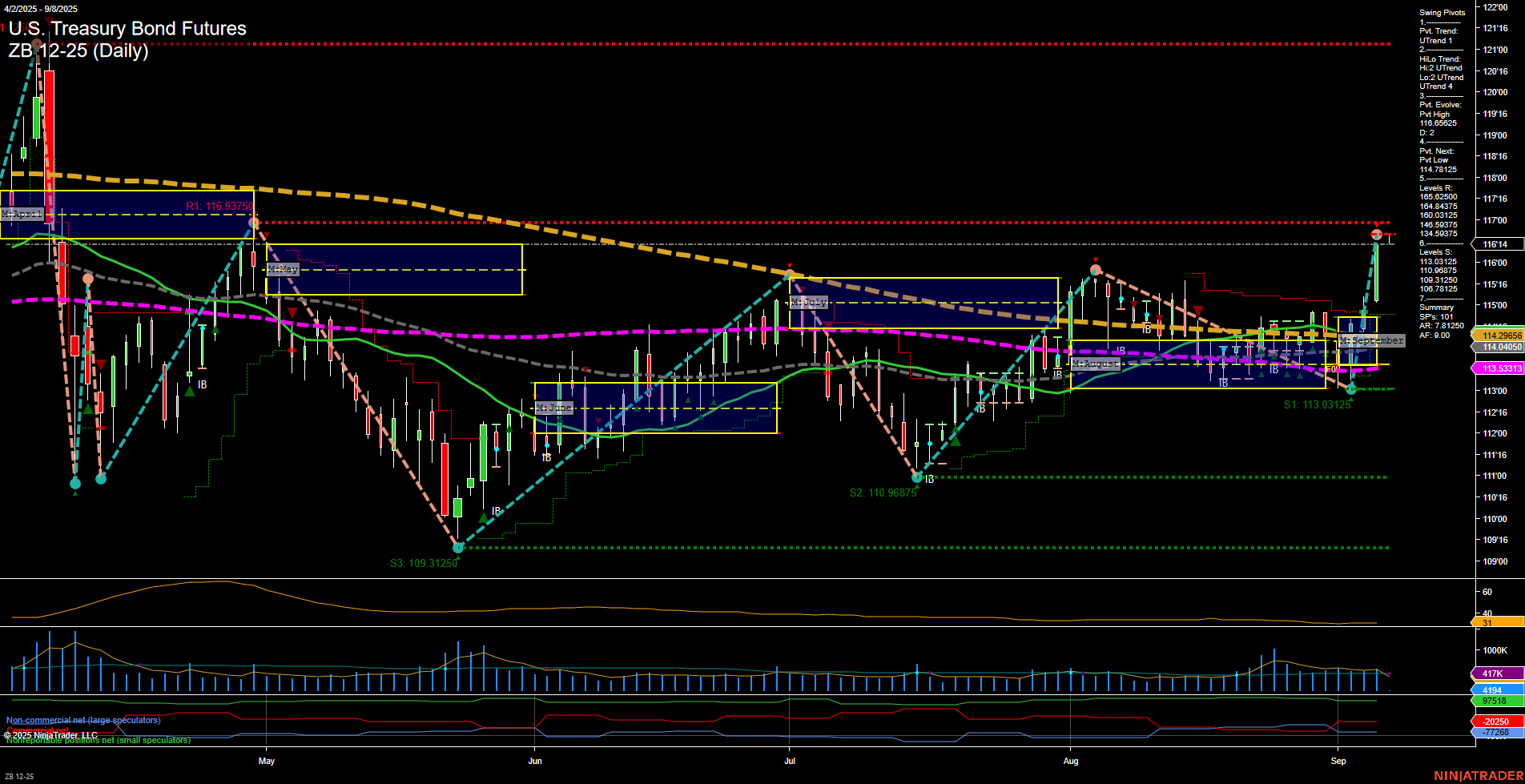

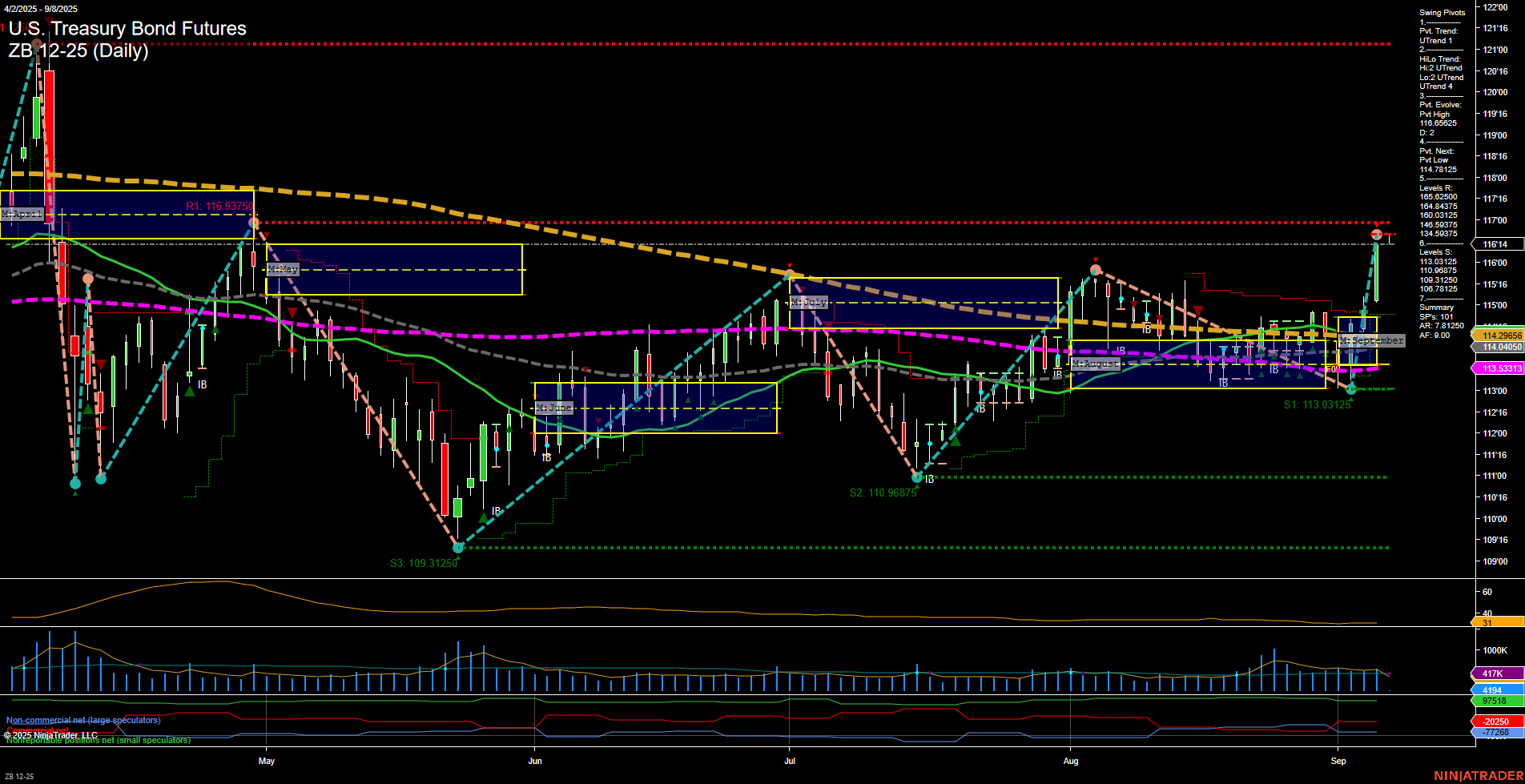

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Sep-07 18:17 CT

Price Action

- Last: 114.0450,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 116.0525,

- 4. Pvt. Next: Pvt Low 114.78125,

- 5. Levels R: 120.6250, 116.4375, 116.03125, 116.9375, 114.59375,

- 6. Levels S: 113.03125, 110.96875, 109.3125.

Daily Benchmarks

- (Short-Term) 5 Day: 113.5331 Up Trend,

- (Short-Term) 10 Day: 113.5331 Up Trend,

- (Intermediate-Term) 20 Day: 114.2956 Up Trend,

- (Intermediate-Term) 55 Day: 114.0450 Up Trend,

- (Long-Term) 100 Day: 113.5331 Down Trend,

- (Long-Term) 200 Day: 114.2956 Down Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart shows a strong upward move with large, fast momentum bars, indicating a recent surge in buying interest. Both short-term and intermediate-term swing pivot trends have shifted to an uptrend, with the most recent pivot high at 116.0525 and the next potential pivot low at 114.78125, suggesting the market is currently testing higher resistance levels. The price is trading above the 5, 10, 20, and 55-day moving averages, all of which are in uptrends, reinforcing the bullish short- and intermediate-term outlook. However, the 100 and 200-day moving averages remain in a downtrend, keeping the long-term trend neutral for now. Volatility, as measured by ATR, is elevated, and volume is robust, supporting the significance of the recent breakout. The market is approaching key resistance levels, with 116.4375 and 116.9375 as immediate upside targets, while support is established at 113.03125 and below. The overall structure suggests a potential trend continuation if resistance is cleared, but the long-term trend has yet to confirm a full reversal. The current environment reflects a strong bullish impulse in the short and intermediate term, with the potential for further upside if momentum persists.

Chart Analysis ATS AI Generated: 2025-09-07 18:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.