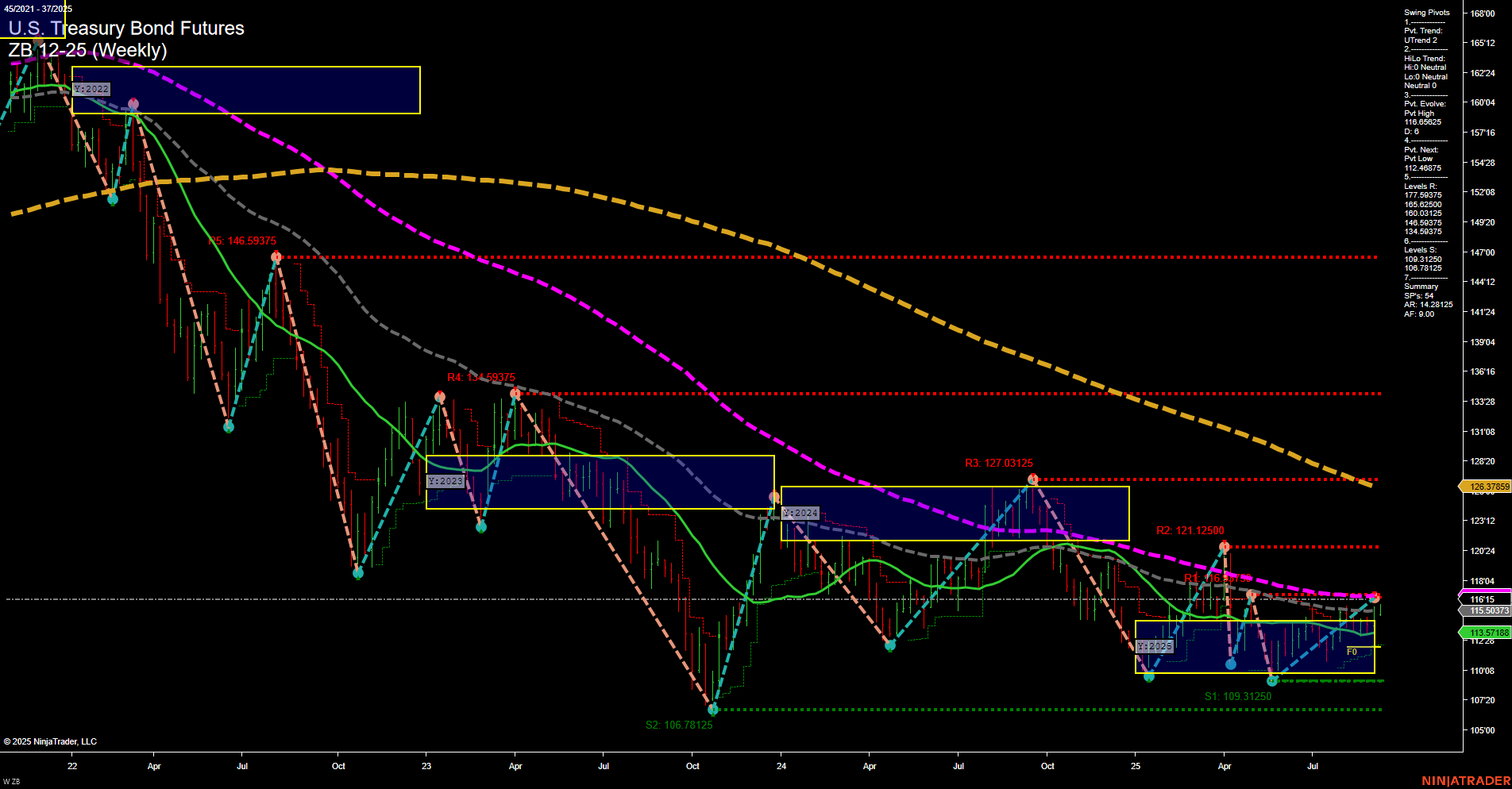

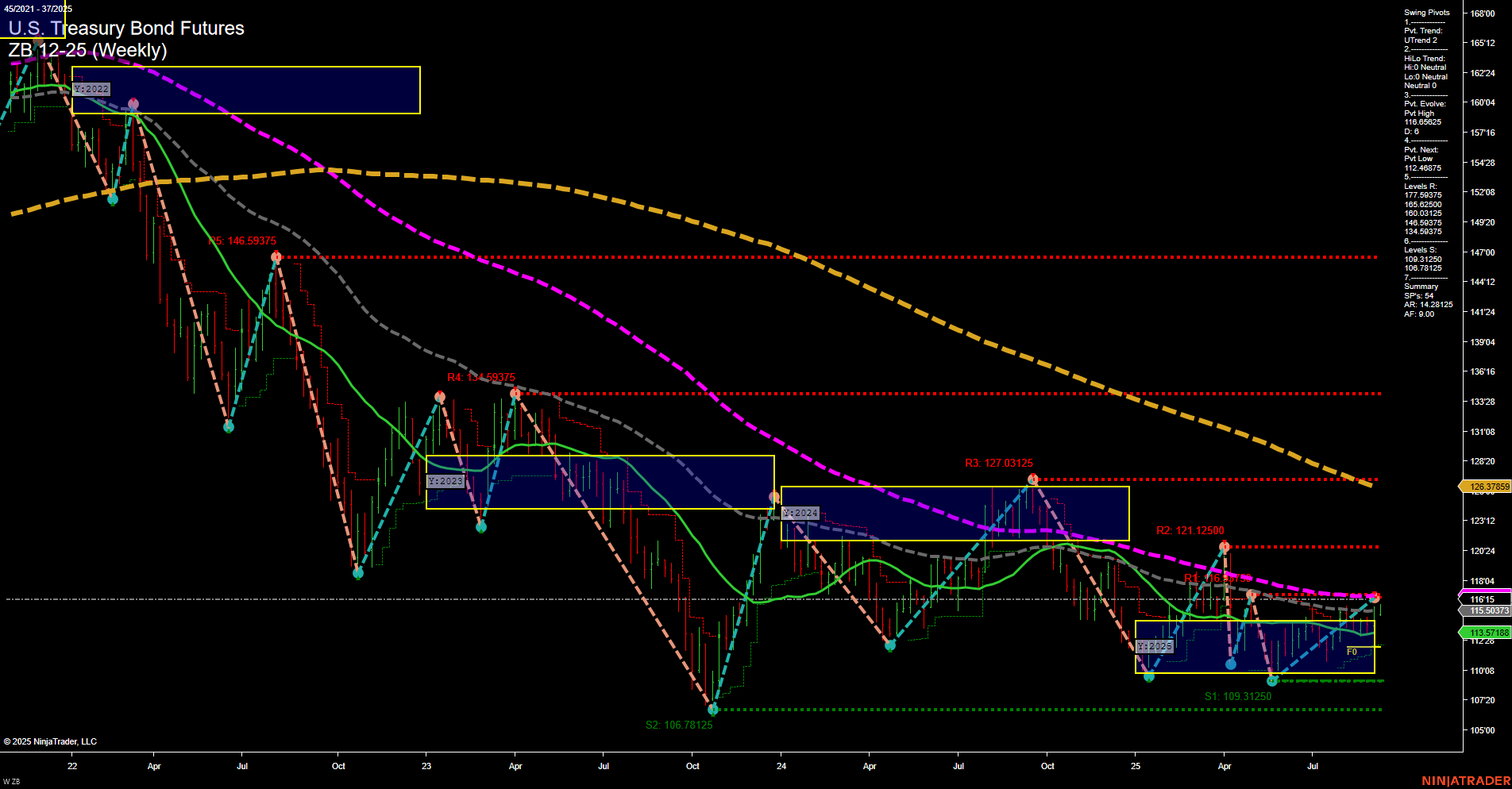

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Sep-07 18:17 CT

Price Action

- Last: 126.37595,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt high 116.09375,

- 4. Pvt. Next: Pvt low 112.46875,

- 5. Levels R: 127.03125, 121.12500, 116.09375, 114.59375,

- 6. Levels S: 109.31250, 106.78125, 100.78125.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115.50737 Up Trend,

- (Intermediate-Term) 10 Week: 113.57188 Up Trend,

- (Long-Term) 20 Week: 116.15 Up Trend,

- (Long-Term) 55 Week: 121.03 Down Trend,

- (Long-Term) 100 Week: 127.03 Down Trend,

- (Long-Term) 200 Week: 146.59 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently exhibiting medium-sized bars with slow momentum, suggesting a period of consolidation or indecision. The short-term swing pivot trend has shifted to an uptrend, supported by rising 5- and 10-week moving averages, indicating some bullish sentiment in the near term. However, intermediate-term trends remain neutral, with the HiLo trend not showing a clear direction and price oscillating between established support and resistance levels. Long-term moving averages (55, 100, and 200 week) are still in a downtrend, reflecting persistent bearish pressure from higher timeframes. Key resistance levels are clustered around 116.09, 121.12, and 127.03, while support is found at 112.47, 109.31, and 106.78. The overall structure suggests the market is attempting a short-term recovery within a broader bearish context, with price currently testing the lower end of a multi-month range. This environment is typical of a market seeking direction, with potential for both range-bound trading and breakout scenarios depending on upcoming macroeconomic catalysts.

Chart Analysis ATS AI Generated: 2025-09-07 18:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.