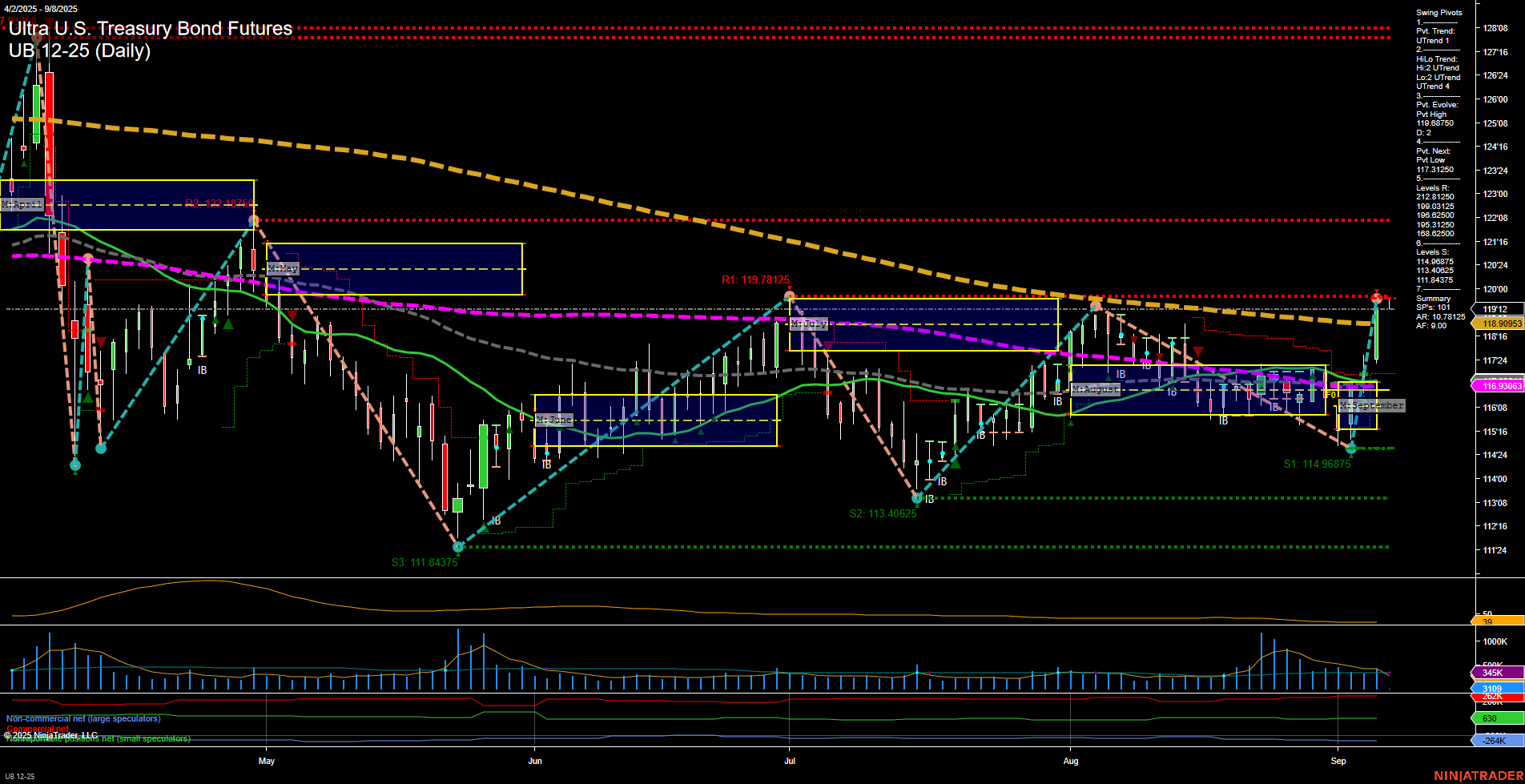

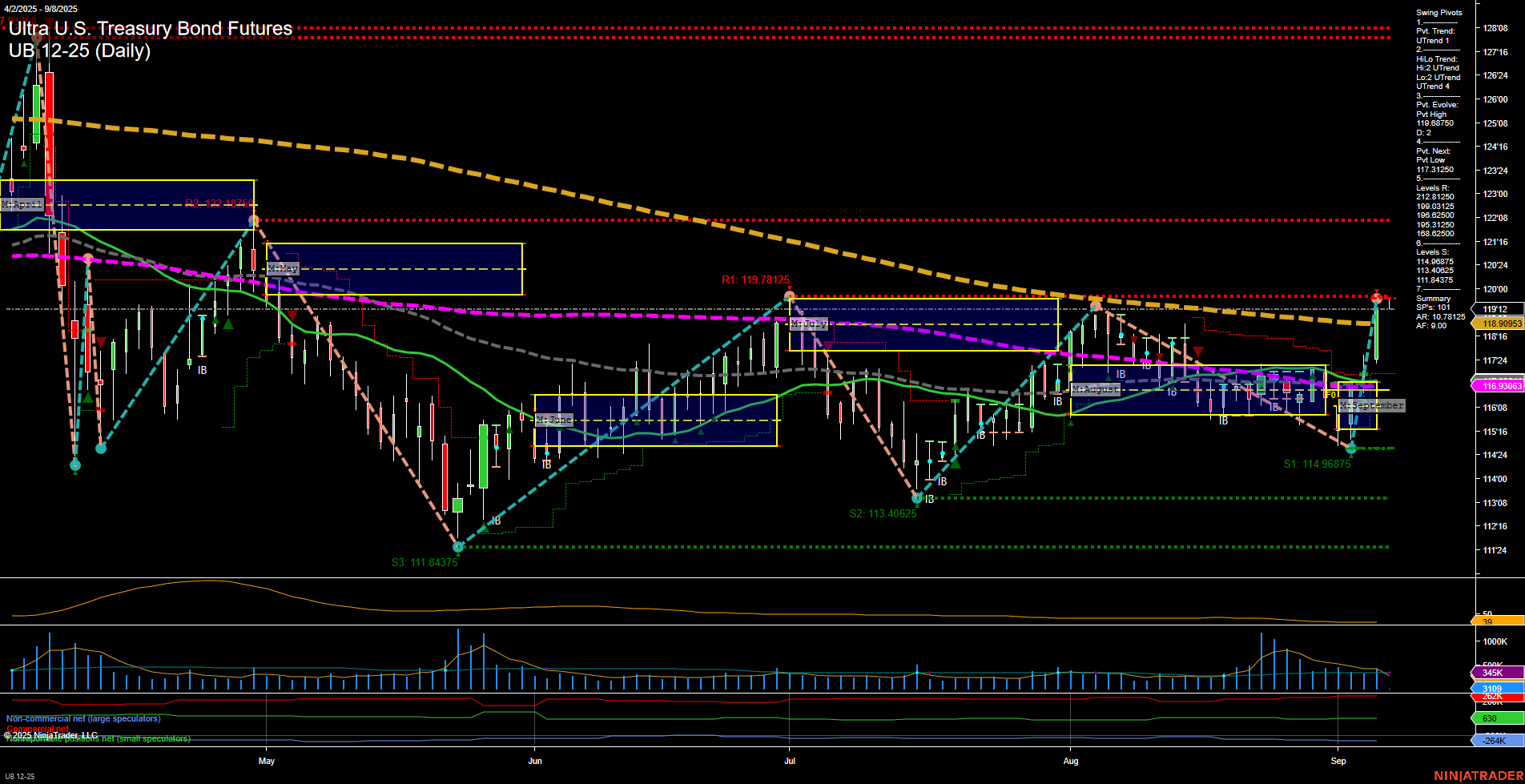

UB Ultra U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Sep-07 18:15 CT

Price Action

- Last: 118.90625,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 65%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 119.6875,

- 4. Pvt. Next: Pvt Low 117.3125,

- 5. Levels R: 119.78125, 119.6875, 119.03125, 118.625, 118.40625,

- 6. Levels S: 114.96875, 113.40625, 111.84375.

Daily Benchmarks

- (Short-Term) 5 Day: 116.99 Up Trend,

- (Short-Term) 10 Day: 116.90 Up Trend,

- (Intermediate-Term) 20 Day: 116.99 Up Trend,

- (Intermediate-Term) 55 Day: 116.90 Up Trend,

- (Long-Term) 100 Day: 116.99 Down Trend,

- (Long-Term) 200 Day: 119.17 Down Trend.

Additional Metrics

Recent Trade Signals

- 05 Sep 2025: Long UB 12-25 @ 118.03125 Signals.USAR.TR720

- 04 Sep 2025: Long UB 12-25 @ 117.34375 Signals.USAR-MSFG

- 03 Sep 2025: Long UB 12-25 @ 116.84375 Signals.USAR.TR120

- 03 Sep 2025: Long UB 12-25 @ 116.59375 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures daily chart is showing a strong bullish reversal, with price surging above key intermediate and long-term moving averages and breaking out of the recent consolidation range. The last few sessions have seen large, fast momentum bars, indicating aggressive buying and a potential shift in sentiment. Both the short-term and intermediate-term swing pivot trends have flipped to uptrends, with the most recent pivot high at 119.6875 acting as immediate resistance. Multiple recent long trade signals confirm the bullish momentum. The price is now trading above the monthly and yearly session fib grid centers, reinforcing the upward bias. However, the 200-day moving average remains slightly above current price, which could act as a longer-term resistance level. Volatility is elevated (ATR 46), and volume is robust, supporting the strength of the move. Overall, the technical structure favors further upside in the short and intermediate term, with the market potentially targeting higher resistance levels if momentum persists.

Chart Analysis ATS AI Generated: 2025-09-07 18:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.