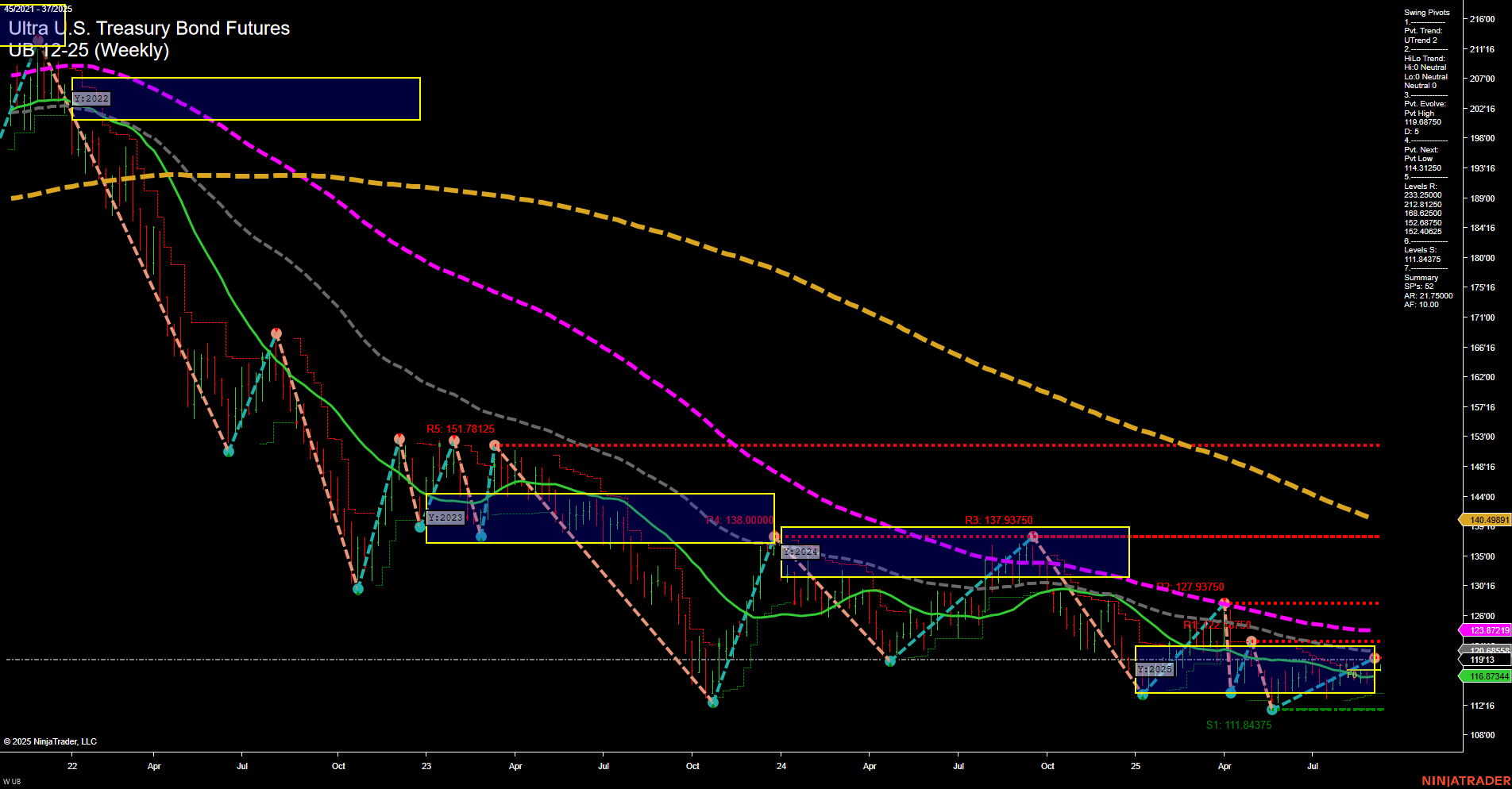

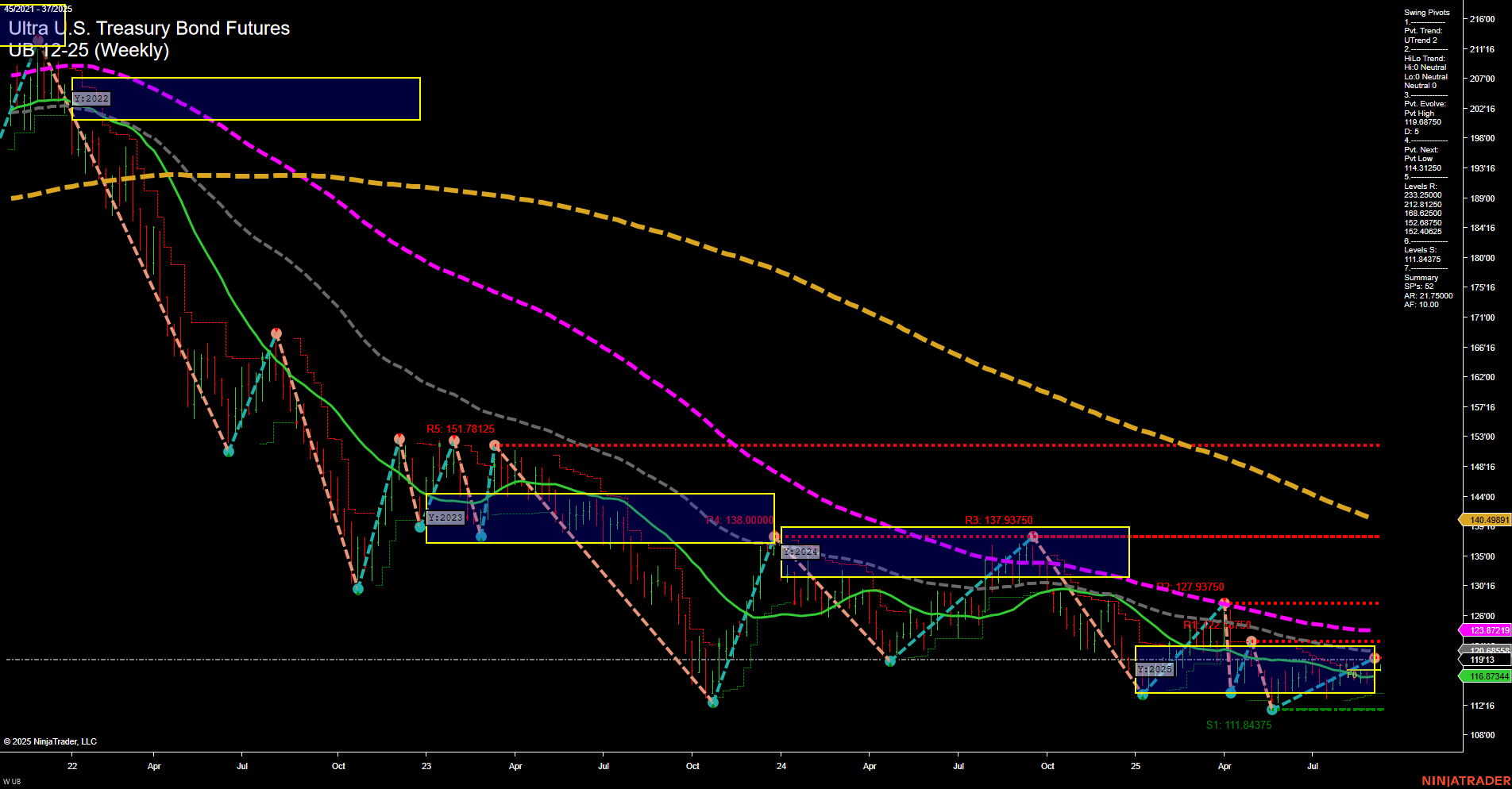

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Sep-07 18:15 CT

Price Action

- Last: 119'13,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 65%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 119.8750,

- 4. Pvt. Next: Pvt Low 114.31250,

- 5. Levels R: 151.78125, 138.00000, 137.93750, 127.93750, 127.1250, 123.2500, 121.81250, 119.8750,

- 6. Levels S: 116.87344, 111.84375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 119'13 Up Trend,

- (Intermediate-Term) 10 Week: 116'28 Up Trend,

- (Long-Term) 20 Week: 123'28 Up Trend,

- (Long-Term) 55 Week: 127'28 Down Trend,

- (Long-Term) 100 Week: 140'16 Down Trend,

- (Long-Term) 200 Week: 149'16 Down Trend.

Recent Trade Signals

- 05 Sep 2025: Long UB 12-25 @ 118.03125 Signals.USAR.TR720

- 04 Sep 2025: Long UB 12-25 @ 117.34375 Signals.USAR-MSFG

- 03 Sep 2025: Long UB 12-25 @ 116.84375 Signals.USAR.TR120

- 03 Sep 2025: Long UB 12-25 @ 116.59375 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is consolidating with medium bars and slow momentum, reflecting a lack of strong directional conviction. The short-term WSFG trend remains down, with price below the NTZ center, but the swing pivot trend has shifted to an uptrend, suggesting a possible early reversal or at least a pause in the prior downtrend. Intermediate-term signals are more constructive: the MSFG trend is up, price is above the monthly NTZ, and both the 5- and 10-week moving averages are trending higher. The long-term picture is mixed; while the yearly session grid and 20-week MA are up, the 55-, 100-, and 200-week MAs are still in downtrends, indicating that the broader bear market is not yet fully reversed. Recent trade signals have all been to the long side, supporting the view of a developing bullish bias in the intermediate term. Key resistance levels are clustered above, with 123'25 and 127'12 as notable hurdles, while support is seen at 116'28 and 111'27. Overall, the market is showing early signs of a potential bottoming process, with intermediate-term strength emerging but longer-term headwinds still present.

Chart Analysis ATS AI Generated: 2025-09-07 18:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.