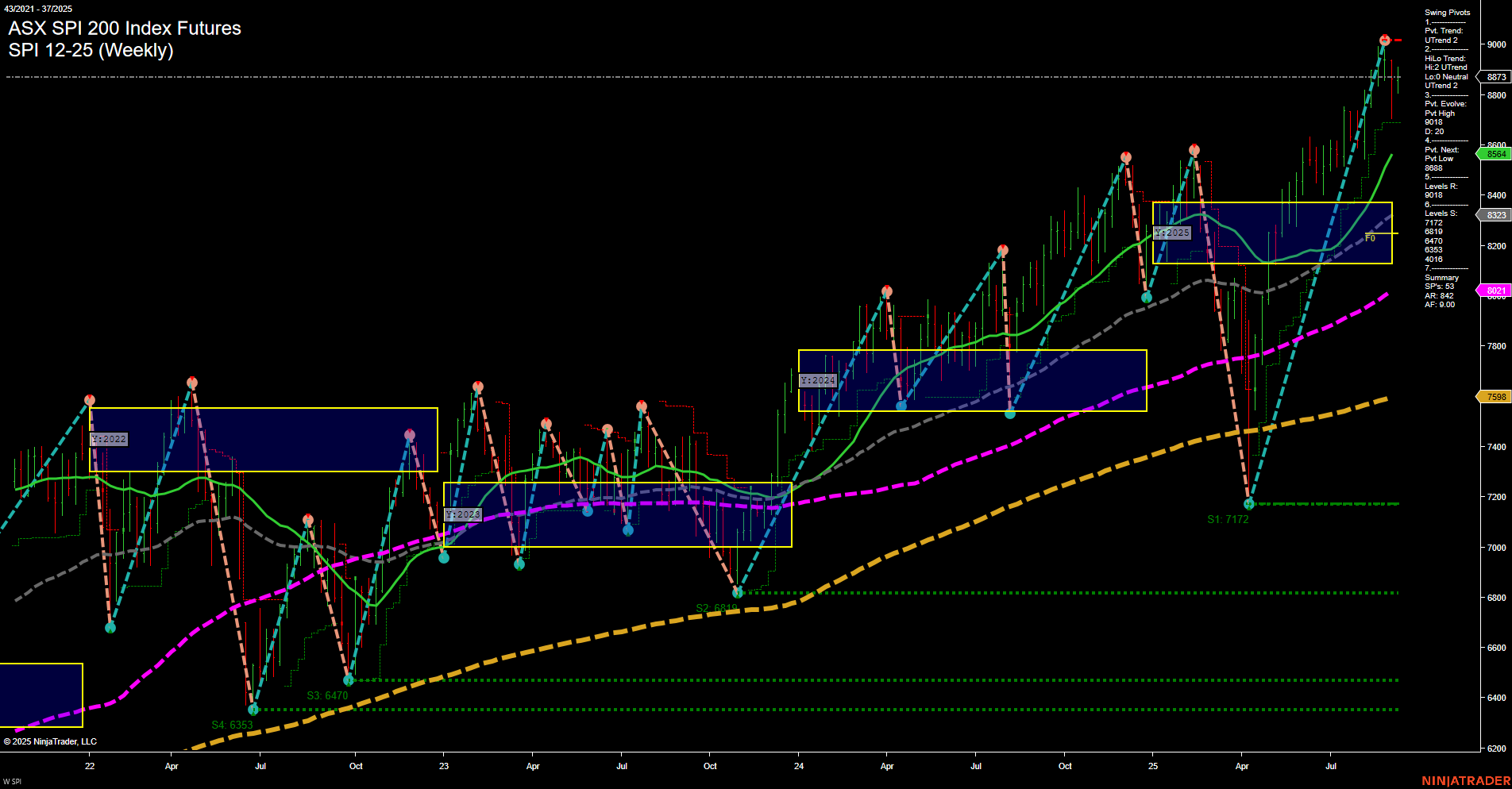

The SPI 200 Index Futures weekly chart shows a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, indicating heightened volatility and strong directional conviction. The most recent swing pivot has established a new high at 8873, with the next key support at 8584, suggesting the market is in an advancing phase with higher highs and higher lows. All benchmark moving averages from short to long term are trending upward, reinforcing the prevailing uptrend. The neutral bias in the Fib Grid overlays suggests price is not currently at an extreme, but rather consolidating gains after a significant rally. The overall technical landscape points to a robust trend continuation environment, with the market having recently broken out of consolidation zones and showing little sign of reversal pressure. This aligns with a classic trend-following scenario, where pullbacks to support may be met with renewed buying interest, and resistance levels are being tested and surpassed. The chart does not currently display signs of exhaustion or major reversal patterns, keeping the outlook constructive for the ongoing trend.