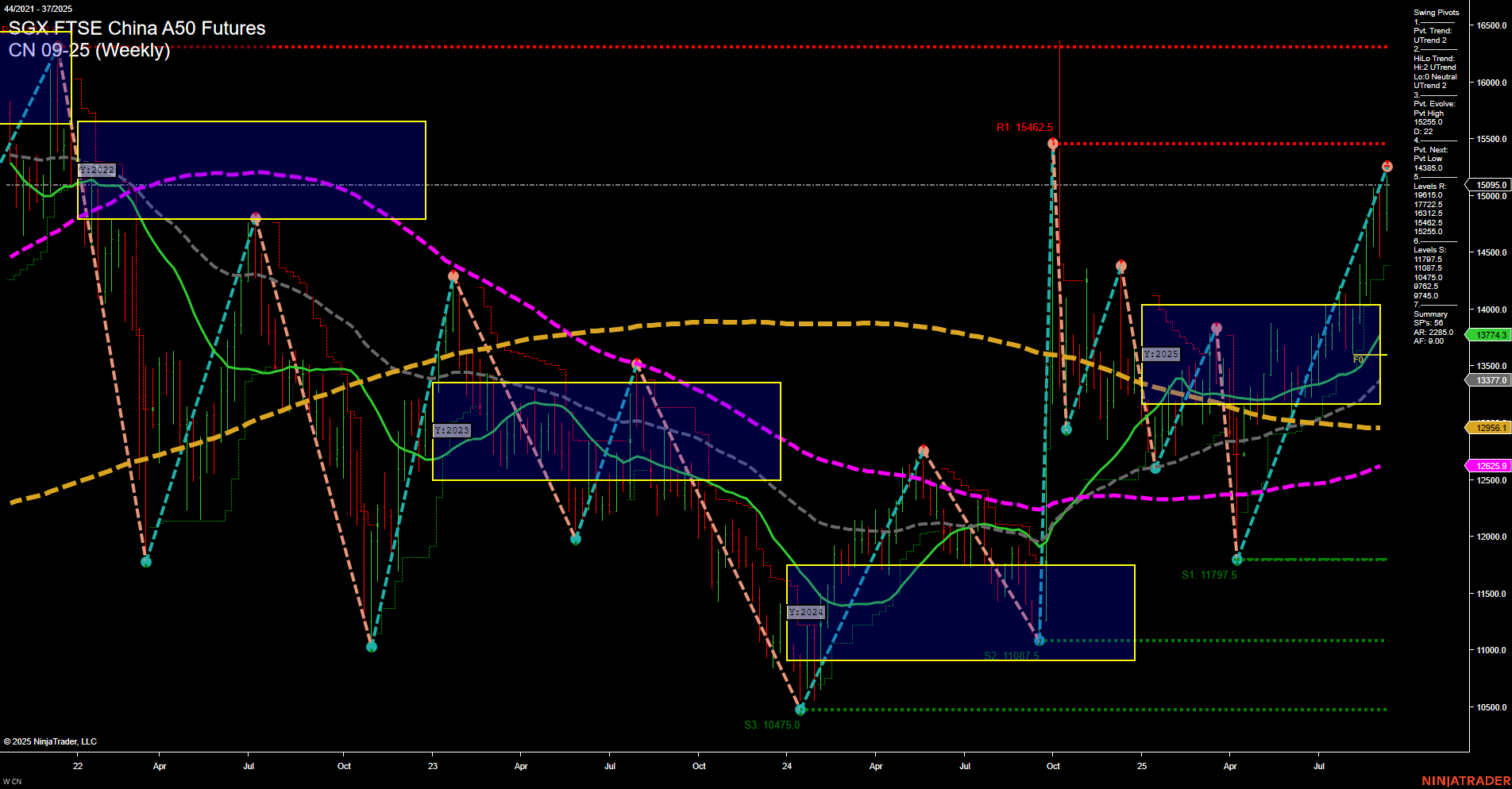

The CN SGX FTSE China A50 Futures weekly chart shows a strong recovery and upward momentum, with price action breaking above key moving averages and swing resistance levels. Both short-term and intermediate-term swing pivot trends are up, supported by a series of higher highs and higher lows. The fast momentum and medium-sized bars indicate active participation and a robust move off the recent swing low at 11797.5. All key weekly benchmarks up to the 55-week MA are trending higher, confirming the bullish structure in the medium term, while the 100- and 200-week MAs remain in a longer-term downtrend, suggesting the market is still in a broader consolidation phase. The price is currently trading within the yearly NTZ, with a neutral bias on the session fib grids, indicating a potential pause or consolidation after the recent rally. Resistance levels at 14385.0, 15462.5, and 16500 are in focus, while support is established at 11797.5 and below. The overall structure suggests a bullish bias in the short and intermediate term, with the long-term trend yet to confirm a full reversal. The market is transitioning from a recovery phase, and traders are watching for either a continuation breakout or a pullback to retest support.