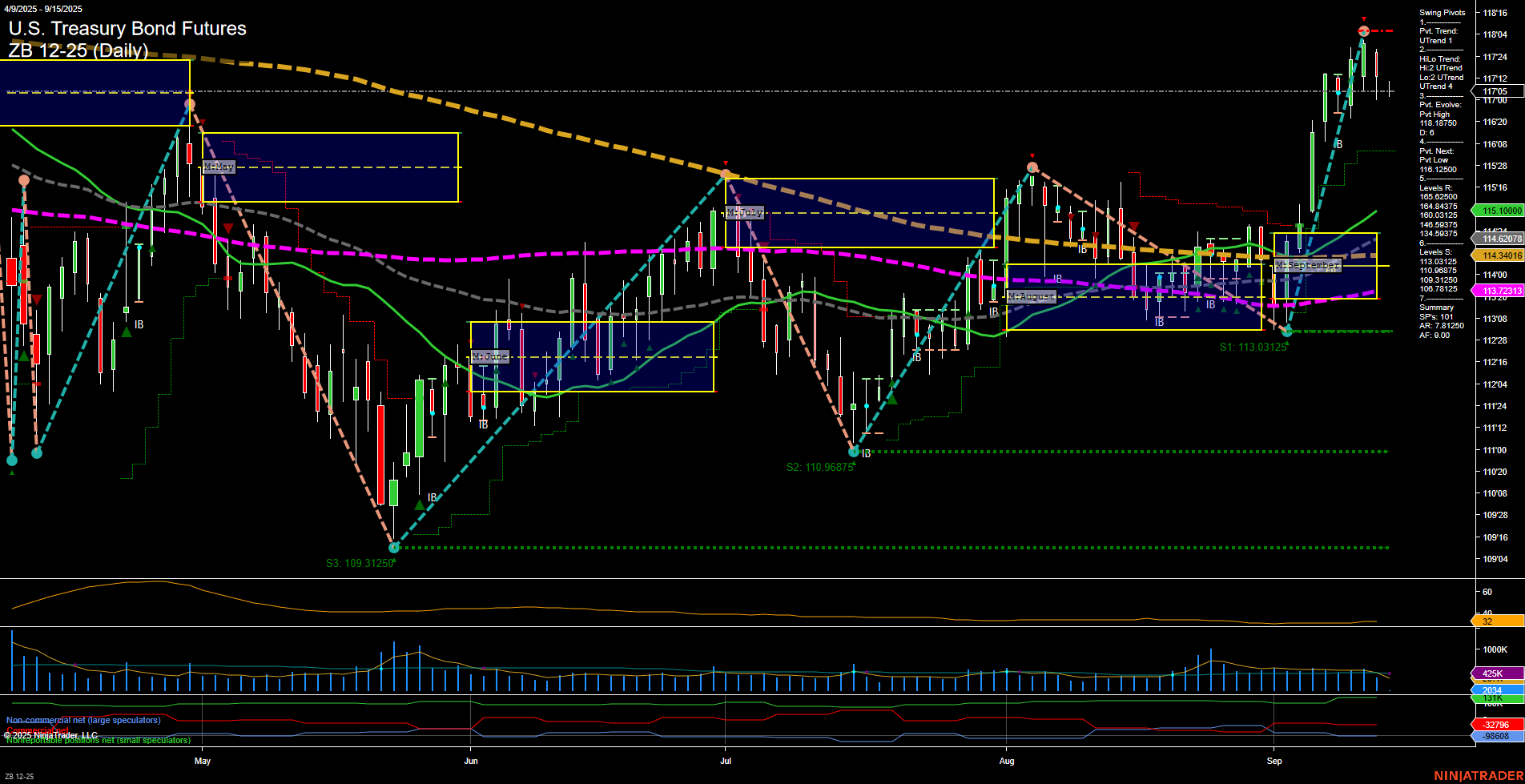

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Sep-14 18:11 CT

Price Action

- Last: 115.10000,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 118.16700,

- 4. Pvt. Next: Pvt Low 116.12500,

- 5. Levels R: 118.16700, 116.84375, 116.59375,

- 6. Levels S: 115.12500, 114.84375, 114.34016, 113.72313, 113.03125, 110.96875, 109.31250.

Daily Benchmarks

- (Short-Term) 5 Day: 116.24763 Up Trend,

- (Short-Term) 10 Day: 114.34016 Up Trend,

- (Intermediate-Term) 20 Day: 115.10000 Up Trend,

- (Intermediate-Term) 55 Day: 114.84375 Up Trend,

- (Long-Term) 100 Day: 113.72313 Up Trend,

- (Long-Term) 200 Day: 113.03125 Down Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart is showing strong bullish momentum in the short and intermediate term, with large price bars and fast momentum indicating aggressive buying interest. Both the short-term and intermediate-term swing pivot trends are in an uptrend, with the most recent pivot high at 118.16700 and the next potential pivot low at 116.12500. Multiple resistance levels are stacked above, but the price is currently holding above all key moving averages except the 200-day, which remains in a downtrend, suggesting the long-term trend is still neutral. The ATR is elevated, reflecting increased volatility, while volume remains robust. The market has broken out of a consolidation phase, with price action decisively above the monthly and weekly neutral zones, confirming a shift in sentiment. Overall, the technical structure supports a bullish bias in the near to intermediate term, while the long-term outlook remains neutral pending further confirmation above the 200-day benchmark.

Chart Analysis ATS AI Generated: 2025-09-14 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.