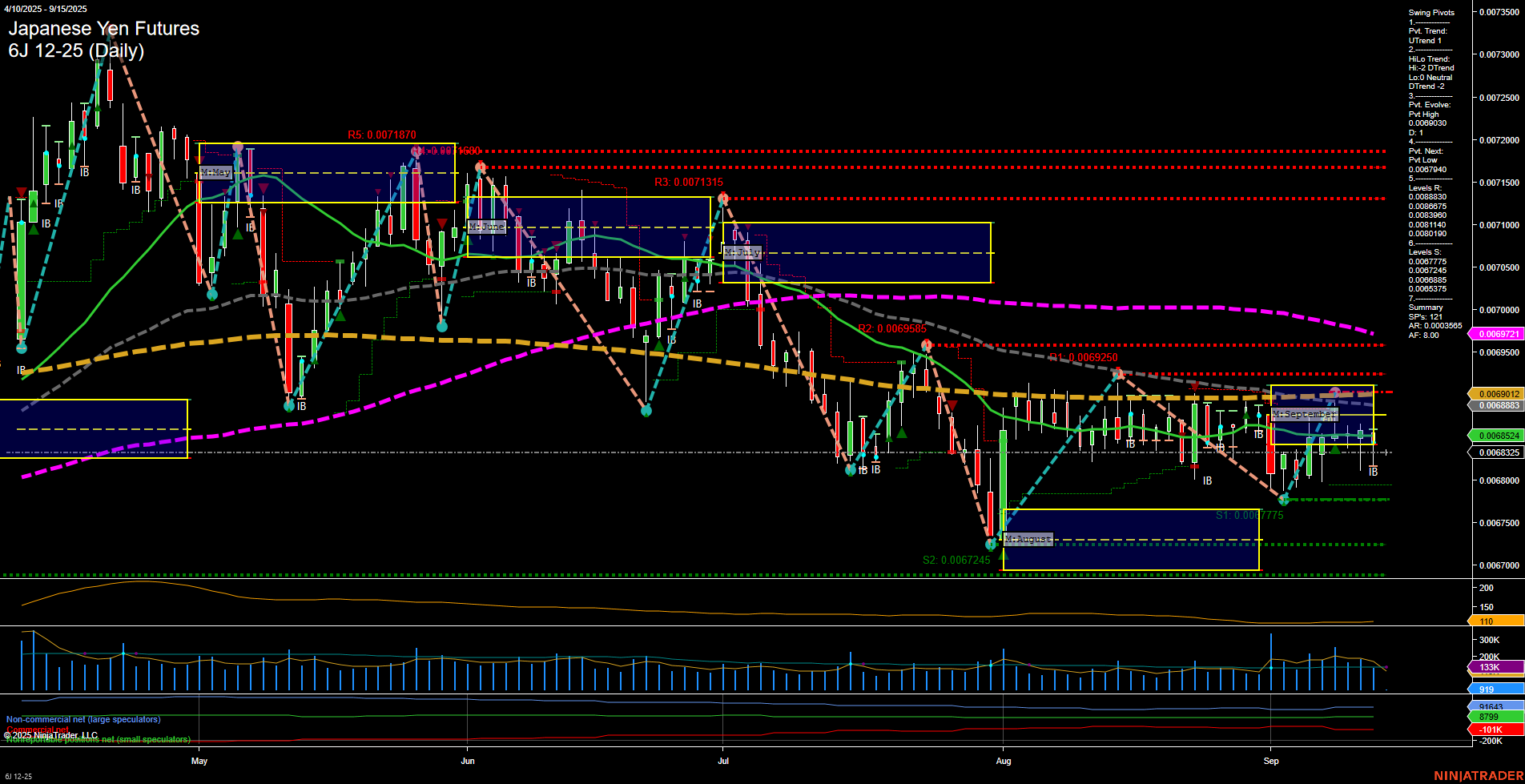

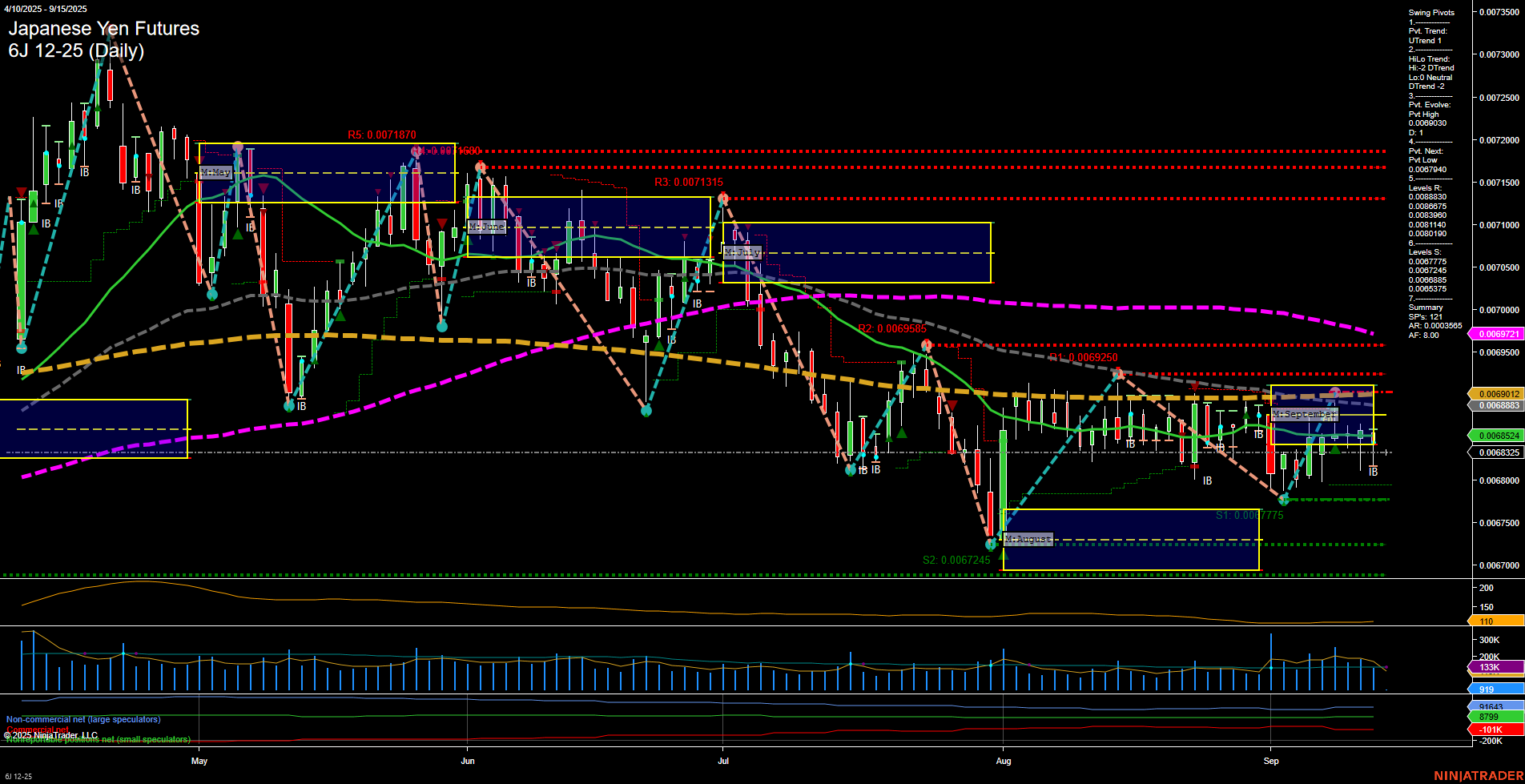

6J Japanese Yen Futures Daily Chart Analysis: 2025-Sep-14 18:01 CT

Price Action

- Last: 0.0068524,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -17%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 20%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 0.0069030,

- 4. Pvt. Next: Pvt Low 0.0067400,

- 5. Levels R: 0.0071870, 0.0071315, 0.0069585, 0.0069030, 0.0068833, 0.0068775,

- 6. Levels S: 0.0067775, 0.0067245, 0.0067175.

Daily Benchmarks

- (Short-Term) 5 Day: 0.0068591 Up Trend,

- (Short-Term) 10 Day: 0.0068383 Up Trend,

- (Intermediate-Term) 20 Day: 0.0068254 Up Trend,

- (Intermediate-Term) 55 Day: 0.0068325 Down Trend,

- (Long-Term) 100 Day: 0.0069721 Down Trend,

- (Long-Term) 200 Day: 0.0069091 Down Trend.

Additional Metrics

Recent Trade Signals

- 11 Sep 2025: Long 6J 09-25 @ 0.006787 Signals.USAR-WSFG

- 11 Sep 2025: Short 6J 09-25 @ 0.006768 Signals.USAR.TR120

- 11 Sep 2025: Short 6J 09-25 @ 0.0067765 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6J Japanese Yen Futures daily chart currently reflects a mixed environment for swing traders. Short-term momentum is positive, with price action above the weekly session fib grid and all short-term moving averages trending up, supported by an upward swing pivot trend. However, the intermediate-term picture is less constructive, as the monthly session fib grid trend is down and the HiLo swing pivot trend remains bearish, indicating ongoing downward pressure from the summer’s selloff. Long-term structure is more supportive, with the yearly fib grid and major moving averages suggesting a broader uptrend, though price remains below the 100- and 200-day benchmarks, hinting at overhead resistance. Recent trade signals show both long and short entries, highlighting the choppy, range-bound nature of the current market. Volatility is moderate, and volume remains healthy. Overall, the market is in a transition phase, with short-term bullishness facing intermediate-term resistance, while the long-term outlook remains constructive if price can sustain above key support levels and break through resistance clusters.

Chart Analysis ATS AI Generated: 2025-09-14 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.