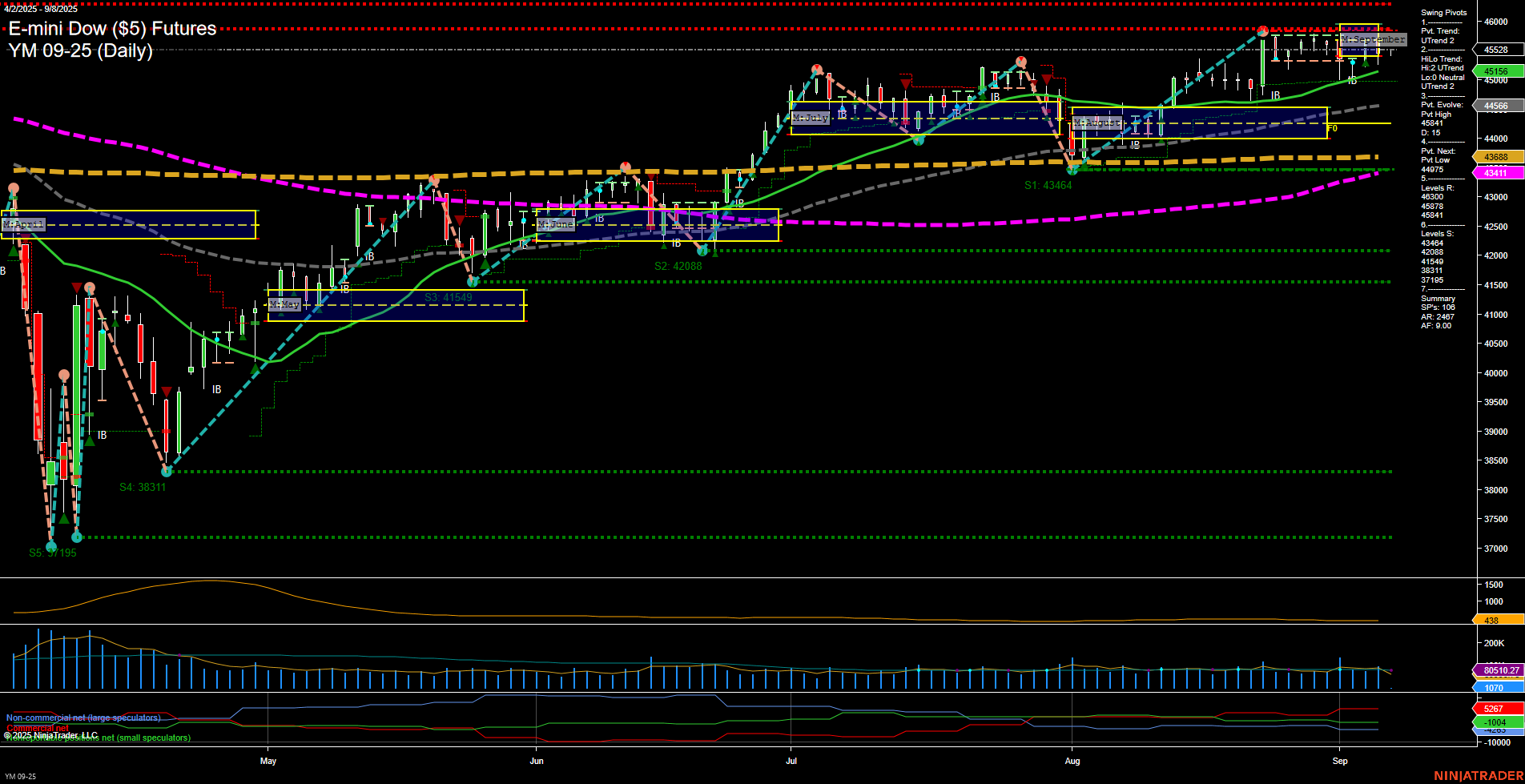

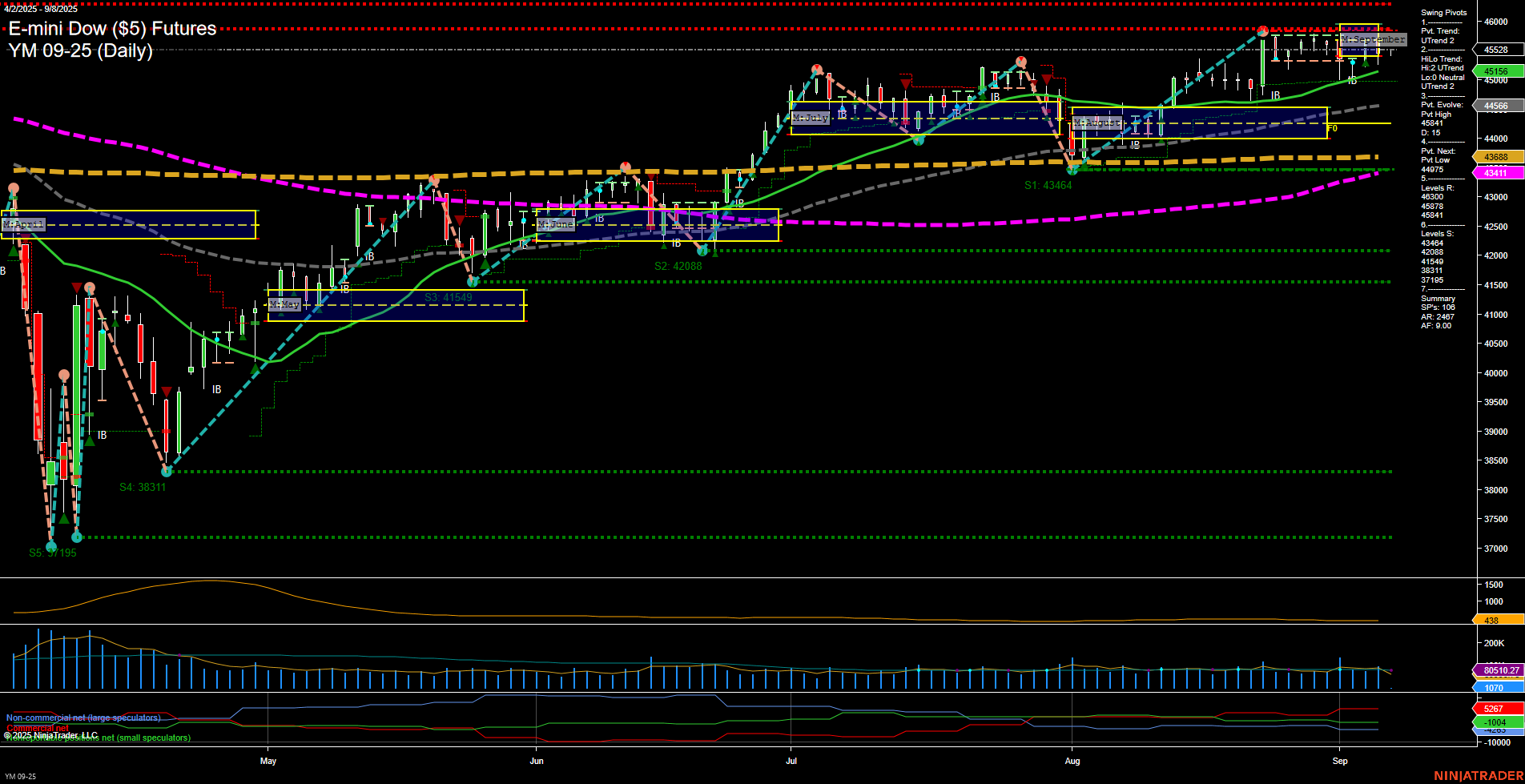

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2025-Sep-07 18:16 CT

Price Action

- Last: 45156,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 24%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 45481,

- 4. Pvt. Next: Pvt Low 44075,

- 5. Levels R: 45528, 45481, 45104, 45031, 44836,

- 6. Levels S: 44075, 43464, 42088, 41549, 38311, 37195.

Daily Benchmarks

- (Short-Term) 5 Day: 45156 Up Trend,

- (Short-Term) 10 Day: 45116 Up Trend,

- (Intermediate-Term) 20 Day: 44566 Up Trend,

- (Intermediate-Term) 55 Day: 43868 Up Trend,

- (Long-Term) 100 Day: 43411 Up Trend,

- (Long-Term) 200 Day: 43388 Up Trend.

Additional Metrics

Recent Trade Signals

- 05 Sep 2025: Short YM 09-25 @ 45350 Signals.USAR.TR120

- 05 Sep 2025: Short YM 09-25 @ 45350 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures daily chart shows a market in transition. Price action is holding above key short-term and long-term moving averages, with the 5, 10, 20, 55, 100, and 200-day benchmarks all trending upward, supporting a bullish bias for both short and long-term outlooks. The short-term swing pivot trend is up, with resistance levels clustering just above current price, suggesting the market is testing overhead supply. However, the intermediate-term (monthly) MSFG trend is down, and price is below the monthly NTZ, indicating a potential retracement or pause in the broader uptrend. The most recent swing pivot is a high at 45481, with the next key support at 44075, highlighting a range where price could oscillate if momentum stalls. Recent trade signals have triggered short entries, reflecting the intermediate-term bearish bias despite the prevailing uptrend in other timeframes. Volatility (ATR) remains moderate, and volume is steady, suggesting no extreme moves or exhaustion. Overall, the market is consolidating near highs, with short-term strength but intermediate-term caution as the market digests recent gains and tests resistance.

Chart Analysis ATS AI Generated: 2025-09-07 18:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.