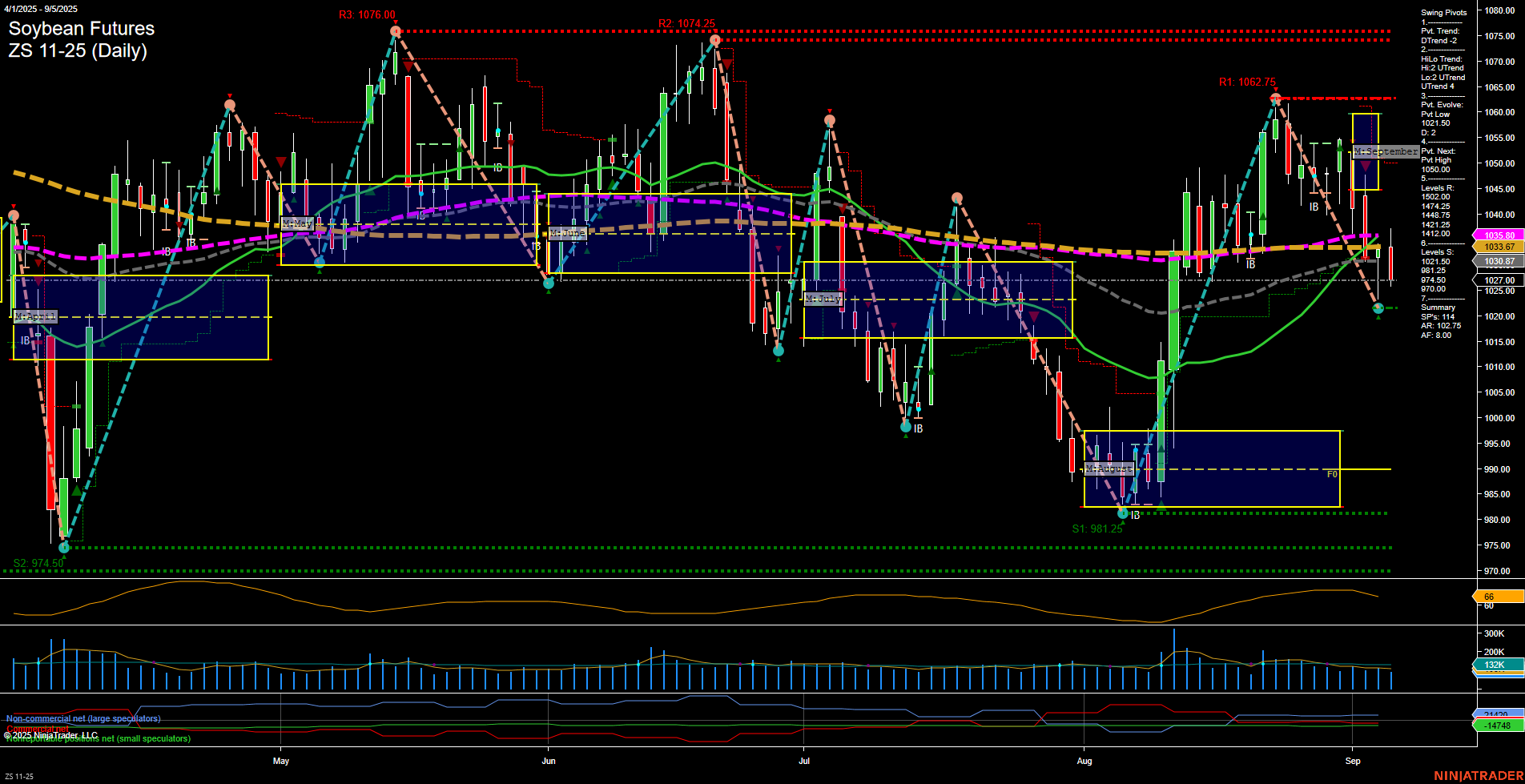

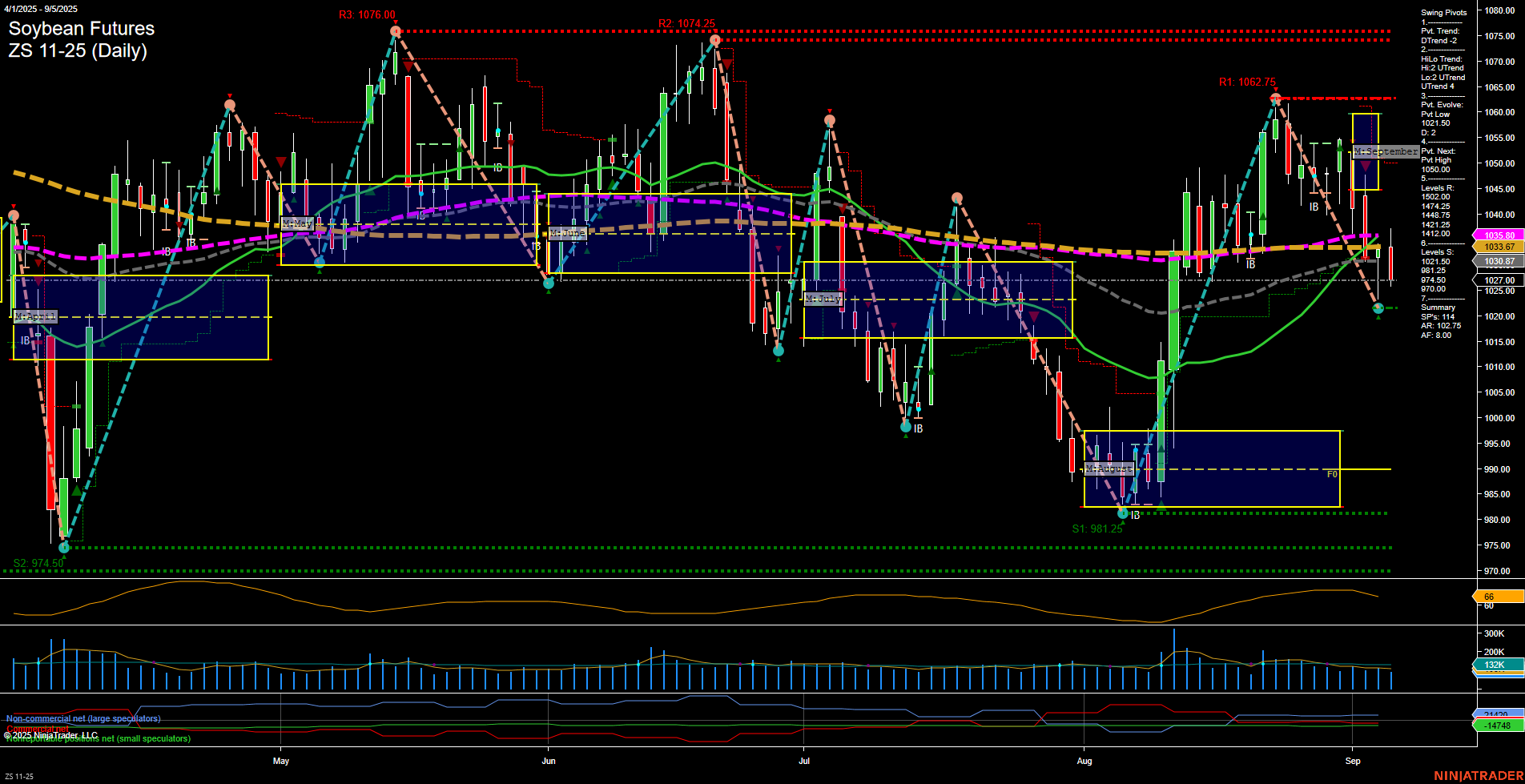

ZS Soybean Futures Daily Chart Analysis: 2025-Sep-07 18:18 CT

Price Action

- Last: 1033.50,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -75%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -40%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1027.00,

- 4. Pvt. Next: Pvt high 1050.00,

- 5. Levels R: 1062.75, 1074.25, 1076.00,

- 6. Levels S: 1027.00, 981.25, 974.50.

Daily Benchmarks

- (Short-Term) 5 Day: 1040.15 Down Trend,

- (Short-Term) 10 Day: 1044.13 Down Trend,

- (Intermediate-Term) 20 Day: 1035.69 Down Trend,

- (Intermediate-Term) 55 Day: 1033.67 Down Trend,

- (Long-Term) 100 Day: 1035.60 Down Trend,

- (Long-Term) 200 Day: 1047.48 Down Trend.

Additional Metrics

Recent Trade Signals

- 02 Sep 2025: Short ZS 11-25 @ 1045 Signals.USAR-WSFG

- 02 Sep 2025: Short ZS 11-25 @ 1046.25 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

Soybean futures are currently experiencing a pronounced short-term and intermediate-term downtrend, as confirmed by both the WSFG and MSFG grids, with price action holding below key NTZ/F0% levels. The most recent swing pivot trend is down, with the last pivot low at 1027.00 acting as immediate support, while resistance is stacked above at 1050.00 and higher. All benchmark moving averages across short, intermediate, and long-term timeframes are trending down, reinforcing the prevailing bearish momentum. The ATR indicates moderate volatility, and volume remains steady, suggesting no major capitulation or breakout event. Recent trade signals have triggered short entries, aligning with the current technical structure. Despite the long-term YSFG trend still holding up, the weight of evidence from price, pivots, and moving averages points to continued downside pressure in the near to intermediate term, with the market potentially seeking to test lower support levels unless a significant reversal develops.

Chart Analysis ATS AI Generated: 2025-09-07 18:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.