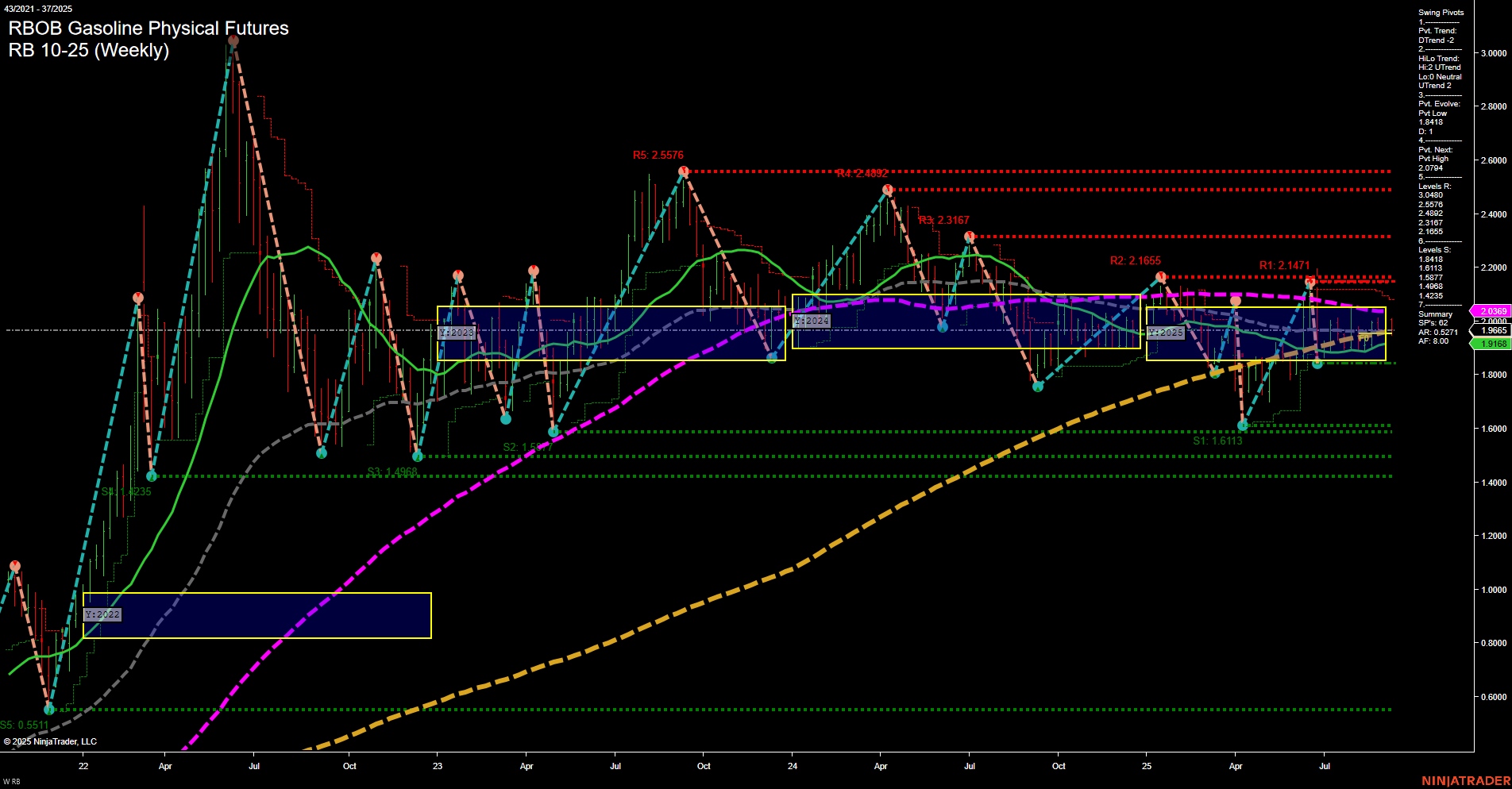

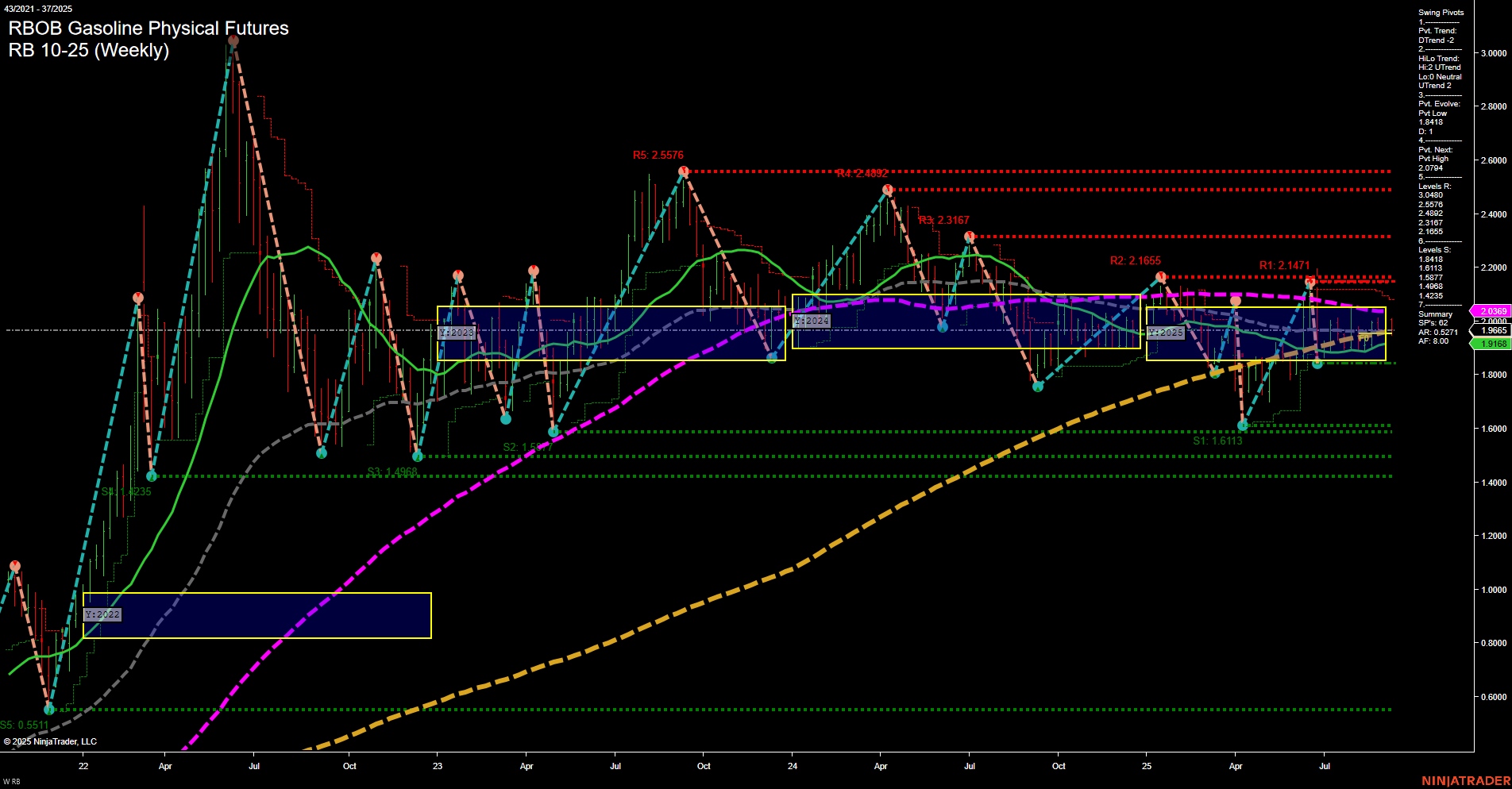

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Sep-07 18:12 CT

Price Action

- Last: 1.9665,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -2%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 1.8418,

- 4. Pvt. Next: Pvt high 2.0044,

- 5. Levels R: 2.5576, 2.4392, 2.3167, 2.1655, 2.1471,

- 6. Levels S: 1.8418, 1.6985, 1.4205, 1.2335.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.9695 Down Trend,

- (Intermediate-Term) 10 Week: 1.9965 Down Trend,

- (Long-Term) 20 Week: 2.0369 Down Trend,

- (Long-Term) 55 Week: 1.9166 Up Trend,

- (Long-Term) 100 Week: 2.0571 Down Trend,

- (Long-Term) 200 Week: 2.1965 Down Trend.

Recent Trade Signals

- 05 Sep 2025: Short RB 10-25 @ 1.9508 Signals.USAR-WSFG

- 03 Sep 2025: Short RB 10-25 @ 2.0029 Signals.USAR.TR120

- 02 Sep 2025: Long RB 10-25 @ 2.0045 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The RBOB Gasoline futures weekly chart shows a market in transition, with mixed signals across timeframes. Short-term momentum is slow and the price is trading below the weekly NTZ center, with a downward WSFG trend and recent short signals, indicating a bearish short-term environment. The swing pivot trend is also down, and key resistance levels remain overhead. However, the intermediate-term picture is more constructive, with the monthly session grid and HiLo trend both up, and a recent long signal suggesting some underlying support. Long-term benchmarks and the yearly grid trend are still down, with price below most major moving averages, reflecting a broader bearish bias. The market is consolidating within a defined range, with volatility compressing and price action choppy. This environment suggests a tug-of-war between bulls and bears, with the potential for range-bound trading until a decisive breakout or breakdown occurs. Key levels to watch are the swing pivot supports near 1.8418 and resistances above 2.16. The overall structure favors caution, as the market awaits a catalyst for the next sustained move.

Chart Analysis ATS AI Generated: 2025-09-07 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.