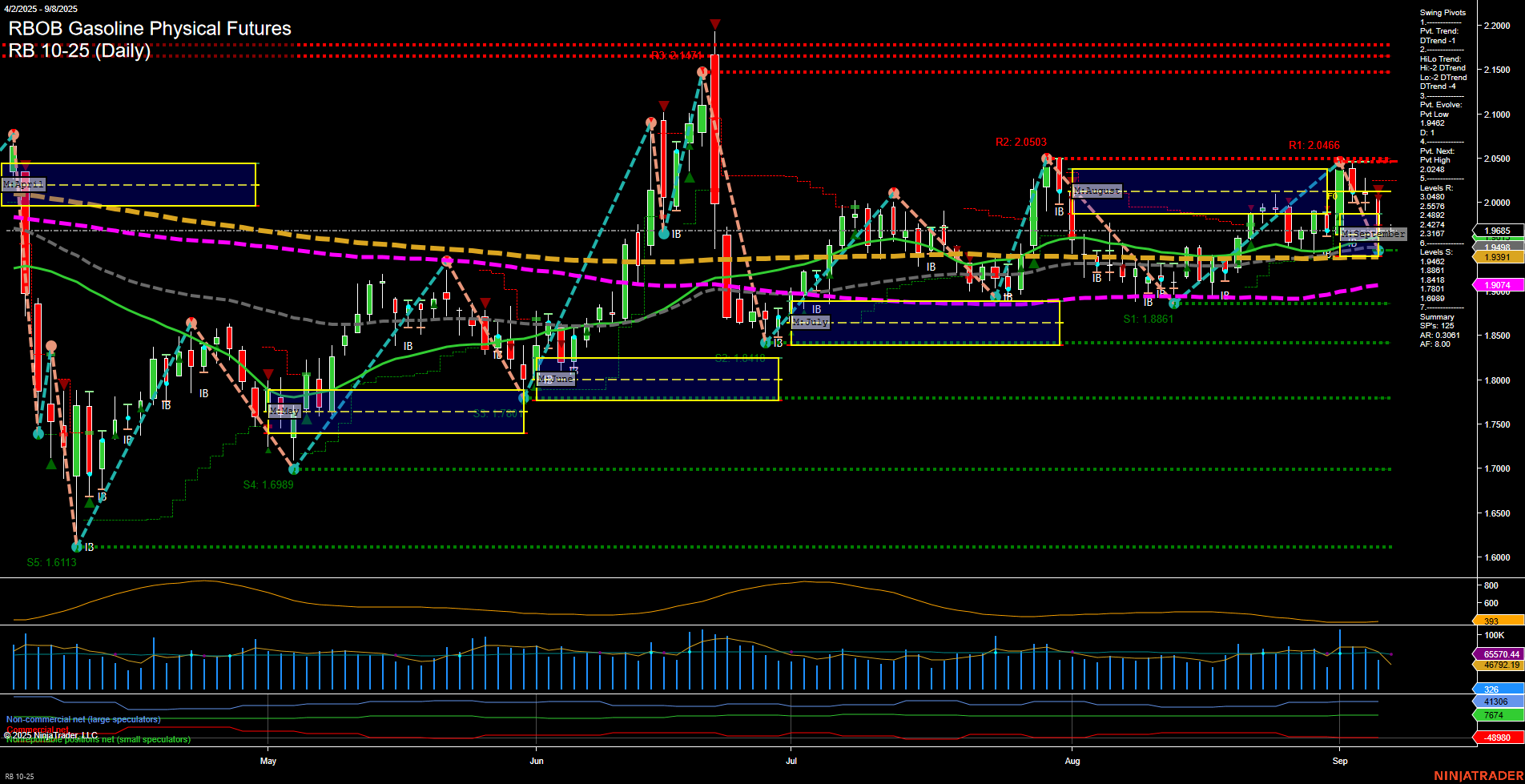

The current daily chart for RBOB Gasoline Futures shows a mixed but evolving technical landscape. Short-term price action is under pressure, with the last price at 1.9508 and momentum at an average pace, following a recent shift to a DTrend in both the short-term swing pivot and HiLo trend. The WSFG (weekly) grid confirms a short-term bearish bias, with price below the NTZ and a negative trend. However, the intermediate-term MSFG (monthly) and long-term YSFG (yearly) grids both show price above their respective NTZs and maintain an upward trend, suggesting underlying strength on higher timeframes. Swing pivot resistance is layered above at 2.0466, 2.0248, and 2.0050, while support is found at 1.9402 and further below at 1.8861. The daily benchmarks show a short-term downtrend in the 5 and 10-day MAs, but the 20, 55, 100, and 200-day MAs are all trending up, indicating that the broader trend remains constructive despite the current pullback. ATR and volume metrics indicate moderate volatility and healthy participation. Recent trade signals have shifted to the short side in the short term, reflecting the current downward momentum, but the intermediate-term signal remains long, highlighting the potential for a bounce or trend resumption if support holds. Overall, the market is experiencing a short-term correction within a larger uptrend. The price is testing key support levels, and the next few sessions will be critical in determining whether this is a deeper retracement or a setup for a renewed advance. Swing traders should note the confluence of support and resistance and monitor for signs of reversal or continuation as the market digests recent volatility.