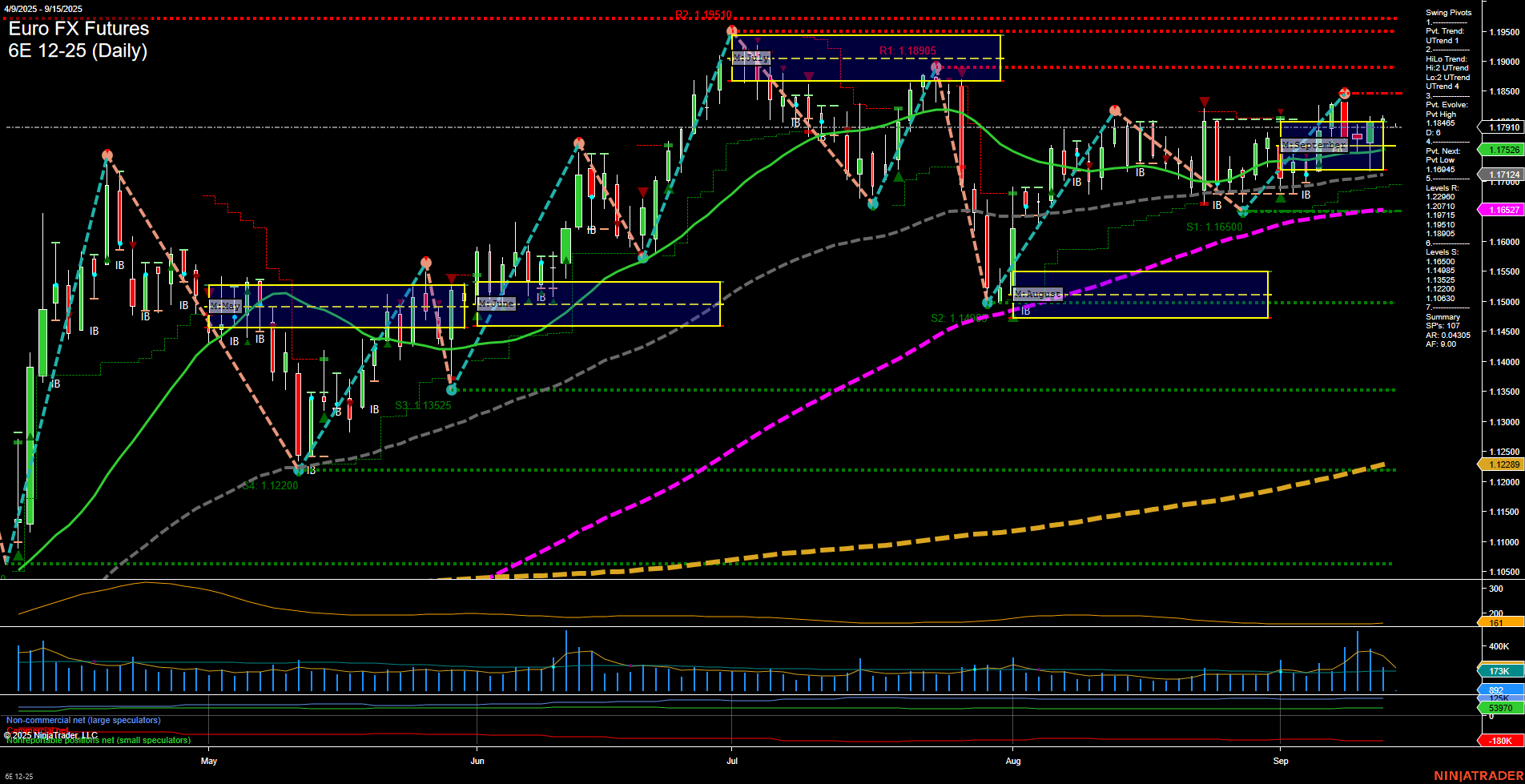

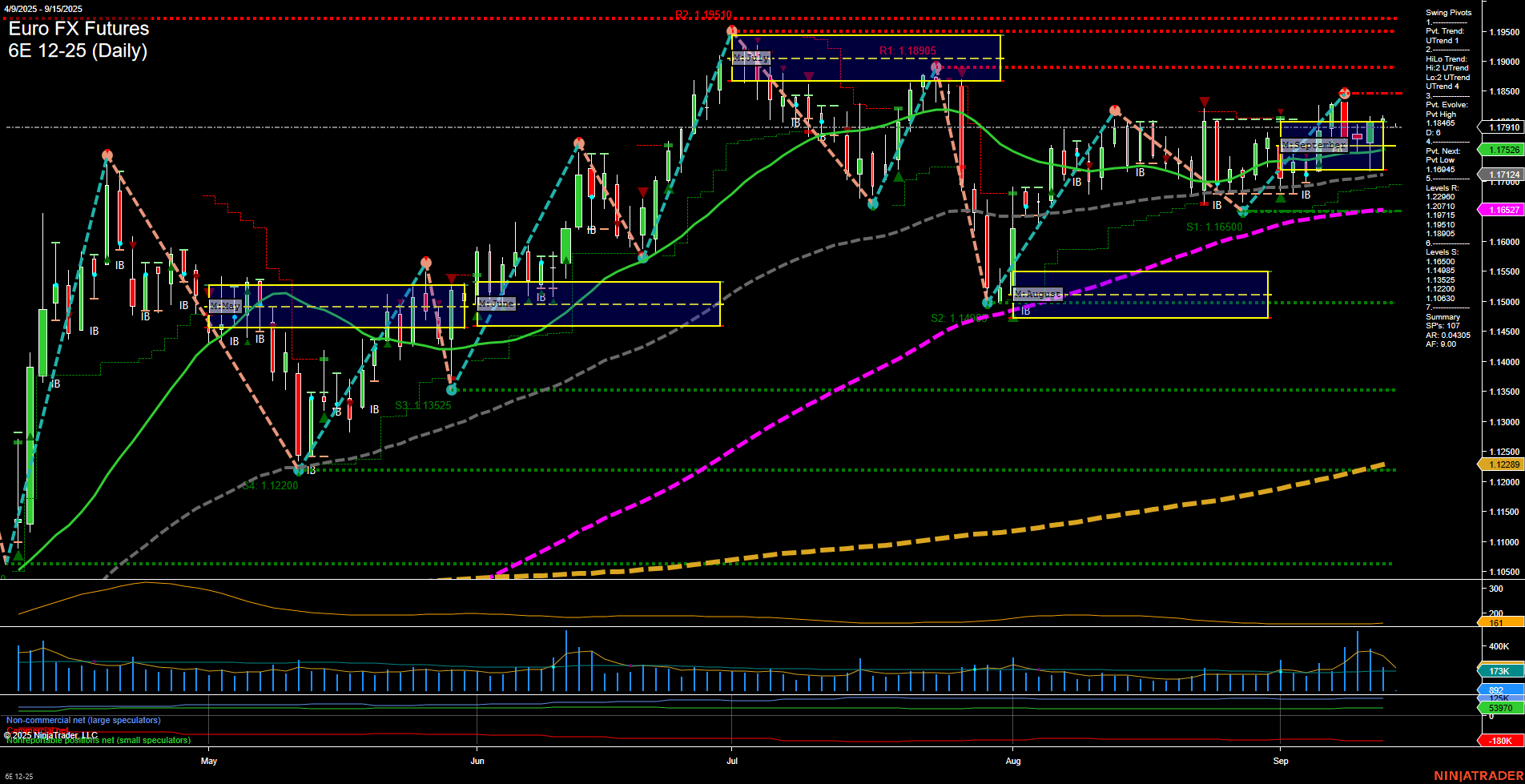

6E Euro FX Futures Daily Chart Analysis: 2025-Sep-14 18:00 CT

Price Action

- Last: 1.17256,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -2%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 87%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 1.17910,

- 4. Pvt. Next: Pvt Low 1.16945,

- 5. Levels R: 1.19500, 1.18905, 1.17910, 1.17465,

- 6. Levels S: 1.16945, 1.16500, 1.15325, 1.12200.

Daily Benchmarks

- (Short-Term) 5 Day: 1.17124 Up Trend,

- (Short-Term) 10 Day: 1.16945 Up Trend,

- (Intermediate-Term) 20 Day: 1.17256 Up Trend,

- (Intermediate-Term) 55 Day: 1.16527 Up Trend,

- (Long-Term) 100 Day: 1.15327 Up Trend,

- (Long-Term) 200 Day: 1.12289 Up Trend.

Additional Metrics

Recent Trade Signals

- 11 Sep 2025: Long 6E 09-25 @ 1.17385 Signals.USAR.TR120

- 11 Sep 2025: Short 6E 09-25 @ 1.16915 Signals.USAR-WSFG

- 09 Sep 2025: Long 6E 09-25 @ 1.17725 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures daily chart shows a market in transition. Price action is currently consolidating just above key intermediate and long-term moving averages, with medium-sized bars and average momentum. The short-term WSFG trend is down, with price below the weekly NTZ, indicating some near-term weakness or a possible pullback. However, both the monthly and yearly session fib grids show price above their respective NTZs, supporting an intermediate and long-term uptrend. Swing pivot structure confirms this, with both short-term and intermediate-term trends in an uptrend, and the most recent pivot high at 1.17910. Resistance is layered above at 1.17465, 1.17910, 1.18905, and 1.19500, while support is found at 1.16945, 1.16500, and lower. All benchmark moving averages are trending up, reinforcing the underlying bullish structure. Recent trade signals reflect mixed short-term direction but continued intermediate-term strength. Volatility and volume are moderate, suggesting a market in a consolidation phase, potentially setting up for a breakout or continuation of the prevailing uptrend if resistance levels are cleared.

Chart Analysis ATS AI Generated: 2025-09-14 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.