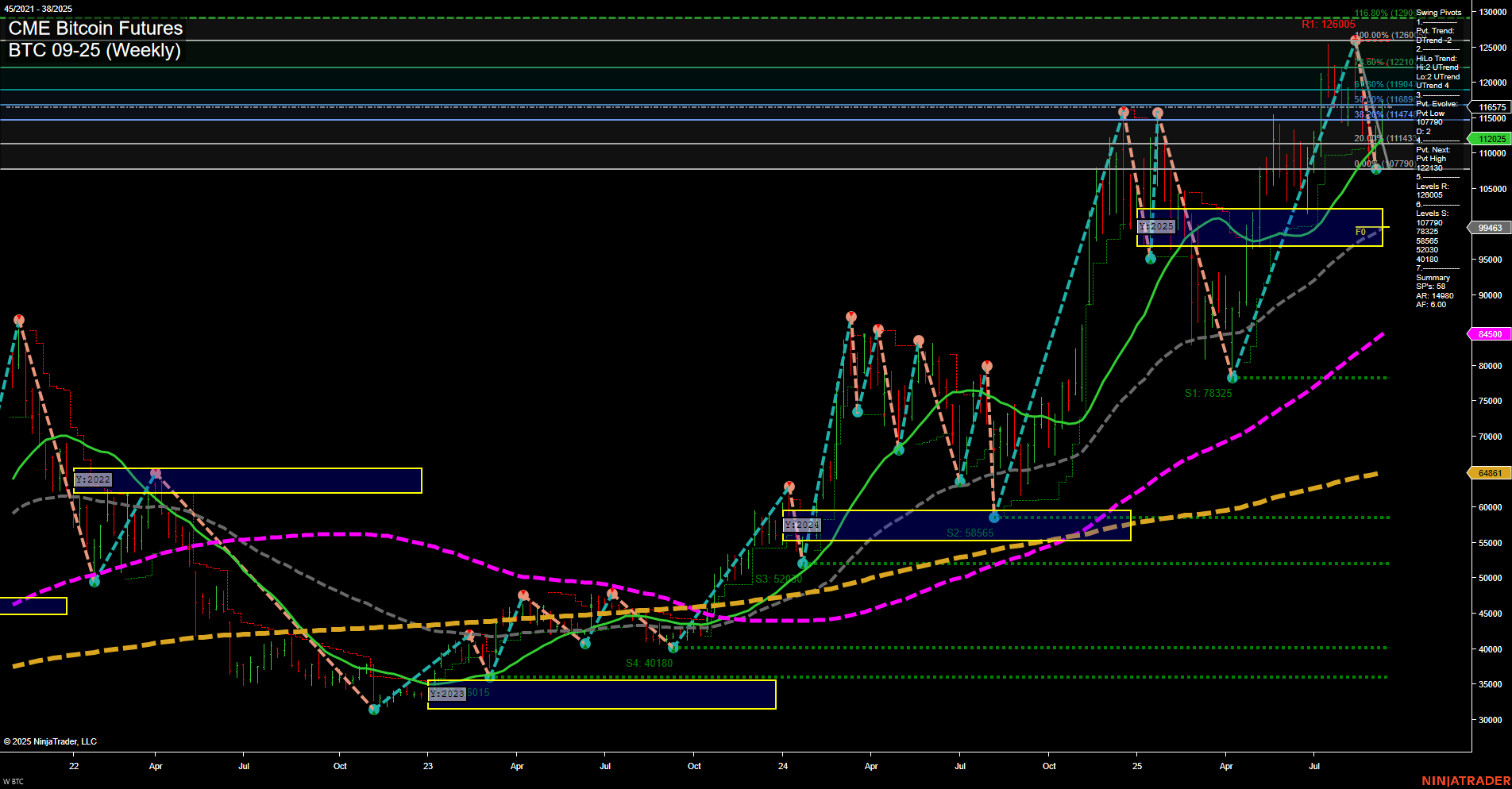

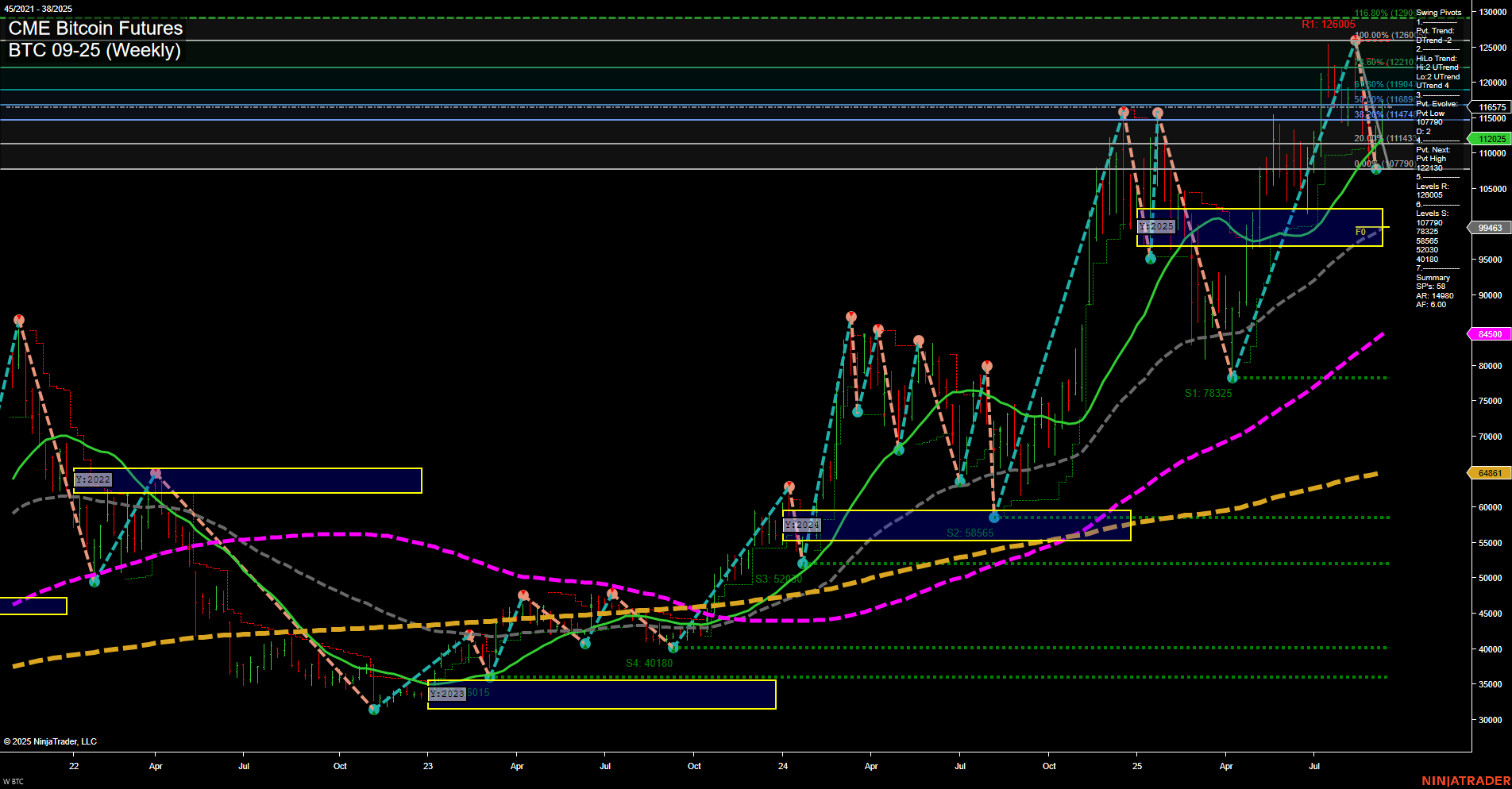

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Sep-14 18:02 CT

Price Action

- Last: 112025,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 97%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 58%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 65%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 107700,

- 4. Pvt. Next: Pvt high 123103,

- 5. Levels R: 126005, 123103, 121240, 117407,

- 6. Levels S: 107700, 99463, 78325, 58665, 52240, 40180.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 114741 Down Trend,

- (Intermediate-Term) 10 Week: 111343 Up Trend,

- (Long-Term) 20 Week: 107790 Up Trend,

- (Long-Term) 55 Week: 84500 Up Trend,

- (Long-Term) 100 Week: 64861 Up Trend,

- (Long-Term) 200 Week: 0 (not shown).

Recent Trade Signals

- 10 Sep 2025: Long BTC 09-25 @ 112715 Signals.USAR-WSFG

- 08 Sep 2025: Long BTC 09-25 @ 111705 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

BTC CME Bitcoin Futures are currently consolidating after a strong rally, with price holding above key Fibonacci grid levels across weekly, monthly, and yearly sessions. The short-term swing pivot trend has shifted to a downtrend, indicating a possible pullback or pause within the broader uptrend, while the intermediate and long-term trends remain firmly bullish. Resistance is layered above at 117407, 121240, 123103, and 126005, with support at 107700 and further below at 99463 and 78325, suggesting a well-defined trading range. The 5-week moving average has turned down, reflecting recent consolidation, but all longer-term benchmarks (10, 20, 55, 100 week) are trending up, confirming the underlying strength. Recent trade signals have triggered new long entries, aligning with the prevailing intermediate and long-term bullish structure. Overall, the market is in a healthy uptrend with short-term consolidation, and swing traders will be watching for either a breakout above resistance or a deeper retracement to support for the next directional move.

Chart Analysis ATS AI Generated: 2025-09-14 18:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.