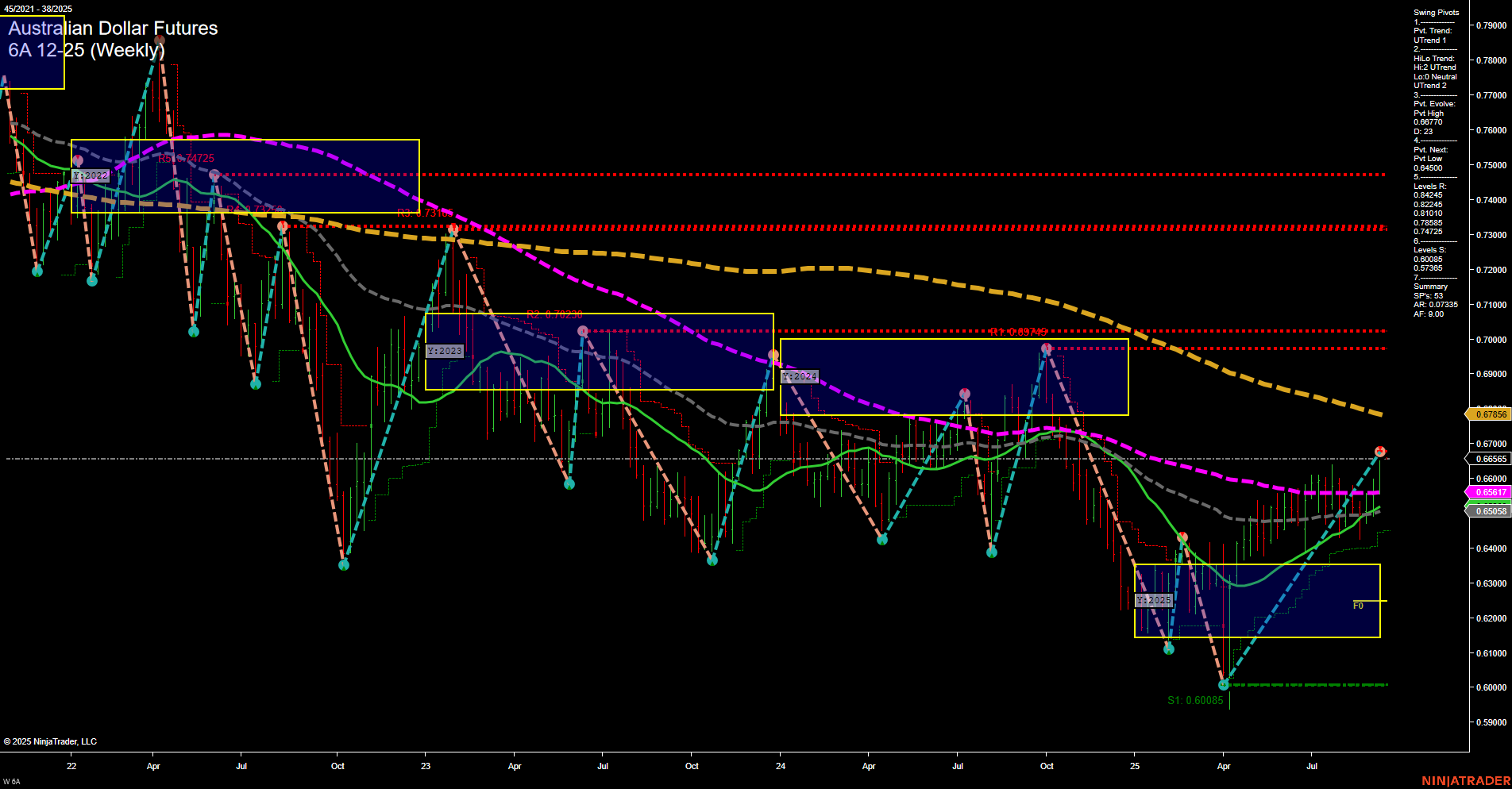

The Australian Dollar Futures (6A) weekly chart shows a notable shift in momentum, with price action moving steadily higher off the 2025 lows. Both short-term and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and a recent pivot high at 0.6710. The price is currently trading above the 5, 10, 20, and 55-week moving averages, all of which are in uptrends, indicating broad-based strength in the medium-term. However, the 100 and 200-week moving averages remain in downtrends, suggesting that the longer-term structure is still neutral and that the market is approaching significant overhead resistance. The WSFG, MSFG, and YSFG grids all indicate a neutral bias, with price consolidating near the center of the yearly and session fib grids, reflecting a lack of clear directional conviction on the higher timeframes. Resistance levels are clustered above, particularly around 0.6747 to 0.6974, while support is established at 0.6555 and lower at 0.6008. Recent trade signals have favored the long side, aligning with the current bullish swing structure. Overall, the chart reflects a market in recovery mode, with bullish momentum in the short and intermediate term, but still facing a neutral long-term outlook as it tests key resistance zones. The price action suggests a transition phase, with the potential for further upside if resistance levels are overcome, but with the risk of consolidation or pullback if the longer-term moving averages continue to cap gains.