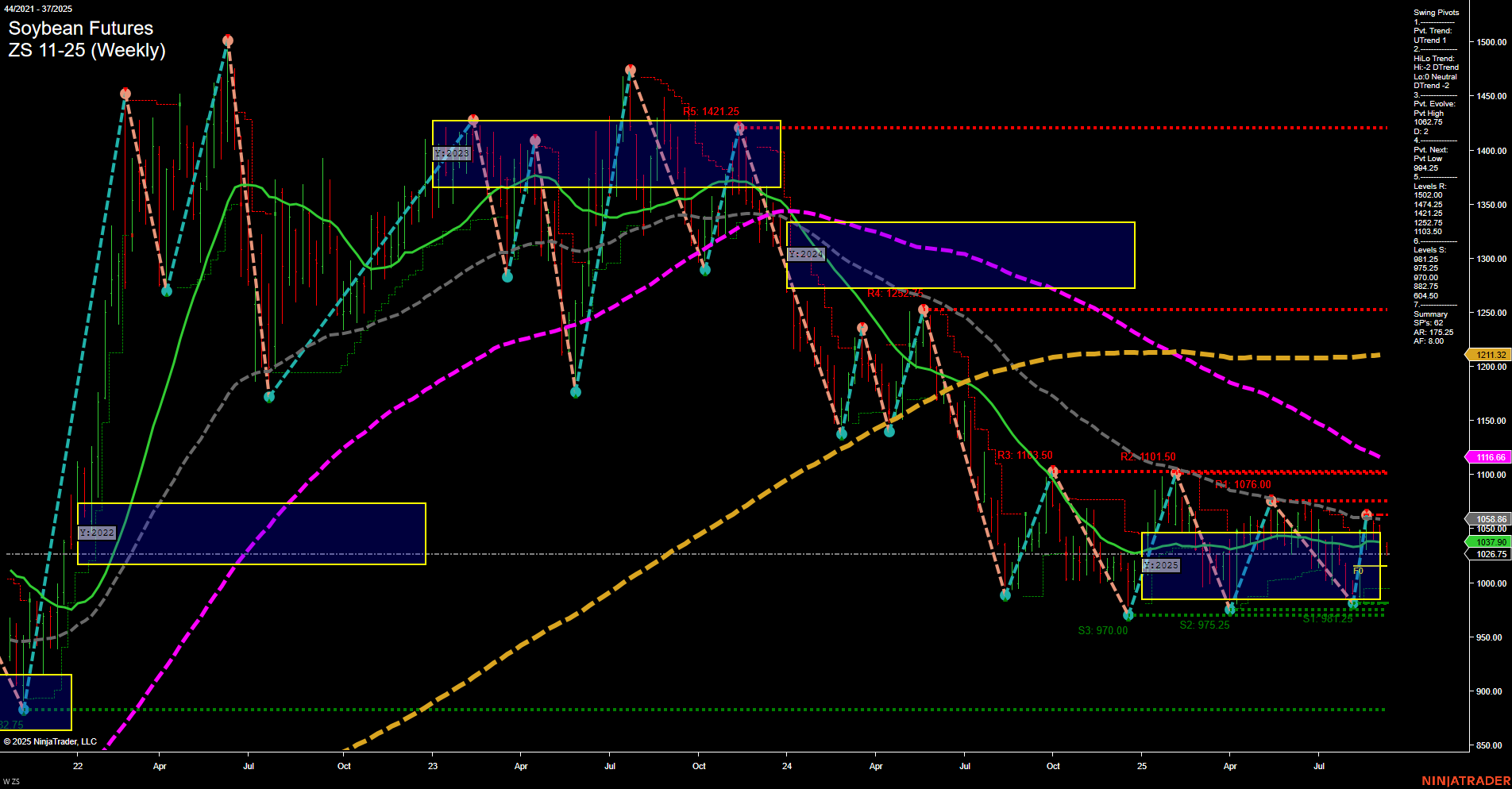

Soybean futures (ZS 11-25) are currently trading at 1058.88, with medium-sized weekly bars and slow momentum, indicating a lack of strong directional conviction. The short-term (WSFG) and intermediate-term (MSFG) session fib grid trends are both down, with price trading below their respective NTZ/F0% levels, confirming a bearish bias in the near to mid-term. Swing pivot analysis shows a prevailing short-term downtrend, with the most recent pivot high at 1076.00 and the next key support at the pivot low of 970.00. Resistance levels are stacked above, with significant barriers at 1101.50 and 1076.00, while support is concentrated around 975.25 and 970.00. Long-term (YSFG) trend remains marginally up, with price just above the yearly NTZ/F0% level, but this is countered by all major long-term moving averages (20, 55, 100 week) trending down, suggesting persistent overhead pressure. Recent trade signals have triggered short entries, aligning with the prevailing bearish structure in both short and intermediate timeframes. The market appears to be in a broad consolidation range, with lower highs and support tests, reflecting a choppy environment. While the long-term structure is not decisively bearish, the weight of evidence from swing pivots, session grids, and moving averages points to continued downside risk in the short to intermediate term, with the potential for further tests of support unless a significant reversal develops.