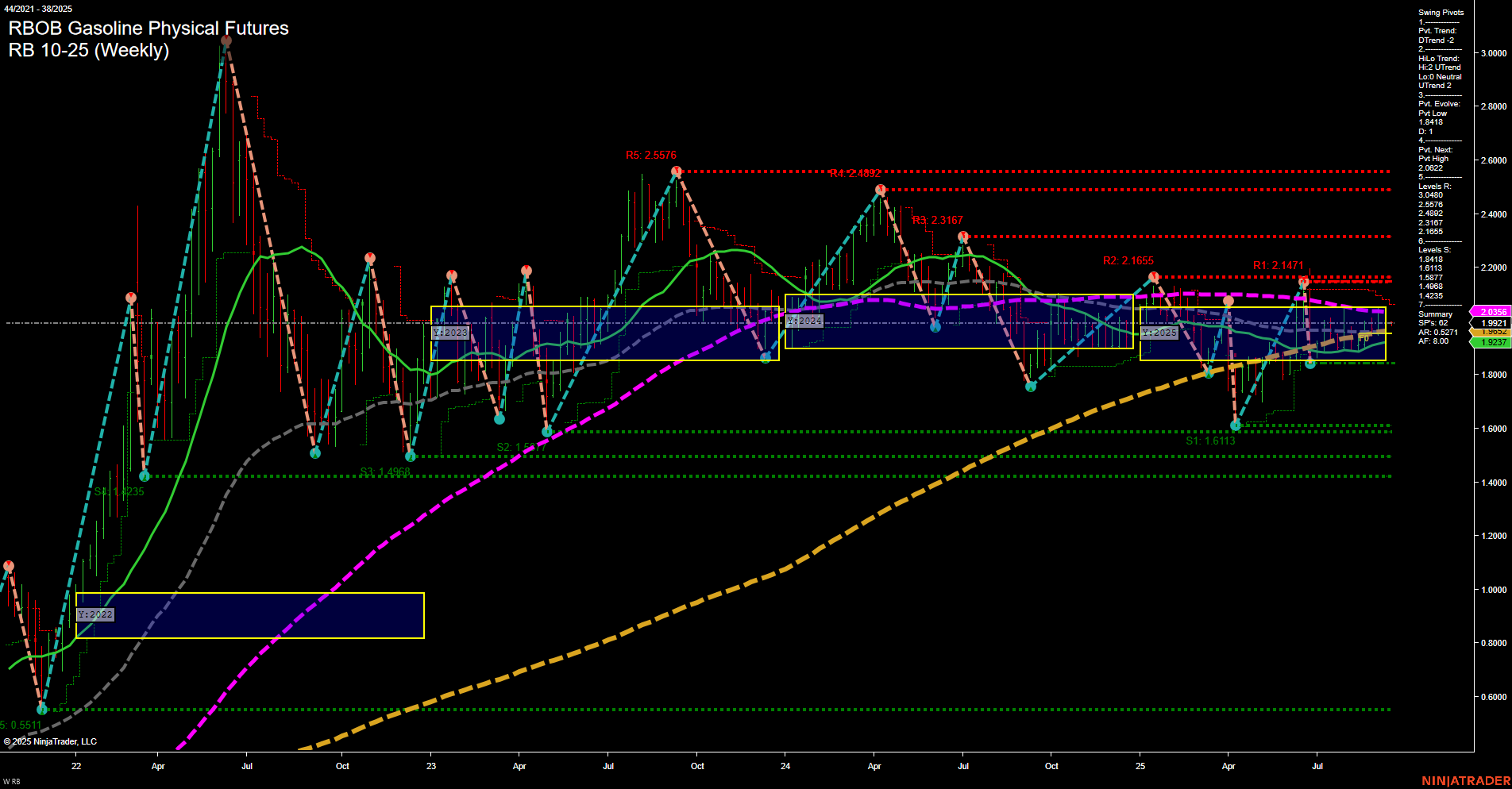

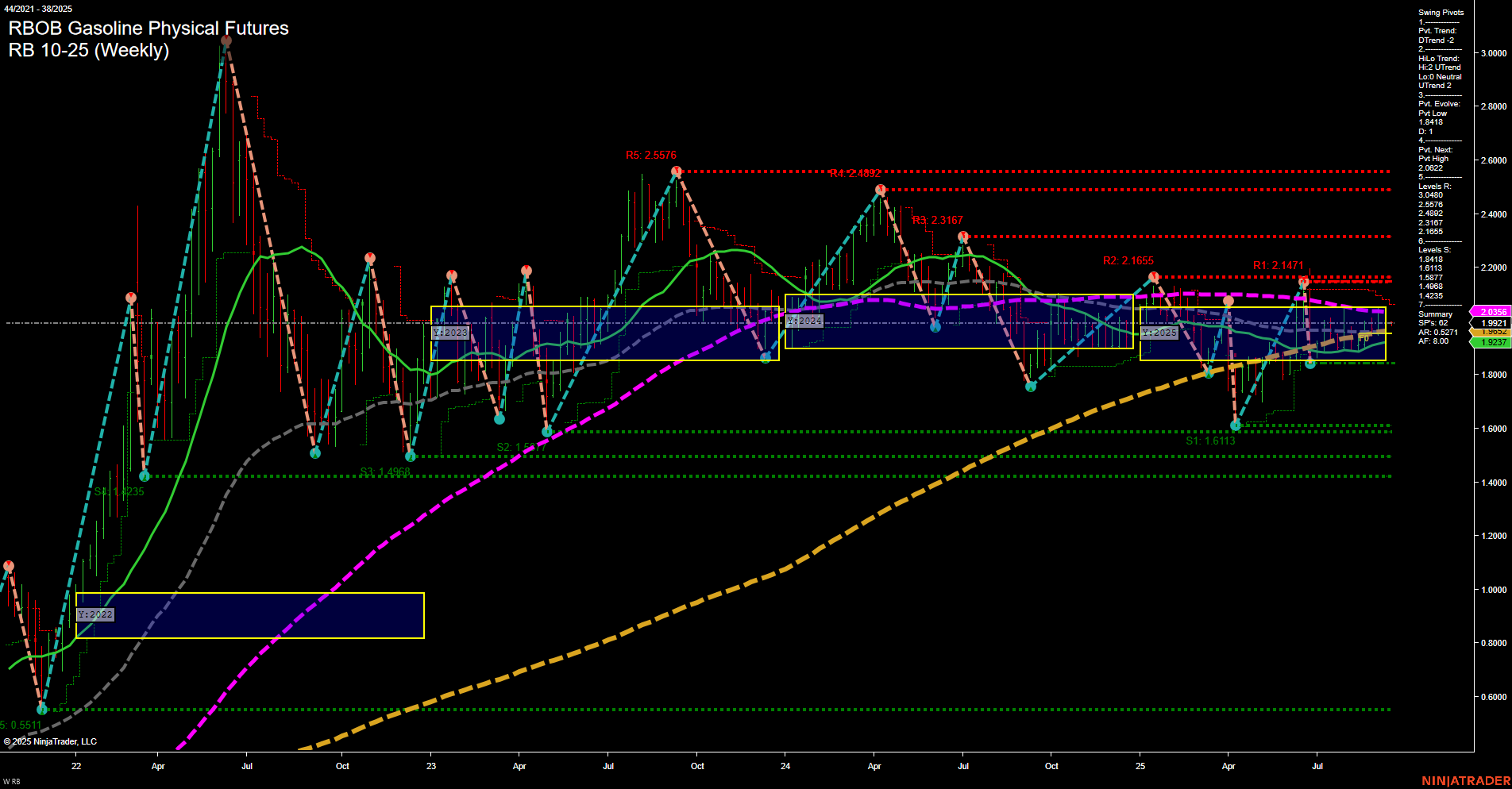

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Sep-14 18:08 CT

Price Action

- Last: 1.9937,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 30%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 15%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.8418,

- 4. Pvt. Next: Pvt high 2.2147,

- 5. Levels R: 2.5576, 2.4892, 2.3167, 2.2147, 2.1655,

- 6. Levels S: 1.8418, 1.6113, 1.4988, 1.4235.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.9921 Up Trend,

- (Intermediate-Term) 10 Week: 1.9327 Up Trend,

- (Long-Term) 20 Week: 1.9937 Up Trend,

- (Long-Term) 55 Week: 2.0395 Down Trend,

- (Long-Term) 100 Week: 1.9921 Down Trend,

- (Long-Term) 200 Week: 1.8237 Up Trend.

Recent Trade Signals

- 12 Sep 2025: Long RB 10-25 @ 1.986 Signals.USAR-WSFG

- 12 Sep 2025: Long RB 10-25 @ 2.0066 Signals.USAR.TR120

- 12 Sep 2025: Long RB 10-25 @ 2.0066 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline futures weekly chart is showing a constructive technical structure from a swing trader’s perspective. Price is currently trading above the key NTZ (neutral trading zone) center line across all major session fib grids (weekly, monthly, yearly), with all three timeframes (short, intermediate, and long-term) in uptrends. The most recent swing pivot trend is up, and the next significant resistance levels are well above the current price, suggesting room for further upside if momentum continues. Support is established at 1.8418 and lower, providing a clear risk framework. The moving averages are mostly in alignment with the bullish trend, with the 5, 10, 20, and 200 week MAs all trending up, though the 55 and 100 week MAs are still lagging and in downtrends, indicating some longer-term overhead supply. Recent trade signals have triggered new long entries, confirming the bullish bias. The market appears to be emerging from a consolidation phase, with a potential for trend continuation, supported by higher lows and a series of successful retests of support. Volatility is moderate, and the price structure suggests a possible breakout attempt toward higher resistance levels if current momentum persists.

Chart Analysis ATS AI Generated: 2025-09-14 18:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.