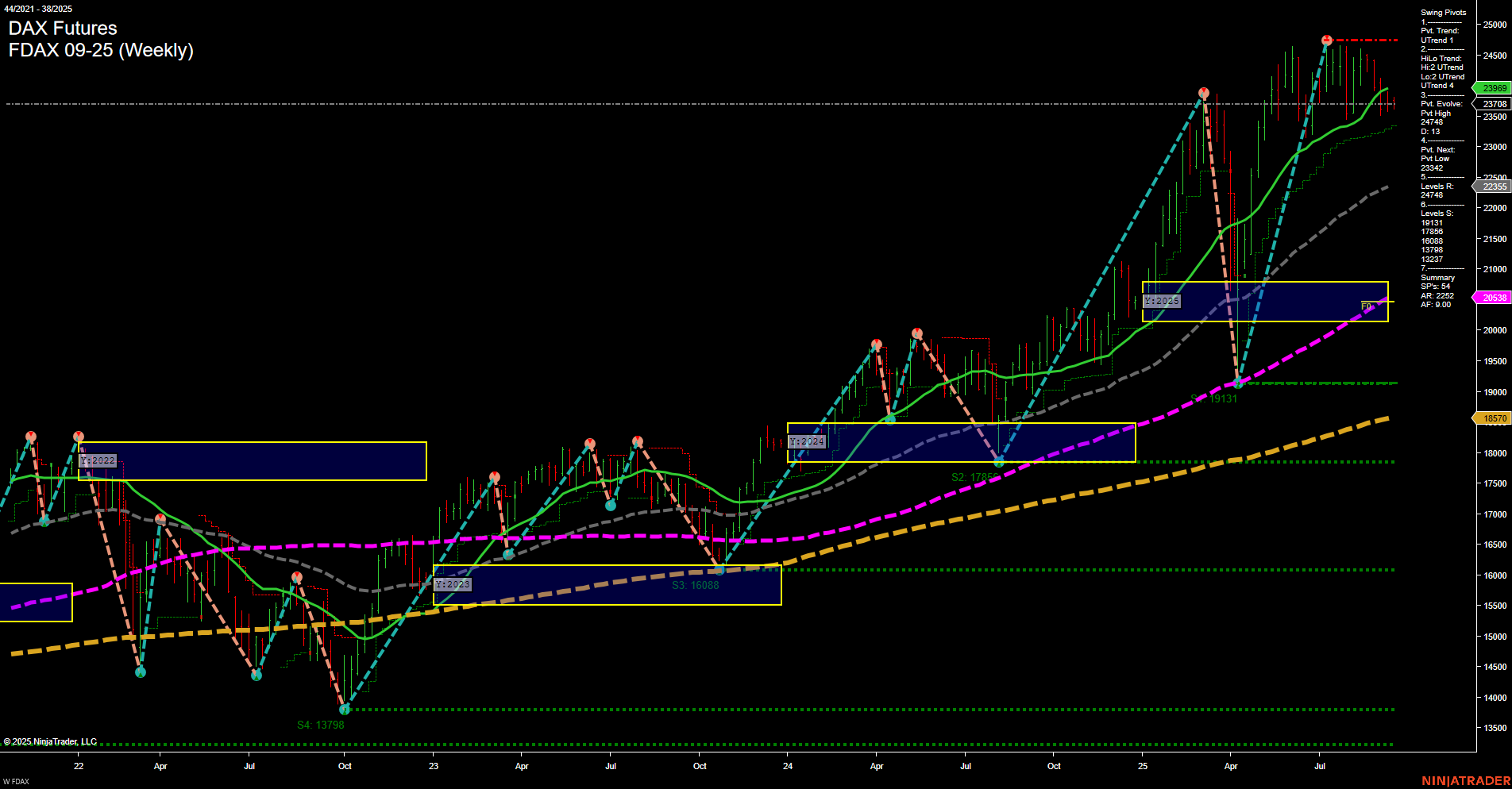

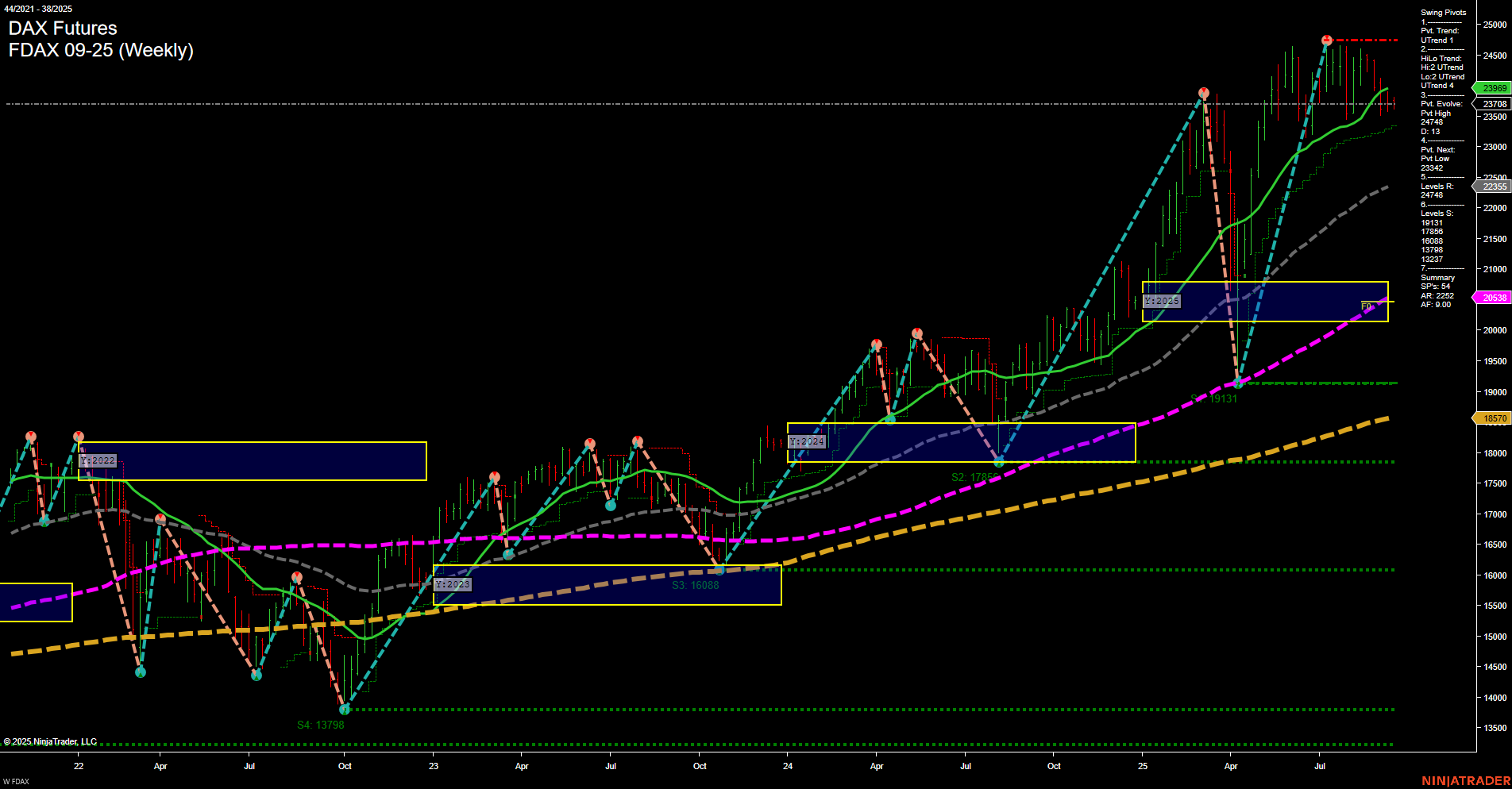

FDAX DAX Futures Weekly Chart Analysis: 2025-Sep-14 18:04 CT

Price Action

- Last: 23989,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -22%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 100%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 24748,

- 4. Pvt. Next: Pvt low 22355,

- 5. Levels R: 24748, 23989,

- 6. Levels S: 22355, 19131, 16088, 13798.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 23708 Up Trend,

- (Intermediate-Term) 10 Week: 23245 Up Trend,

- (Long-Term) 20 Week: 22355 Up Trend,

- (Long-Term) 55 Week: 20538 Up Trend,

- (Long-Term) 100 Week: 18570 Up Trend,

- (Long-Term) 200 Week: 18570 Up Trend.

Recent Trade Signals

- 12 Sep 2025: Short FDAX 09-25 @ 23719 Signals.USAR-MSFG

- 12 Sep 2025: Long FDAX 09-25 @ 23763 Signals.USAR-WSFG

- 10 Sep 2025: Short FDAX 09-25 @ 23646 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The FDAX DAX Futures weekly chart shows a market that remains structurally strong in the long-term, with all major moving averages trending upward and price holding well above key yearly and long-term support levels. The short-term trend is bullish, supported by an uptrend in both the weekly session fib grid and swing pivots, as well as a recent long signal. However, intermediate-term signals are mixed: the monthly session fib grid is in a downtrend and price is below its monthly NTZ, while the HiLo trend remains up, suggesting a possible consolidation or corrective phase within a broader uptrend. Resistance is defined at the recent swing high (24748), with support at 22355 and further below at 19131. Momentum is currently slow, and price action has moderated after a strong rally, indicating a potential pause or sideways movement before the next directional move. The market is digesting gains, with the possibility of further upside if support levels hold and momentum returns.

Chart Analysis ATS AI Generated: 2025-09-14 18:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.